Lendoit is a decentralized P2P loan platform that brings together lenders and borrowers from around the world. It is a reliable, fast and simple platform that takes advantage of smart contracts and blockchain technology.

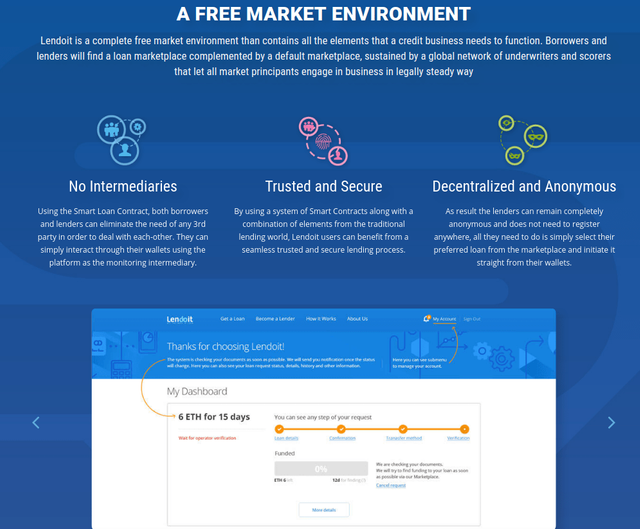

Lendoit is a full-fledged market environment containing all the elements necessary for the functioning of a credit institution. Borrowers and lenders will have access to the loan market and the debt market, which will be supported by a global network of insurers and scoring companies. Thanks to this, all market participants will be able to conduct business in a reliable and legal way.

No intermediaries Through the use of smart loan contracts, borrowers and lenders will be able to enter into transactions directly, without resorting to the services of third parties. They can simply perform transactions through their wallets, using the platform as an intermediary for monitoring.

Reliable and secure platform With the help of a smart contract system combined with elements of traditional loans, Lendoit users will have access to reliable and secure loan procedures.

Decentralized and anonymous platform Lenders can remain completely anonymous and should not be registered. You just need to select an interesting bid in the market and finance it from your wallet.

Site - P2P lending

Loan sites are online platforms that allow lenders to lend to retail and commercial borrowers. Unlike banks, the lending sites themselves do not accept deposits and do not issue loans. Therefore, their balance is not threatened. Monetization occurs only through payments and commissions received from borrowers and lenders.

Lending to individuals is carried out by selecting borrowers and lenders through online platforms. On them, borrowers usually receive funds quickly and at reduced interest rates; compared to banking offers, this is a good alternative to banks. The funds are issued by different lenders - from private lenders to credit institutions.

Private lenders and credit institutions make a profit by issuing funds at interest rates based on their own credit scoring assigned by the platform. Since lenders usually issue only a portion of the loan and distribute the loan amount among multiple buyers, lenders can theoretically get a stable income, while distributing risks among borrowers.

P2P lending is rapidly developing, as borrowers are looking for alternative solutions instead of using banking services. According to a recent study by the American holding Morgan Stanley, by 2020 the income of global lending sites could reach $ 290 billion, it is also expected that in the period from 2014 to 2020. their cumulative average annual growth rate will reach 51%.

...

Overdue loans

Overdue loans are the main problem of every business in this industry, and we believe that we have found the perfect solution to minimize this risk. Without taking into account the heavy burden of collateral borrowers, we had to find a multifunctional mechanism to compensate for it, and here we described it in general terms:

First, we believe that the best way to cope with overdue loans is to prevent them. That is, with the help of well-known “real” world lenders to get access to the borrower's ability to repay a loan and download the so-called Reputation on the blockchain. Borrowers with a low score will not be able to easily get a loan. We also use a syndicated loan system to divide the loan amount among several borrowers. In addition, the borrower fills out an application for a loan, which acts as a contract, and we are able to significantly reduce the degree of delay of the loan.

After the loan is issued, a certain amount of funds will be saved in a special compensation fund, which will be used as an insurance pool.

If an overdue loan appears, the lender will be partially compensated from the compensation fund. The loan contract will then be sold to a local official and supervised collectors in the borrower's country of residence, returning the loan amount with a certain discount (depending on the standards of this country, also calculated by the lender at the first stage). These two methods of loan repayment guarantee a full refund to the lender.

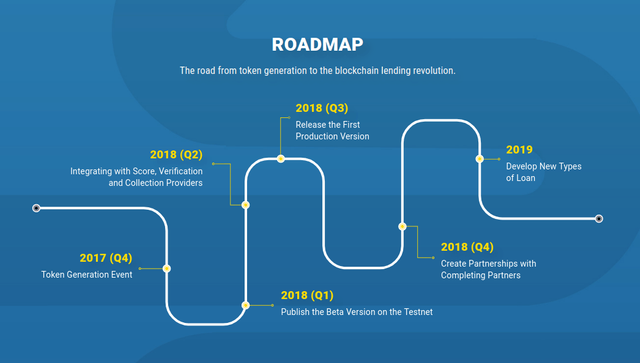

Road map

Tokenomics

Comment:

The specialists of our team have extensive experience in the field of financial technology, which together totals more than 100 years. With the support of a talented group of developers, we are ready to realize our vision, change the loan industry and start a revolution in the field of individual finance based on the blockchain