U.S. investors have remained resilient dispute ongoing trade disputes between the US and China, interests rate hikes, Europe's woes which include Brexit uncertainties, the start of yield curves inverting and the re-emergence of volatility.

in which we witnessed not one, but two corrections of at least 10% from the highs as noted by the SPY below.

In 2018 we saw not one, but two companies reach the $1 trillion market cap milestone. The first company to hit this mark was Apple, but than Amazon hit the mark one moth later on Aug 2. However, the year ended with Microsoft having the #1 market cap.

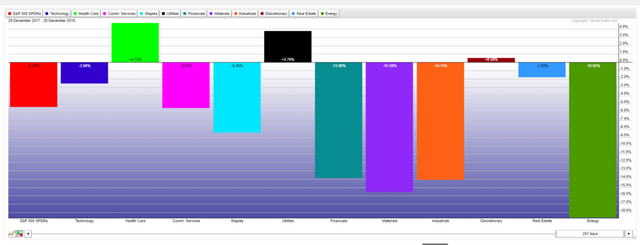

You know the "The Tortoise and the Hare" story...slow and steady wins the race. Well only three sectors will go positive this year and they are Healthcare, Utilities and Discretionary (thanks to Amazon).

I don't think anybody saw it, but should of saw it was written on the wall. The cryptocurrency bubble burst resulted in a bear market the entire 2018. All digital currencies lost at least 75% of their values.

Then there are the ICOs. ICO projects raised twice more than what was raised last year at more than $10 billion, yet, 70% of all the ICOs failed.

Oil was a loser as well, losing over a third of its value since October and nearly 25% in November alone, the biggest monthly loss in a decade due to record production in the United States, Russia and Saudi Arabia and shrinking demand.

Then there is the stepchild, gold. Gold has dropped 15% from a peak of $1,365 in April to a 1-1/2-year low in August to $1,159. However, gold has gained nearly 10% since then and is on track for its best month since January 2017, rising 5% in the month of December.

The US Feds raised interests rates four times in 2018 and the nine times since the Fed began raising rates from near-zero three years ago. This has helped the U.S. dollar to have its best yearly performance since 2015.

As we close 2018 and approach the 10-year anniversary of what would be known as the Great Recession, expect volatility and uncertainty to continue in 2019. Themes to pay attention to in 2019 include: US Feds potential pausing interests rate hikes, the US dollar declining, further break downs in the global equity markets, the rise of Gold and Bonds and corporate debt/loans blowing up.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Nice 2018 recap ! Happy new year 🎆🎊🎈 my dear !

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @vlemon.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Are there ANY safe havens right now?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Gold, bonds and possibly Bitcoin (but that remains to be seen).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

2018 should have been worst but the tax reform helped sustain the valuations most of the year until realization came to knowledge that 2019 will be up against tough comparisons for earnings expectations.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very true, get ready for the roller coaster ride.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sure do hope the fed pauses, tired of watching the rate on my equity line increase ;-)

Should be an interesting year indeed my friend! Let's make some $$$

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wall Street definitely wants them to pause, if the Markets continue to go down, from a public relations standpoint, I think they won't have a choice but to pause hikes.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent 2018 summary Rolland. I think gold will do very well in 2019 and there are a host of my highly paid newsletter editors who have laid out the case for it. I can't wait. I think 2019 will be a great year for my portfolio with all the gold/silver exploration and mining companies I've positioned myself in. Many of them have 10% ownership by the top resource investors.

Do you think oil will break through the 42 level and head lower in 2019? I have 4 small companies I own and one I would like to own, but not if oil returns to the low of 2014 of 26.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @morseke1 Yes, like you, I'm already in gold too and expect more upside in 2019 and beyond. I think gold has some upside for several reasons: 1) we are a couple of months away before oil demand starts to increase for summer time driving. 2) some of the shale players should go belly up because they won't be able to pay for their debt 3) OPEC will cut production again 4) the dollar will decline and oil has a inverse relationship with the dollar.

I think we can see oil again in the mid $50s by mid 2019.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @rollandthomas! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit