Recently, Binance has announced they will soon allow margin trading on their platform. While it still remains a question if US customers will be allowed access to margin trading, they have recently released margin trading in a form of beta testing. After the rumors from a reddit user inspecting Binance and finding margin trading were confirmed by Binance, they have since added some features of margin trading in a beta version. Some users can enable this feature and test it out with up to two times leverage, but the beta version does not appear to be available for users in Cuba, Iran, USA, Crimea, Syria, and North Korea.

Currently the only coins that users can trade with leverage in beta testing are Bitcoin (BTC), Binance Coin (BNB), Ethereum (ETH), Ripple (XRP), and Tron (TRX). On top of their being limited currencies, the beta version for margin trading is currently also invite only. Binance has not announced any time for an official version to be released, as they are still working heavily primarily in the beta version.

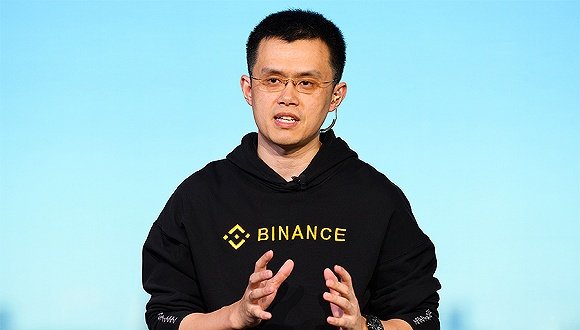

Binance is undoubtedly attempting to capture a greater customer base by offering margin trading, trying to compete with other margin platforms like Bitmex, Kraken, and Bybit. Trading with leverage comes with an increased level of risk. Binance is likely following through with the slow roll-out launch plan of margin trading due to the fact of the potential stress on the servers. Binance recently has been reporting all time high usage, as the Binance Coin (BNB) has also reached an all-time-high. With this great success from Binance they are rapidly attempting to expand to capture more of the cryptocurrency market’s traders.

While the CoinMarketCap data has been criticized for its general accuracy, it is still interesting to look and see the Exchange ranks for as general point of reference. While the exchange trade volume that CoinMarketCap is reporting is in beta, in the last 30 days Bitmex has done $124 billion dollars of volume, and Binance has done $65 billion. It is important to point out Bitmex launched in April 2014, and Binance is relatively more new with a July 2017 launch date. Due to the fact that Bitmex is doing roughly double Binance’s volume in 30 days may be one of the motivations for Binance to begin to offer margin trading on their platform.

A large criticism of Binance in general would be their lack of order types. Currently on the Binance exchange, it is not possible to set both a take profit and stop loss without using a third party or connecting some sort of bot automation. While this is a large issue in traditional trading in general, this will undoubtedly be a problem with Binance margin trading as it is almost essential to have these types of basic order types in order to properly trade. Hopefully with margin trading comes multiple order types, as it would seem almost unfair to trade without the basic ability to set a take profit and stop loss.

Overall, it is an exciting development that Binance is expanding their platform. While this may be a feature some traders enjoy using, it will likely be a risk to new traders who are inexperienced with leverage but attempt it anyway. The lack of proper order types offered on the Binance exchange posses greater challenges as well. Cryptocurrency trading is volatile by definition, and Binance is looking to enable users to multiply that volatility with margin trading. While there are no official dates for the full release of the margin trading platform it can be expected that Binance will continue to roll out updates throughout the year as they attempt to grow.

Sources:

- https://www.newsbtc.com/2019/05/30/will-bitcoin-margin-trading-help-binance-and-coinbase-survive-big-banks-entering-crypto/

- https://twitter.com/binance/status/1134063961282760704/photo/1

- https://twitter.com/cryptounfolded/status/1134078496748314625/photo/1

- https://bitcoinexchangeguide.com/beta-version-of-margin-trading-on-binance-now-live-as-new-exchange-option-excitement-builds/

- https://www.coinspeaker.com/binance-margin-trading-selected-cryptos/

- https://coingape.com/binance-upgrades-user-interface-margin-trading/

Posted from my blog with SteemPress : https://whalereports.com/margin-trading-coming-to-binance-exchange/