Hello Sheeshans,

This article is all about metrics, what they are and what they tell us.

Metrics, stats, data, and numbers are everywhere in crypto and sometimes all the jargon can be tough to follow. After reading this article, the next time you see terms like circulating supply and diluted market caps, you’ll know exactly what they mean.

Annual Percentage Yield (APY)

As crypto investors, one of their major interests is in knowing what return they can expect when maximizing returns on tokens. This process of maximizing returns can take different forms such as staking, yield farming, liquidity mining, etc.

When picking the right yield generating option, they usually come across the term APY.

The annual percentage yield, or “APY”, is the rate of return that an investment provides when compared to the initial investment. APY also takes into account compounding interest.

When you see an investment offering a 5% APY, it is important to remember that the 5% is on an annual basis. If the investment pays out monthly, the monthly rate of return will be the 5% APY divided by 12 months which would equate to a monthly return of 0.41%.

The terms APY and APR are often used interchangeably which is not exactly accurate as they do differ. Let’s take a look at APR.

Annual Percentage Rate (APR)

The annual percentage rate, or APR, measures the amount of interest an investment earns over a year.

The key differences between APY and APR are as follows:

• APY takes compounding interest into consideration, the APR does not. So, 5% APY would yield a higher return than a 5% APR

• APY will most commonly be advertised by investment products. Whereas APR is more common for lending products as the APR will be the rate based on the initial amount borrowed.

Staking/Stakers APY

The staking APY follows the same principle as the APY described above. It’s the return on investment that someone can expect from participating in staking.

It’s common for crypto stakers to get confused by this as the term APY stands for “annual” percentage yield, whereas many staking platforms will offer products with:

• 7-day APYs

• 14-day APYs

• 30-day APYs

• And so on…

A 5% APY on a 7-day APY staking product does not mean the staker will receive 5% in those 7 days, unfortunately. That is where that pesky word “annual” comes in.

The 7-day APY is an annualized APY using 7-day returns. It is calculated by taking the net difference in the price from 7 days ago and today and generating an annual percentage. Here is how that looks:

APY = (X − Y − Z) ÷ Y × 365/7

Where:

• X = the price at the end of the 7 days

• Y = the price at the start of the 7 days

• Z = any fees for the week

Circulating Supply

The circulating supply of a token is the number of coins available in the market and public hands. This can be compared to how many of an asset’s shares there are in the traditional stock market.

It is important to note that circulating supply is not the same as total supply. Many projects use different vesting schedules and plan to release more tokens at future dates.

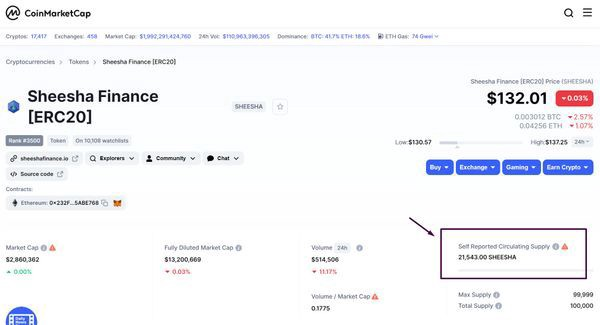

Circulating supply can be found on sites like Coin Market Cap and CCoin Gecko

Circulating supply of SHEESHA onCoin Market Cap

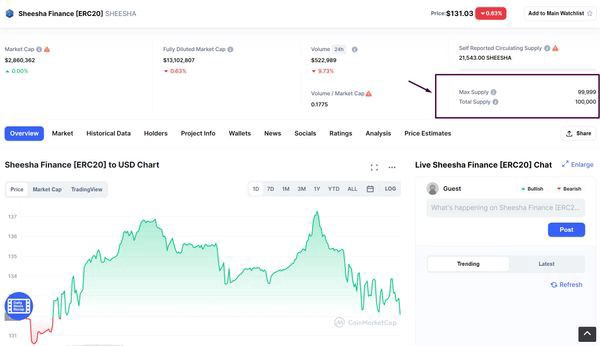

Max Supply and Total Supply

The Max supply tells us how many coins will ever exist in the lifetime of the cryptocurrency. It is Analogous to the fully diluted shares in a stock market.

Total Supply is the number of coins that have already been created, minus any coins that have been burned. This is analogous to the outstanding shares in a stock market.

Max and total supply for SHEESHA on Coin Market Cap

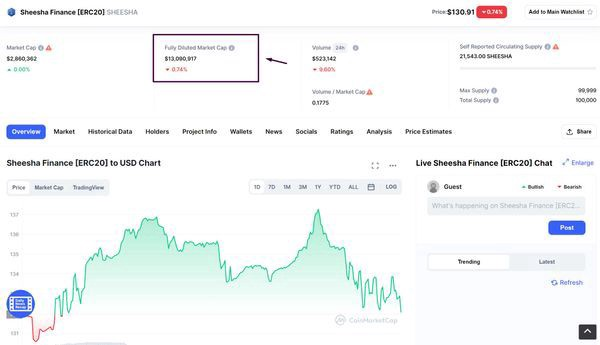

Fully Diluted Market Cap

The Fully Diluted Market Cap shows us the market cap if the max supply was in circulation.

Fully diluted market cap for SHEESHA on Coin Market Cap

The Fully Diluted Market Cap (FDMC)= price x max supply.

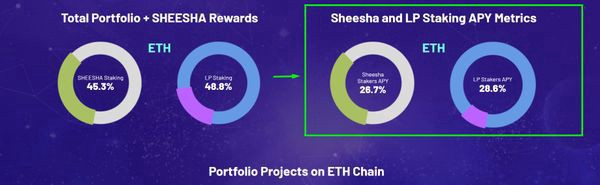

What Does the Sheesha APY Metrics Page Tell Us?

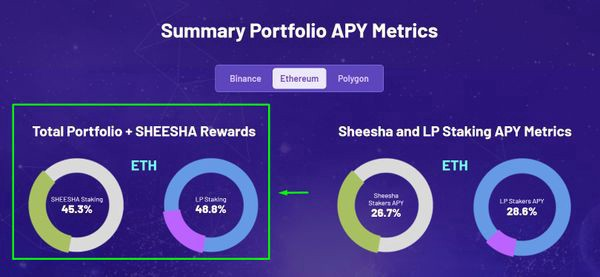

On the right side of the screen, you see the banner “Sheesha and LP Staking APY Metrics”. This shows figures for LP Stakers APY and Sheesha Stakers APY metrics:

Sheesha and LP Staking APY metrics on Sheesha Finance dashboard

• LP Stakers APY — This is the APY in Sheesha tokens that LP stakers receive for LP staking. This figure does not represent partner rewards.

• Sheesha Stakers APY — This is the APY in Sheesha tokens that users receive for staking Sheesha. This figure does not represent partner rewards.

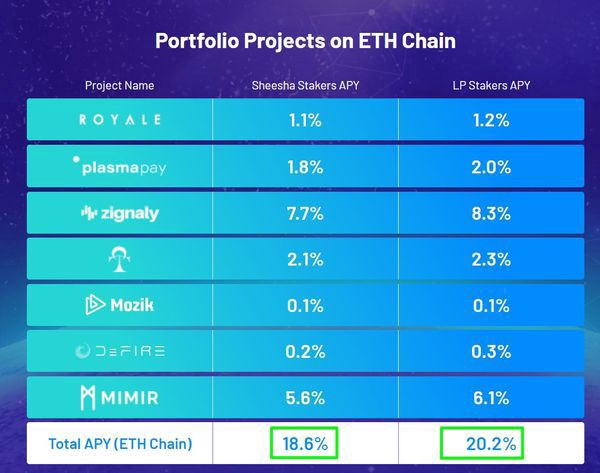

In the middle, users will see a diagram that shows LP Stakers APY and Sheesha Stakers APY from their partner projects:

Portfolio projects on ETH chain

• LP Stakers APY — This is the APY from their partner projects for LP Stakers. This figure excludes Sheesha Token rewards.

• Sheesha Stakers APY — This is the APY from their partner projects for Sheesha Stakers. This figure excludes Sheesha Token Rewards.

On the left side of the screen, “Total Portfolio + SHEESHA Rewards” indicates total earnings for LP Staking and SHEESHA Staking:

Summary portfolio APY metrics

• LP Staking — This is the total APY for LP Stakers, combining both Sheesha and partner rewards.

• Sheesha Staking — This is the total APY for Sheesha Token Stakers, combining both Sheesha and partner rewards.

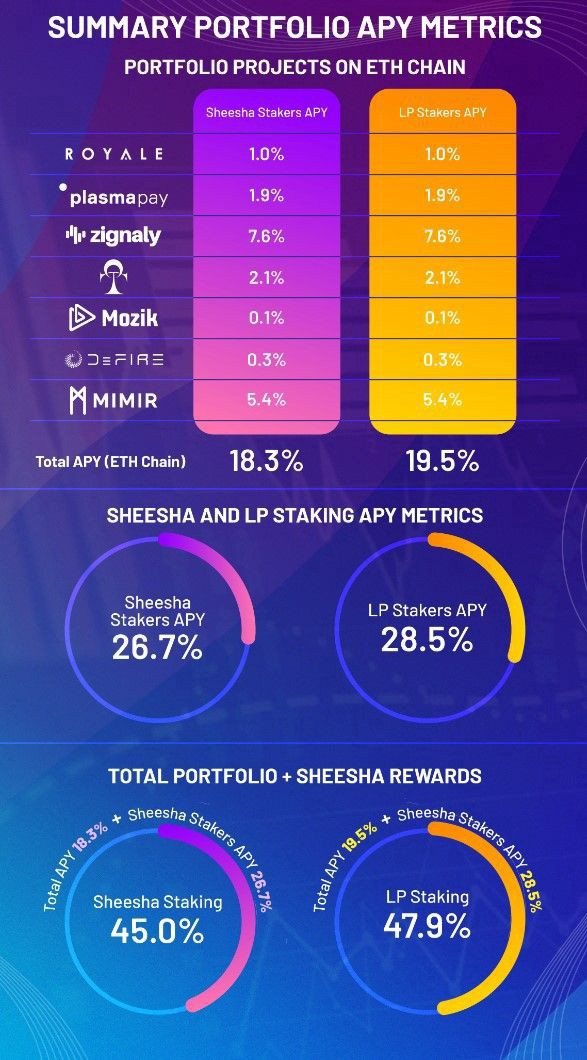

Here is a graphic that puts this all together and summarizes how it works:

APY metrics for SHEESHA staking and LP staking

They hope this helps clear up any questions about crypto metrics in general and Sheesha Staking metrics specifically.

Twitter — https://twitter.com/SheeshaFinance_

Web — https://www.sheeshafinance.io/

Telegram — https://t.me/Sheesha_Finance

Linkedin — https://www.linkedin.com/company/sheeshafinance/

Youtube channel — https://www.youtube.com/channel/UCOJlCe_sLTBfYz05l6DFbAg

Reddit — https://www.reddit.com/r/SheeshaFinance_

$SHEESHA - looks great project

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is an amazing project.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Huge potential, awesome project progress so far.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is really a good news

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a Hidden gem. It will shine!$SHEESHA

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit