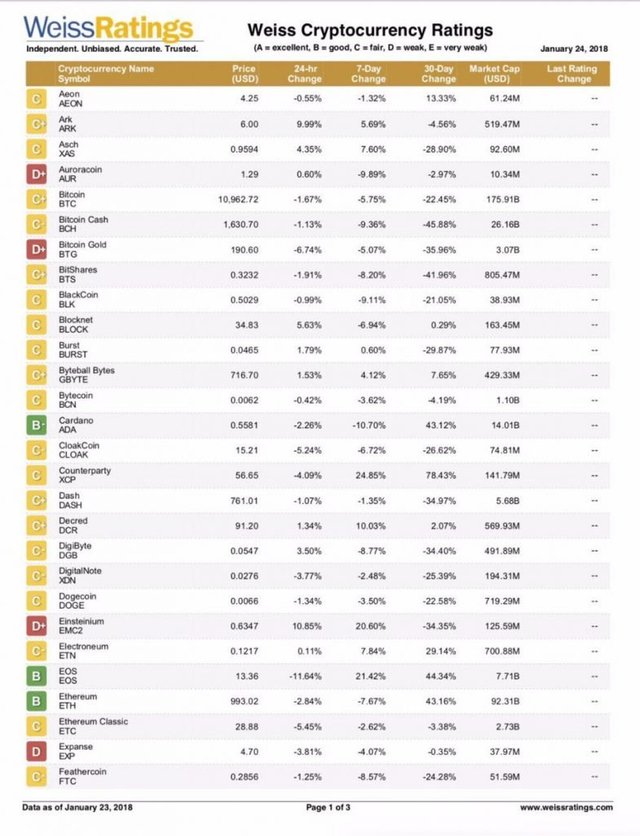

Bitcoin - C+ (major delays and high transaction costs)

Etherium - B (better speed and benefits from still upgradable technology)

The ratings are based on 4 criteria - the risk index, the reward index, the technology index, and the fundamentals index.

The risk index analyzes the potential risk and downside of the digital currency. Similar to any stock or bond, it looks at the level of risk taken by investors.

Reward index, on the other hand, considers the potential for growth and opportunity within the digital currency. This means the chances the price will increase, stabilize, and otherwise provide a return for investors.

The technology index looks at the underlying technology behind each digital currency. It analyzes the framework that the digital currency uses, and identifies if it believes the technology is ‘future-proof’. This unique aspect gave way to the importance of white papers released by digital currency creators.

On the business side, the fundamentals index considers how each digital currency could be used in the real world and to help individual investors get a sense of what the digital currency is good for.

No one gets an A in this class

"The experiment called #crypto #bitcoin #ethereum is still very new. As soon as one compares ethereum with bitcoin, it becomes very clear that there is a lack of understanding as pertains to Weiss and its overview on cryptocurrencies as a whole. Its like comparing apples with roast beef. Bitcoins function has become one of an asset; while ethereum's trajectory is that of business tool including smart contracts, DAOs and now a vast token economy. It's all a smoke screen or divergence of the fact that crypto is here to stay. There is no need for a central rating agency. Cryptos' free market democracy leaves the grading system to the people. The people will ultimately choose which currency is best for transactional purposes vs. which currencies cater to storage of value and so forth. Unlike fiat, there is no need for adult supervision or rating system. The free market(people)will do the rating." said an expert connected to me on LinkedIN

Exactly something which bothered me.. I couldn't agree with the criteria they set. The only questions they are asking is how bad they can be, how good they can be, how easy/fast they are, and how can they be used? I felt there is a lot more to it. One coin is working as an asset, while the other is working as a business tool with a vast token economy. These coins are democratic to its base (as you mentioned), and people hold a substantial significance in their ratings. (if there is a need to grade them). I just had a question about including more 'people' in this grading criteria, do you think activities like surveying or word of mouth in the market should be considered for their score (if they are graded in the future)?

Ether and Eos are good picks but that’s pretty obvious, highly rated Icos will continue to do well. The railroad is built now the cities will come

The cities will definitely come". But ratings like these, even if they are published annually, will drive the prices of already volatile cryptos annually. I personally didn't like this rating idea since it is not encompassing all aspects of their valuation and pricing. And if Credit Rating Agencies can be wrong during 07 crisis, this is nothing.

looks like a load of bs to me

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

great post, But don't forget that steem got a good ranking in this Weiss rating, so for me, it's not that bad :)

Bitcoin is facing big technical hassles, most of the time the network is very slow and the fees are higher more & more.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I know they got a good rating, but that doesn't make the the valuation criteria of other coins less fatuous. Steem is an entirely different coin in comparison to BTC and ETH. I am in total favor of it, but this. No Sir!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit