It’s been a brutal three months for Bitcoin investors as the leading cryptocurrency lost more than 56% in value in Q2 2022.

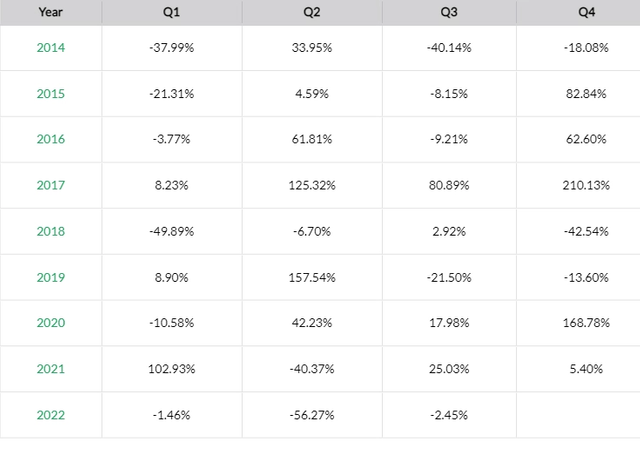

#Bitcoin (BTC) has posted its steepest quarterly loss in 11 years as the price of the leading cryptocurrency plummeted as much as 56.27% between April and June, according to data from blockchain analytics Skew.

It’s the worst #quarterly performance since Q3 2011, when #Bitcoin fell by 66.62%—from $15.40 to $5.14, which is also beating the drastic price slumps of the first and the fourth quarters of 2018, when #BTC lost 49.89% and 42.54%, respectively.

Bitcoin quarterly returns (%).Source: Skew

After a relatively calm first three months of 2022, which saw #Bitcoin fall by just 1.46%, the benchmark #cryptocurrency plummeted from above $45,000 at the start of April to levels below $20,000 on June 30—slipping underneath $18,000 in the process.

#Bitcoin was trading at $19,594 by press time, up 1.89% over the past 24 hours, according to CoinMarketCap.

The latest market meltdown happened amid a cascade of dramatic events, such as the collapse of #Terra ecosystem in May and the #liquidity crisis faced by some crypto lending firms and hedge funds, including #Celsius and #ThreeArrows Capital (3AC).

As the cumulative market #capitalization of all #cryptocurrencies slipped below $1 trillion in June, many established firms also announced they were reducing their headcount or shrinking operations.

These included crypto exchanges #Coinbase, #Gemini, #Crypto.com, and #Bitso, crypto lender #BlockFi, as well as the leading European crypto broker #Bitpanda.

Stocks join Bitcoin in downturn

#Geopolitical tensions, growing uncertainty in global #financial markets, and the Federal Reserve’s move to up interest rates by 0.75%—the largest such hike in 28 years—added more pressure to traditional equity markets too.

As of Thursday’s closing bell, the tech-focused #Nasdaq Composite is down by more than 30% since the start of the year, the S&P 500 is down 21%, while the #DowJones Industrial Average fell 15.88% over the span.

Yet, it’s not all doom and gloom in the crypto space, as some key players, including crypto exchanges #Binance, #FTX, and #Kraken, confirmed their plans to hire new talent.

Others, such as Michael Saylor of #MicroStrategy and #ElSalvador's president Nayib Bukele, took the opportunity to buy the dip, adding more #Bitcoin to their stacks.

Earlier this week, #MicroStrategy said it purchased an additional 480 Bitcoins for approximately $10 million at an average price of $20,817 per coin, while #ElSalvador announced today the country bought 80 Bitcoin at $19,000 per coin.