Serving users in the age of always-on requires increased agility and adaptability, generally beyond the current offerings of traditional banking systems. As the world — and transacting — becomes more interconnected, creating payments solutions to minimise costs and latency is an increasingly crucial component of daily business functioning.

Recognising the importance of seamless payments rails, the likes of Coinbase and Robinhood have been working hard to implement their own non-custodial wallet solutions, including fiat-to-crypto onramps to facilitate seamless payments.

However, the development of in-house solutions is a massive undertaking for any business, regardless of size. Beyond the resources required to develop such novel infrastructure, businesses implementing payments solutions independently are forced to wade through swathes of red tape, from AML and KYC/KYB compliance to on-chain monitoring of crypto transactions and their veracity.

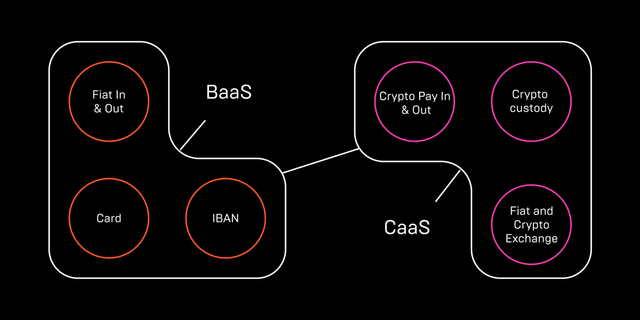

With these considerations in mind, Mercuryo has developed an embeddable wallet bundling a host of features — offering both Banking-as-a-Service (BaaS) and Crypto-as-a-Service (CaaS) payments solutions complete with comprehensive compliance management and on-chain analysis.

How Does It Work?

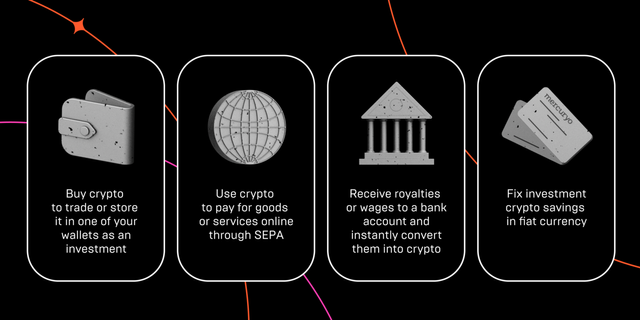

In the rapidly evolving arena of fintech, Mercuryo endeavours to provide an easily-accessible, all-in-one solution that allows growing businesses to focus on scaling and enhancing core products, while also benefiting from the increased reach offered by the embeddable wallet’s robust features and diverse payment methods. With crypto adoption increasing in exponential strides, offering customers the means to directly trade these assets, as well as purchase products using these payment methods, is fast becoming a necessity rather than a nice-to-have for any business hoping to scale globally.

The embeddable wallet has been developed with ease-of-use front of mind. The customisable tool can be integrated into business software through a rapid and secure API to handle your transacting needs, whether they be crypto or fiat-related.

Exploring the Embeddable Wallet’s Feature Set

Banking-as-a-Service (BaaS)

Crypto-native businesses continue to grow exponentially, and in many senses face similar challenges across the board; particularly pertaining to the speed, cost, and regulatory red-tape of handling fiat and digital assets.

With the embeddable wallet, businesses can leverage Mercuryo’s comprehensive financial infrastructure by implementing modular components covering a host of functions, including bank transfers, IBAN accounts, and easy access to payment funds.

Importantly, embeddable wallet integration allows for off-ramping of fiat directly to customers’ credit cards or bank accounts from sales of crypto including BTC, ETH, and USDT. With on-ramping solutions on the way, Mercuryo is moving ever closer to acting as an all-in-one gateway bridging the worlds of legacy finance and crypto innovation.

Crypto-as-a-Service (CaaS)

Where the embeddable wallet’s BaaS component serves to facilitate fiat payments solutions for crypto-first organisations, the product’s robust, scalable CaaS implementation allows businesses to manage crypto without needing to be concerned with compliance, monitoring, and handling the process of licensing.

The relative novelty of crypto as a whole has presented significant challenges for regulators, with policy remaining unclear in much of the industry. By leveraging Mercuryo’s resources and expertise via the embeddable wallet, businesses can rely on us to manage compliance and bureaucratic red tape through comprehensive on-chain analysis, and regulatory verification including AML and KYC/KYB procedures.

Besides handling the aforementioned processes, the embeddable wallet allows customers to directly purchase businesses’ products and services using crypto, affording customers a wealth of payment methods that integrate easily without disrupting businesses’ existing infrastructure.

Paving the Way for Further Progress

The components of the bespoke embeddable wallet represent cryptopowered payments solutions at the cutting edge of the fintech industry. Mercuryo’s development and inclusion of these rich feature sets in the embeddable wallet serves as a live proof-of-concept, demonstrating the vast potential of these technologies and paving the way for broader advancement of BaaS integration via API.

Discover more about Mercuryo’s embeddable wallet integrations to expand your business’s reach and streamline your payments infrastructure .

Originally published at https://blog.mercuryo.io.

Your post was upvoted and resteemed on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit