Ann – Telegram Bot (https://t.me/Crypto_Cal_App) which is based on the Telegram API Bot and provide information in relation to cryptocurrencies and can tell the return from a crypto currency based on the Capital Asset Pricing Model ('CAPM').

In order to make this bot intelligent, it is backed with Artificial Intelligent (“AI”) & Machine Learning (“ML”) servers that track global the data of global exchanges and store them in databases to be used Ann server to provide various details of the Crypto & Bloch-chain World.

What is CAPM ?

The capital asset pricing model (CAPM) is a model that describes the relationship between systematic risk and expected return for assets, particularly stocks. CAPM is widely used throughout finance for the pricing of risky securities, generating expected returns for assets given the risk of those assets and calculating costs of capital.The CAPM model says that the expected return of a security or a portfolio equals the rate on a risk-free security plus a risk premium. If this expected return does not meet or beat the required return, then the investment should not be undertaken. The security market line plots the results of the CAPM for all different risks (betas).

So, In order to compute the return from a crypto currency, following method is involved.

Return % = Risk free return + Beta of coin(Crypto Market Return - Risk free return)

What is Beta ?

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. Beta is used in the capital asset pricing model (CAPM), which calculates the expected return of an asset based on its beta and expected market returns. Beta is also known as the beta coefficient

A beta of 1 indicates that the security's price moves with the market. A beta of less than 1 means that the security is theoretically less volatile than the market. A beta of greater than 1 indicates that the security's price is theoretically more volatile than the market. For example, if a stock's beta is 1.2, it's theoretically 20% more volatile than the market. Conversely, if an ETF's beta is 0.65, it is theoretically 35% less volatile than the market. Therefore, the fund's excess return is expected to underperform the benchmark by 35% in up markets and outperform by 35% during down markets.

So, bets is the measure of the risk the investor takes when he invests in a particular coin, higher the risk, higher is the return expected from the investment.

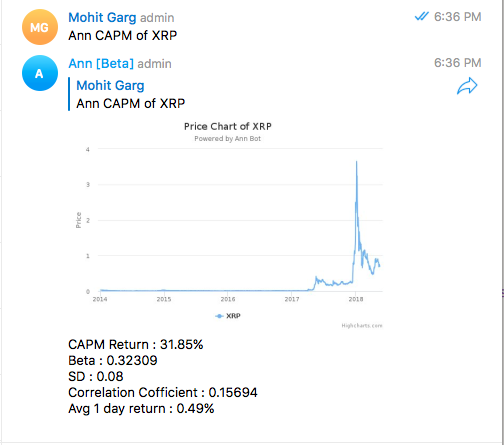

Ann is the advance bot that can compute the CAPM return of any crypto currency based on its past performance and the current market return.

Ann can respond based on the following command:

Ann CAPM of XRP

Join our Telegram Group to boost your income with "Ann - AI Bot" .

https://t.me/Crypto_Cal_App