Hello Steemians! In this article, you'll learn a few tips and good advice on how to make a good portfolios.

What is a portfolio?

The Portfolio is the cryptocurrency file you own. Diversification is a key aspect of investing to reduce the overall risk of profit-earning. If you owned only one crypto-coin, it eventually dropped you, while if it was just one of the cryptos that you owned, that fall would not be disastrous to your nanny. When thinking about buying cryptocurrency, it is important to create a rating framework and then use this framework to create a portfolio.

Investment criterion

When investing, it is important to create a framework for assessing potential investments.

What criterion to use?

1. Product / Feature: Is this product durable and has a unique ability?

2. Community size: Do they have a large community? Is this community concerned with this project?

3. Technology: Will you solve the problem with the new method? Introduce interesting, new technology?

4. Market Opportunity: How big is the problem trying to solve?

Portofolio

Be sure to invest in more cryptocurrency because you diversify in many classes of assets. It allows you to reduce the risk of total loss, as mentioned above. We can divide the cryptcurrency into several groups.

1. Main cryptocurrency: Bitcoin and Ethereum. These two cryptocurrency should form the largest part of your portfolio, with 50-70% of the total portfolio.

2. "Zombie" cryptocurrency: Zombies because they had tremendous potential in the past, but the market decided differently. These include Litecoin, Bitcoin Cash and Ethereum Classic. Beware of these three cryptocurrency because of their lack of value in terms of "uniqueness." These cryptocurrency can grow as the market grows, but at some point they may fall.

3. Platform cryptocurrency: These cryptocurrency try to solve various problems using the blockchain. Ripple is trying to resolve the international payment system. NEO provides a platform for program expansion of smart contracts, and NEM is a technology platform for managing and building smart assets. DASH has a community of people who are trying to resolve digital payments in a new way.

4. Anonymous cryptocurrency: These include, for example, Monero and ZCash. The purpose of these cryptocurrency is to give you complete privacy. Today, privacy is quite searchable, so you will certainly not have one of these cryptocurrency owned.

5. Protocol Cryptocurrency: We can include cryptocurrency such as Eos, Iota, BAT Token or Maidsafe. Most of the old cryptomenias are focused on the protocol layer, so far in the future they will be more focused on a particular application layer.

6. ICO: ICO is a form of crowdfunding. In the ICO campaign, certain percentages of cryptocurrency are sold to the early project promoter in exchange for existing cryptocurrency, usually for Bitcoin or Ethereum. But investing in ICO is risky because the overwhelming majority end up failing and only a few ICOs are really good.

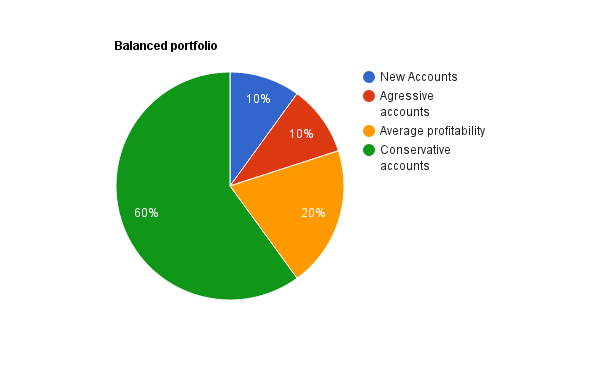

Portfolio Types

1. Long-term portfolio: Long-term holding strategy. Recently, Coinbase has released a safe deposit function that requires double authentication to free up funds and a mandatory 48-hour waiting period until the money can be transferred from the vault to the account. In addition, the system forces you to make more strategic choices with your assets and prevent you from doing excessive responses to short-term negative news, meaning panic sell, which is the enemy of every beginner. If you have a 75% portfolio just for a long-term HODL, you will not be able to do anything. This portfolio is suitable for those who are not experienced in investing or do not want to trade "short".

2. Mid-term portfolio: In this cryptomian portfolio, you should have about 10% of other alcohoins and about 5% ICO. If you do not know what ICO is, we recommend this article. It is important to know that about 98% of the ICO will fail.

3. Short-Term Portfolio (Arbitration): The most exciting way to actually use bitcoin is to take advantage of short-term arbitrage opportunities on the market. This type of portfolio is suitable for you if you want to actively trade in bitcoin and not just keep it "motionless". The advantage over the long-term portfolio is that you can respond to market behavior and make use of its benefits to your advantage, which can be incredibly sound for the newcomer. On the other hand, if you prefer a long-term, you will save a lot of money on transaction fees. Short-term trading requires a lot of time for market research, chart studies, news from the world, and so on. In the cryptome market, even one administration of a more significant person or institution is able to shake cryptomeni prices in high heights.

If you like my post, please upvote and follow me. Leave coments and get resteem. You will help me get more followers. THANK YOU!

@crypto.paulinho

Thanks for that ! I came up with a review of the best softwares to track your crypto portfolio hopefully it could be of some use !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank's for the comment! I looked at your article, it's really good, I learnd something new. Some apps I already used. I gave you a upvote and follow you! @pedrombraz

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a @crypto.paulinho, same here ! cheers mate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit