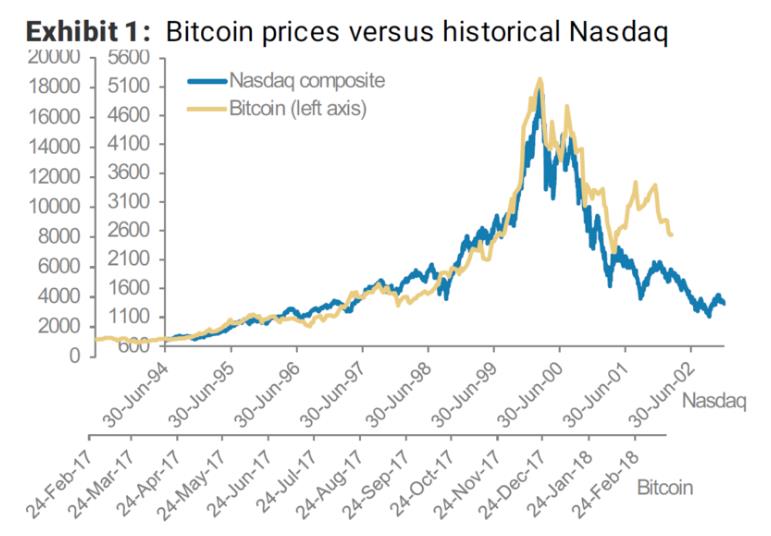

As we know, one of the stereotypes that in recent years accompanies the critiques and Bitcoin in particular, is that the success of electronic money most famous of all is comparable to the dot-com bubble of the beginning of two thousand years.

While not agreeing with this theory, it is curious to note the results of a study published yesterday by Morgan Stanley (in an analysis related to the BTC and the factors that affect the trend), according to which Bitcoin, in fact, would be tracing the same path of the Nasdaq historical indices.

The recent evolution of Bitcoin, in fact, almost fully reflect those of the Nasdaq Composite Index in the period at the turn of 2000, with the curiosity that the trend of Bitcoin has evolved 15 times faster.

To reach its maximum, the NASDAQ rose by 278% in 519 days, reaching its peak in March 2000; for the same evolution towards its maximum, as we know, Bitcoin took just 35 days to reach the famous $ 20,000 threshold in December, according to the report. It should be noted, however, that the starting point is completely arbitrary.

The affinities, comparing the price developments, are clamorous: Bitcoin has had oscillations, again in December 2017, oscillating between 45 and 50 percent; Nasdaq, in 2000, had five drops with an average of -44 percent: this means that the performance graphs are almost ... overlapping!