This post builds on the ideas in another article of mine and outlines further factors contributing to the January 2018 cryptocurrency market sell-off/crash/correction (depending on how you see it).

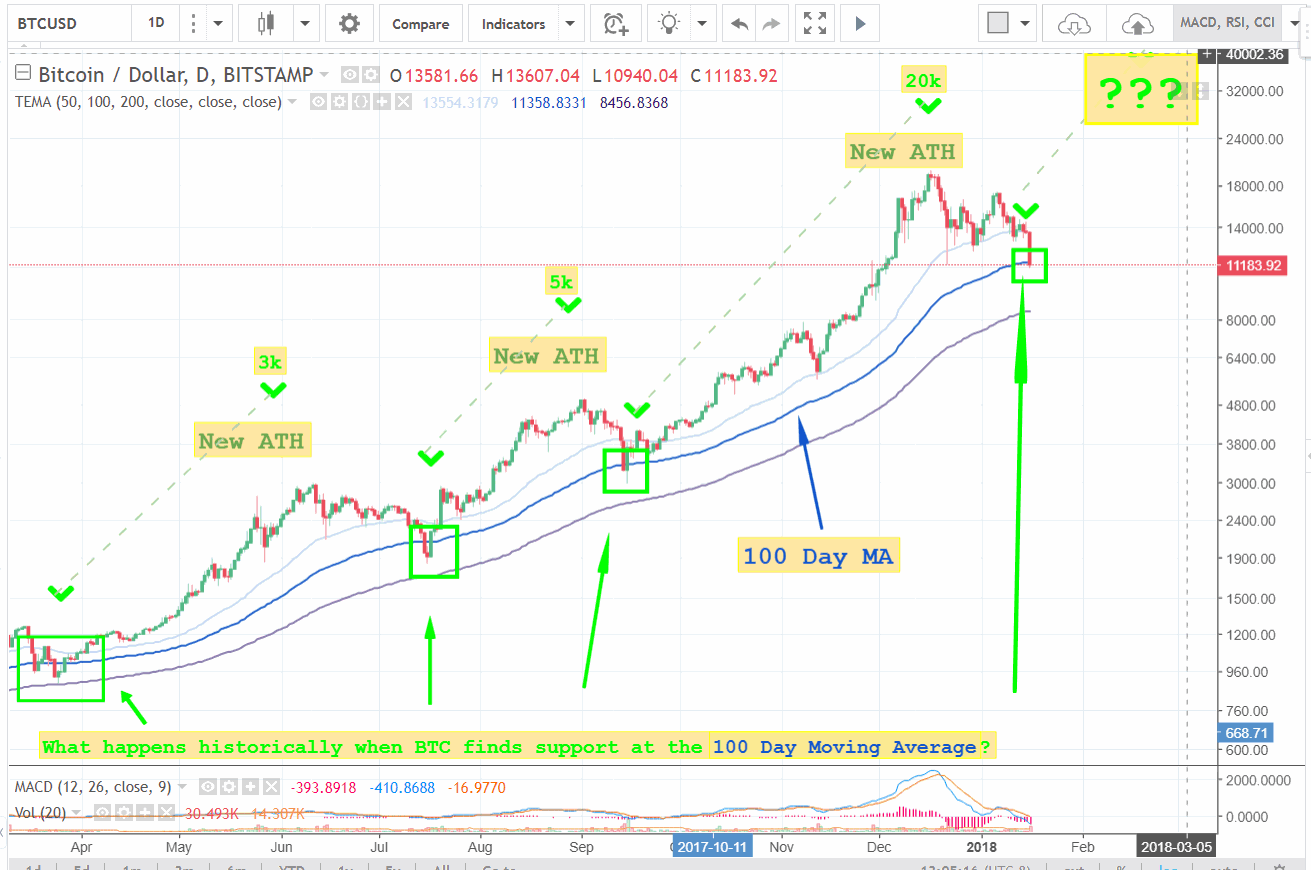

"Whales" (investors with large portfolios) are one contributing factor to the current market dip, as their profit-taking sell-offs (and possibly collusion) cause significant volume and price movement. When this price movement is negative, this sends novice traders (who recently joined the cryptocurrency market, close to the all-time-high) into panic. These novice traders get rid of their cryptocurrency, only for whales to purchase coin again at lower prices, once the market has been culled of novice investors. This is why experienced cryptocurrency traders will tell you to hold on to your current portfolio and weather the storm. You'll see trade ideas like this:

When we consider fundamental market principles, during and following the sell-off, there is an over-supply of a particular coin on the market which exceeds the demand, and accordingly buyers are inclined to seek ever lower prices, considering the sheer supply on the market. However, eventually and inevitably, the bearish sellers won't be able to exert further pressure and the bullish buyer pressure will prevail. Thus the market will start its recovery.

To this extent, particularly for novice traders, it's important to contextualise the entire market. If we consider ETH/USD we will see that the current sell-off amounts to 77% of its value since its most recent high on 15 January 2018. However, when we compare it to the December 22 low, the current price is 52% higher than the December low. Thus it is important to consider how a coin and the market as a whole has performed. Since October there has been a 400% explosion in the size of the cryptocurrency market. A growth rate that large is unsustainable, particularly when you consider the nature of the investors actually pouring this money into the market.

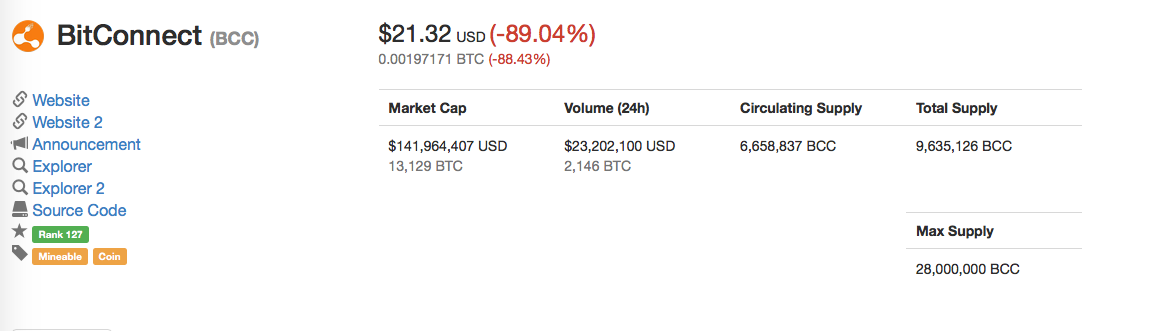

Further factors contributing to the sell-off/correction are the implosion of currencies such as TRON (TRX) and BitConnect (BCC) which result in millions of dollars leaving the cryptocurrency market. With BitConnect, over the past 24 hours, $23 million has been withdrawn from the market, with the market becoming increasingly aware that it is in fact a ponzi scheme. Over the past week $2.5 billion has been withdrawn from BitConnect. Unfortunately, the founders of BitConnect are behind this sell-off and the unwitting novice investors stand to lose from their uneducated decisions (see this gallery on all the sad stories emerging from the BitConnect sell-off). Therefore, part of the cryptocurrency community is optimistic that this market sell-off/correction actually weans the market of alt-coins with no underlying value proposition (scam coins).

Think of the mass exit as a purge of sorts, which is part conniving on the part of whales, as well as other factors mentioned in this article, but also a healthy market correction which.

Ultimately, the October 2017 rally in cryptocurrency prices and the extraordinary all-time-highs over that period thanks to the media frenzy and influx of investors, could to a degree be considered a bubble. Now with that having "burst" to some degree, normalcy and conventional market forces relating to the underlying technology and its economic adoption can prevail, with all the novice speculative investors having been forced out of the market due to the crash/correction. Thus, cryptocurrency having strongly been driven by news and social media (particular with new investors), is somewhat less exposed to this threat, with the core cryptocurrency/blockchain community remaining in the market. Nonetheless, one must always be wary of the potential for fake-news and market manipulation.

A last point which will be noted but not discussed in this article is that the Chinese and South Korean tax year-ends are 31 December.

Volatility is nothing new when it comes to the cryptocurrency market. At earlier all-time-highs, a 30% drop in price is as significant as it is now. However, considering the price rally in late December, a fall from those heights looks all the more worrying on a chart. Nonetheless, a prudent investor should have known cryptocurrency was extremely volatile before entering the market.

The fundamental principles remain: (1) do your research; and (2) do your research.

That being said, if you wish to participate in trading cryptocurrencies, Binance is a top 3 cryptocurrency exchange (according to CoinMarketCap.com), which has a good track record of supporting forks and currently has 6 million registered users. Alternatively, you can look into KuCoin, an exchange which has grown in popularity ever since large exchanges such as Binance and Bittrex have closed sign-ups for new accounts. KuCoin has a large variety of alt-coins not found on Binance and currently has 2 million users.

P.S. At the time of writing this article, BitThumb and UpBit outranked Binance for volume traded over 24 hours. What makes this interesting is that BitThumb and UpBit are both Korean exchanges.

DISCLAIMER:

This is not financial advice and these are simply my own opinions, as such, this should not be treated as explicit financial, trading or otherwise investment advice. This is not explicit advice to buy these cryptos, do you own research.

Congratulations @crypto-curator! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @crypto-curator! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit