Monaize is an e-banking system, that will conduct its ICO via Komodo (a decentralized ICO platform, analysis of KMD can be found here), which will take place at the 10th of November 2017 at 12:PM (GMT). They want to create the possibility for their target group to open a ready to use e-banking account in 5 minutes and provide them a British IBAN as well as a Mastercard. They want to focus on a very specific group, which is normally hard for regular banks to serve: SMEs (small & medium enterprises, usually companies with less than 10/50/250 employees) as well as freelancers.

The goal seems trivial - but everyone who tried to open a business account at a german bank knows what a nightmare this is.

Let’s see, how Monaize wants to change this nightmare.

Disclaimer:

This is the update on the short analysis on the blockchain project "Monaize", which was first released at the 16th of September in addition to the analysis of Komodo platform.

It was reviewed and updated to include the events of the past 4 weeks.

While this post has applied for their bounty campaign, I have no connection to Monaize, their partners or employees.

It is my personal view on their project.

I have not received any inside-information.

Eventual bounty earnings do not influence my opinion. To prevent giving this impression in the first place, I will not revise the grading itself, but only add information of what has changed in the past 4 weeks and give a general outline of the meanings behind these information.

This analysis does not claim to be complete

For more detailed informations regarding e.g. fund allocation, please read their whitepaper.

For banks, SMEs are usually too small to be profitable for regular business accounts. At the same time, SMEs require – just like big companies –special conditions for their business accounts, that a regular consumer account rarely can satisfy (like faster transactions, insurance, small loans with a reasonable interest rate, low costs etc.). In general, this is a good consumer base to target, as most companies in Europe are SMEs. But they are very hard to satisfy at the same time. Monaize wants to accomplish this ambitious goal by providing not only a business account, but also wants to make this account manageable from a smartphone and add several more functions like “blockchain based crowd lending”.

A good way to focus on their target group – a big company is too big, too complex to manage their accounts just by a regular smartphone (the security implications alone would be tremendous). Big companies also normally have the opportunity to get smaller loans from a bank faster and with lower interest rates, than a small company. Your everyday plumber with 3 employees on the other hand faces more problems in this regard.

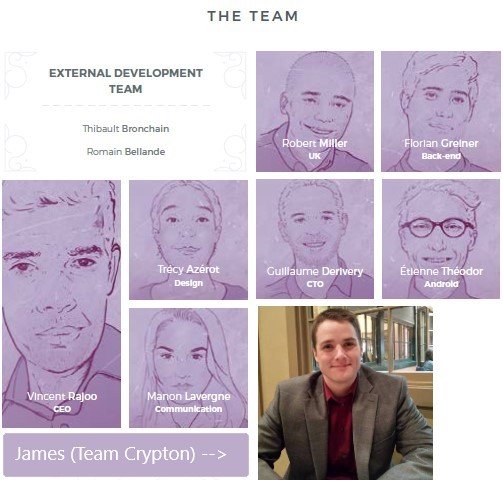

Monaize is a French startup, located and registered in Paris since the 19th of January 2017. Faces and names of the team are published on their website as well as links to their linkedin accounts. They seem to work on Monaize not just as a side project, but in full time. The line-up regarding their qualifications is broad and includes one designer, one for marketing and some more for the technological expertise of course. The hiring of a community manager is underway. The CEO Vincent Rajoo was involved in several other non-blockchain projects across several industries for more than 20 years already.

Do not mistake Monaize as some kind of a bank - they still identify themselves more as a FinTech-company than a financial one. Monaize wants to create a “more collaborative and ethical way of doing banking”, not mimic a regular bank based on blockchain technology.

Publicity: 7/10 (8 – very transparent & experienced members, basic means of public communication are established; a rating of 9/10 is likely, if the communication channels stay active, responsive as well as moderated)

Update on the past 4 weeks

Another team member was introduced: "Team Crypton" or James will be the community manager, I guess. Since then, the social media activity went up significantly.

I am not so good with social media, but more exposure can always be deemed a positive sign, as long as it used in a professional way.

The team so far, excluding partners, external developers (names are listed, but no faces) and advisors

Their public activity is good so far – there is a website, two twitter accounts, a young subreddit and a slack for everyone to join on their website (which is active, welcoming and the devs are responsive). They attended several business pitches like the Paris fintechfoum 2017 and UPComingVC, where the CEO Vincent Rajoo pitched their idea in quite a short way (which is good and actual the whole point of pitches).

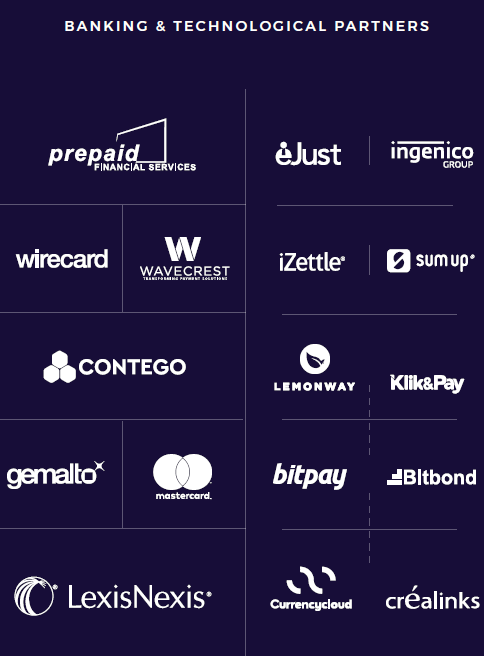

Monaize is also in partnership with 7 financial companies as well as 10 technical partners:

| Partner | Description |

|---|---|

| Prepaid financial services (UK) | provides prepaid cards and general financial services |

| Wirecard (German) | international active; financial / IT service provider; many companies cooperate with Wirecard for using the banking-licence of their daughter-company Wirecard Bank AG |

| Wavecrest (USA) | similar to prepaid financial services |

| Contego (UK) | tech-company for providing software for identity checks & verification among other things |

| Mastercard (USA) | no words |

| LexisNexis (USA/UK/Netherlands) | biggest provider of legal information worldwide |

| eJust (France) | Company focusing on solving legal disputes via arbitration |

| inGenico group (France) | focuses on payment solutions for merchants and service providers |

| iZettle (Sweden) | offers mobile payment services |

| SumUp (UK) | Offers mobile payment services; main competitor of iZettle |

| Lemonway (France) | Offers digital payment solutions |

| Klik&Pay (Switzerland) | Offers individual payment solutions for online merchants |

| BitPay (USA) | Offers digital payment solutions for merchants; one of the major players in bitcoin payment transaction processing |

| Bitbond (Germany) | Offers micro-loans via blockchain-technology |

| Currencycloud (UK) | Focus on cross-border payments & individualized financial services |

| Créalinks (France) | company for providing insurance |

All of their partnerships

Good coverage of partners, well spread out in several fields, from legal to technical to finance and insurance – everything what small SMEs as well as bigger companies need. Also, their whitepaper refers to Komodo and lists “James Lee” (also called “jl777”, the founder of Komodo – it is however not confirmed that James Lee is his real name) and Crip Anarc (of course also not a real name) from SuperNET as their partners. I however would not list this as a major disadvantage, as they seem to know each other personally.

They should get more attention in the next weeks, as their ICO draws near. With their combination of blockchain and SME-banking, they even can get a good amount of attention from mainstream media, especially now, as the industry draws more public attention day by day – this however is only a possibility, but should not be ignored by Monaize.

Activity: 7.5/10 (6 – basic grade as not enough time passed to decide if this activity is lasting; +1 for having good potential to raise lasting awareness outside of the blockchain industry and therefore also for Komodo; +0.5 for good coverage of partners; can be raised to 7 or higher, if activity is lasting)

Update on the past 4 weeks

In the past 4 weeks, a Community Feedback Form was added. While I consider this a good way to stay in touch with the community, it basically boils down to be only a better contact form, if the questions asked via this form is not answered in public. It needs to be developed into a public two-way communication.

The reddit is still not so much active, but this will come with time and more supporters of the project - after all, reddit is a community driven platform.

Also, the ICO itself was delayed by about a month, changing from the 20th of October to the 10th of November. It is debatable, if this is good or bad. It is bad, as it can be interpreted as bad planning. It is good, as this can also mean, that the product itself will not be rushed. Hold in mind, that they are not yet another Ethereum Token, but the first dICO (decentralized ICO) based on Komodo. I would give them credit for announcing it early and being transparent on the cause, as if messing this up would have not only hurt the reputation of Monaizebut also the reputation of Komodo.

On top, they attended the IoT Solutions World Congress in Barcelona recently - not to be confused with the conference SONM took part in (which was the "Blockchain Solutions Forum"). Same place, around the same time, two different conferences.

Monaize aims to bring the advantages of blockchain tech to the banking sector. This includes trustless transactions among the users of Monaize, language independent smart contracts etc. – it will also be able to use the tech of Komodo, making it compatible with “all technology built on top of it”.

This could be a step into adapting blockchain into mainstream as well as it is a mutual benefit for Komodo as well as for Monaize. The implications can range from gigantic to minor – it mainly depends on how Monaize is received in their target group in the next months as well as how well Komodo is doing with their decentralized ICOs.

Technology: 5/10 – (5 – basic grade, as they “only” use the existing tech of SuperNET; can be upgraded to 6 if the project is working on the market - higher is only possible if the tech is transparent and innovative)

Update on the past 4 weeks

Monaize actually - as the first dICO (decentralized ICO) so far - underwent its first atomic swap on the Komodo network, meaning that the ICO can start without any technical problems, I guess. Being able to utilize strong points from Komodo should be the whole point in using Komodo in the first place, so it is good to see that this works.

It is worth mentioning, that due to the partnership with Bitpay, it will be possible to operate with fiat as well as with BTC and MNZ from their platform. This would be a great step in the adaption of crypto currencies into the general public.

The roadmap is hard to analyze, as they still are quite young. They exist only since June 2016, registered in October the same year and started development on January 2017. The first account was opened in July. Other than that, all we have is the past of the CEO himself, with several other startups, starting with the 90ies and going on to today.

History: 5.5/10 (5 – basic grade, due to lack of relevant history; +0.5 for the broad experience of the CEO; if they match their milestones this year without any delay or problems, 6 or 7 is thinkable)

Update on the past 4 weeks

The history of the past 4 weeks is actually worked into the other points and there is no graph to analyze, so... I dont know what to put in here, to be honest.

Hard to tell – there are still many competitors. Not only are big banks not inactive in this sector, there are already operating competitors like Tide, who not only is past his funding phase, but is already operating . Also, the competitor Monzo is a similar company but with a banking license, basically offering the same product . At the same time, Monaize might get the edge by being more agile, decentralized and overall more independent. If they earn the trust of their customers and make their product easy enough, to use the blockchain as an everyday tool for SMEs to manage their finances, they will find their way into the market.

Future: 6/10 – (6 – they still need to prove that their product will have an edge over other competitors; -0.5 for the sheer amount of competition; +0.5 for the detailed plans on how using funds)

Update on the past 4 weeks

Well, as you probably already know, they conduct ther ICO on the 10th of November. They aim to raise abbout 10,000 BTC (~60 million USD) in value over the course of 30 days and have a short incentive period of six hours, where you can exchange Komodo (KMD) for a bonus of 20% MNZ. It can be expected, that this incentive has also an positive impact on the price of KMD.

The fact that they also aim to release their product in the same month of their ICO in the UK might be another positive indicator. After UK, they aim to get into the German as well as into the US market in 2018. I expect them to release an updated roadmap in the near future, as the one in the whitepaper is quite vague after 2017.

Overall, their project looks solid. If they match their roadmap, their product would be up in November – quite an ambitious goal, considering that real products with blockchain technology are still quite rare. I would consider keeping an eye on them every few days, to see if there are significant news until the ICO opens up on the 10th November 2017. Other than that, it is to be expected that the ICO of Monaize will also affect the demand for KMD.

The original PDF with footnotes and sources

Feel free to visit my blog, where you can find even more analysis on altcoins

If you like my analysis & want to give something back – vote here on steemit or treat me a beer with BTC, ETH or LTC.

After all, I am a German penguin.

BTC: 12dTyxchdGhYjGBi1QFVPWbagQrRSJssWT

ETH: 0x3D8e6B27F7ab389888791ABEe6FA62F4718A1164

LTC: LT6qfsrxPhVxcYPbNgT267W1aVRd6n5AFq

KMD: RFQB3SE6DZjxxPrGDQfdSfqqx8NnaX4N8Q

Great article man =)

Loved your analysis!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks mate, I try to keep the quality high. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @randallmaller! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit