This guide is a helpful attachment to the original podcast interview, 7 Step Beginner’s Guide to Getting Started with Crypto. Please listen to that podcast first and then check out this guide.

My name is Dani Amsalem and I’m the founder of a little project called Decryptionary.com

I got started with crypto in March or April of 2017 after buying a little bit of Monero and Ethereum. I quickly forgot all about it until a couple of months later, a friend told me to check out Ethereum’s price, apparently it had skyrocketed.

I was surprised to see my small investment 5Xed in value!

I made 5X my initial investment on something I didn’t understand. I knew I needed to research it some more and get a better understanding of what was making me money. It became clear to me that every website, forum, and news article was full of technical terms and crypto slang. The learning curve was very, very steep.

As I was digging through the confusion, I realized that there must be others experiencing these same problems. A few friends mentioned the idea of a dictionary, and so I decided to make one!

Decryptionary is the simplest crypto dictionary and beginner’s guide.

Decryptionary has over 200 entries all defined using super plain English. I tried to write everything in an Explain Like I’m 5 (ELI5) format.

I then created 4 visual tutorials to help beginners get started. They introduce readers to crypto, show them how I invested in my first bitcoin, show them how I diversified into other coins and how I protect my investment.

While everything in Decryptionary is aimed to help beginners and amateurs understand the subject of cryptocurrency and its technology, I am not a financial adviser. Nothing published by me or Decryptionary constitutes an investment recommendation, nor should any data or content published by Decryptionary be relied upon for any investment activities. I do like to buy and sell cryptocurrencies and own over a dozen different types, but will never tell you what to buy.1

Step 1 - Understanding Cryptocurrency

Let’s quickly look at the word “cryptocurrency”. The first part, crypto-, is short for “cryptography”. Cryptography is computer technology used for securing and hiding information.

The second part, currency, is a common word and just means the money currently in use.

Cryptocurrency is an electronic money with technology, not governments, controlling its creation and protecting its value and users.

- Instead of trusting a bank to receive, store, and send your money, users work directly with each other.

- Instead of trusting a bank to verify a transaction, thousands of people simultaneously and publicly do that.

- Instead of paying a bank every time you ask them to send your money, a few pennies are given to the many thousands who record your transaction.

The digital recording of all crypto transactions is called a blockchain. The blockchain is a public, permanent, secure database. Anyone can access it. Anything can be recorded into it.

The openness and security of the blockchain passes on to the cryptocurrency it manages. Compare those unique features with the dollars and euros we’re used to.

Step 2 - How You Can Buy Your First Crypto

For most people, the easiest crypto to buy is bitcoin. To buy your first crypto:

- I usually suggest exchanges that accept credit cards like Coinbase, Bitpanda, or Coinmama.

- Wire transfers or direct deposits (also known as Automated Clearing House, ACH for short) are a slower more affordable way to buy crypto.

- GDAX is owned by Coinbase and they offer direct deposits.

- Kraken accepts wire transfers.

- Gemini accepts wire transfers and direct deposits.

- One of the best ways is to ask a trusted friend to help you. They can walk you through the process, sell you some crypto, and help you secure your investment.

You should use the easiest route available to you.

Step 3 - Securing Your Crypto

Crypto security is an all too important subject and one not discussed enough. If you do a Google search for “bitcoin theft” or “stolen bitcoin” you will find dozens of articles where people claim to have lost many thousands of dollars worth of bitcoin.

Lost or stolen cryptocurrencies cannot be recovered.

Bitcoin itself has never been hacked. Weak user or business security was the problem.

You are responsible for your own crypto. You are responsible for safely storing your access keys to your crypto. You are also responsible for the security of your email, phone, and computer.

I’ve discovered 9 simple security actions anyone can take to reduce their chances of theft and increase their protection:

- Keep your information private. Don’t go shouting all across Facebook, Twitter or your blog that you bought bitcoin or ethereum. That will make you a public target for hacks and attacks.

One of the more recent types of attacks are hackers stealing your phone number and hacking into your email then using both your email and phone to steal your online identity and your crypto. The following steps will tell you how to greatly reduce your chances of becoming a victim to this kind of attack. - Use a brand new, secure email for all of your accounts. Protonmail is a must when it comes to your crypto accounts. They have an incredibly secure free plan that is greatly superior to Gmail, Yahoo or any of the other typical email providers. I highly suggest you visit their website and check them out.

- Use strong passwords. That means 21 characters or more. Don’t include words personal to you like names, birthdays, or addresses.

- Use Lastpass to store your complex passwords. They use the same cryptographic security as bitcoin and other cryptocurrencies. While Lastpass has been attacked by hackers, there are no reports of information ever being exposed. They also have a really handy password generator you can use for the earlier step.

- Use 2 Factor Authentication (2FA) for all of your accounts including email and Lastpass. While Google Authenticator is the common suggestion, I actually prefer Authy. I did some serious digging and found Authy was leagues ahead of Google Authenticator. Authy offers a much more user-friendly experience, better security and good customer service. I have more information about them in my free PDF, 8 Steps to Protecting Your Crypto.

- Use strong antivirus software with a good reputation. There are computer viruses that can allow a hacker to see your private information and steal your cryptocurrency, so make sure your computer itself remains safe.

- Avoid fake websites and emails that pretend to be legit. This is known as phishing. For example, a phishing website might make themselves look exactly like Coinbase and have a domain that is spelled “Colnbase” with an “l” replacing the “i”. The simplest way to avoid phishing is to save the correct website with Lastpass or a bookmark and only access it that way.

- Spread out your cryptocurrency. This is known as decentralization. By keeping all of your crypto in one location, any weakness in your security means a hacker who gets lucky can take all of your money. Wallets that are not connected to the Internet are the most secure. I have more information in my free PDF, 8 Steps to Protecting Your Crypto.

- Tell a trusted family member about your crypto and how to access it. There are stories of unfortunate people who passed away before their time and never told their family how to get access to their small fortune in crypto. By sharing information about your crypto with a trusted family member, you can be sure your wealth will last past your lifetime.

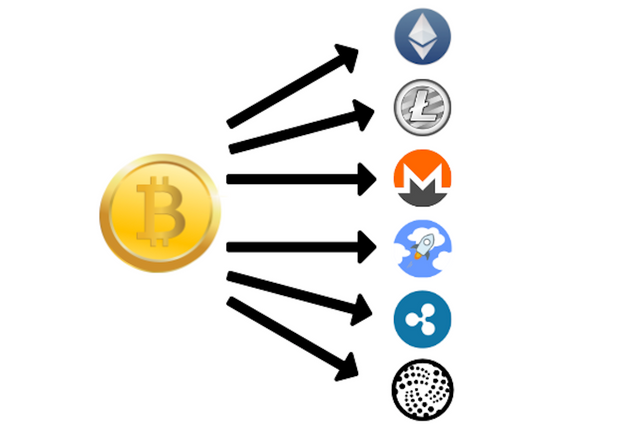

Step 4 - Diversifying into Alternatives to Bitcoin

Excluding bitcoin, there are close to 1,400 cryptocurrencies available. These are known as “altcoins”, which is a contraction of “alternatives to bitcoin”.

Most altcoins were developed with a unique perspective, purpose, and value for their audience. Every altcoin trades at a different price.

I’m often asked if it’s too late to get into the crypto game. Both Matthew and I think there is both plenty of time and opportunities.

- Ethereum is one of the most popular altcoins. Ethereum is not only a cryptocurrency, but a technology that allows other cryptocurrencies to be built with it. I recently read a great comparison on Reddit: if you were to imagine bitcoin as an app, Ethereum is an app store.

- Litecoin is the silver to bitcoin’s incredible, and expensive, gold. Litecoin is swift in adopting the latest technology to improve transaction time, security, and other advantages. Litecoin offers lower transaction fees and faster transaction time than bitcoin.

- Ripple is a cryptocurrency specializing in payment technology not only for individuals, but also institutions and banks. They have already established a network with many big banks such as American Express and Santander.

Those are just 3 of the many cryptocurrencies available. All will have their rises and falls. There are even a few that are really revolutionary.

On the other side of the coin (pun intended), there are many cryptocurrency scams. You must always DYOR, or Do Your Own Research.

To get altcoins, you must use an exchange with more options than Coinbase. Popular exchanges include Bittrex, Poloniex, Kraken, and Binance. There are many more, and with any of those, you can swap your bitcoin or ethereum many other altcoins.

CoinMarketCap.com is a great website with many tools. One tool is a list of exchanges that a cryptocurrency is available on. Click on any cryptocurrency and select the [Markets] tab. On the left hand side you will see what exchanges are trading that crypto.

Step 5 - Checking Out Initial Coin Offerings

Initial Coin Offerings, or ICOs, are a marketing event created by the founders of new cryptocurrencies. In an ICO, the public is allowed to invest in a cryptocurrency before it has become publicly tradable. Sometimes ICOs happen before any code has even been written.

Unfortunately, ICOs are a breeding ground for scams. Recently, the SEC went after an ICO scam by the name of Plexcoins. Apparently, Plexcoins was a very shameless scam where they promised investors a 13X profit in less than a month. They managed to get over $15 million from thousands of investors.

The important thing with researching ICOs is to:

- Study their website and team for professional appearance and experience.

- Study their less non-technical writings, known as a light paper (if available).

- Study their technical writings, known as a white paper. You can learn more with my free PDF, How to Become a Wizard with White Papers.

- Search for them in reddit to see what people are saying about them.

- Study their github, which is a website where you can review their code and updates.

- Study their announcement (ANN for short) in bitcointalk.

By the end of that process, you should have a very good idea of the team behind the ICO, how likely it is that they hit their goals, how unique and valuable their cryptocurrency can become, and whether they have a good marketing plan.

Anything that is unclear or missing is a red flag.

Step 6 - Trading Crypto

For the more adventurous cryptomaniac, buying crypto at a low price and selling it at a high price might be interesting. This is known as “trading”.

There is massive risk in trading crypto because you can lose your entire investment if your timing is bad.

Recently, I pulled out my initial investment of over $2,000 in crypto. Less than a week later, I found that if I hadn’t have pulled my money out, it would have nearly doubled!

The emotion involved in seeing a big miss like that can be crippling. Trading is not for the faint of heart.

Step 7 - Keep Learning

Cryptocurrencies are the most rapidly evolving tech I have ever seen.

The potential of blockchain technology has only been used in a handful of industries.

Here are some very popular resources both I use to stay up to date in crypto.

- Reddit.com - Reddit is a meetingplace for humans. You can find groups discussing anything, including crypto. A few popular groups, known as “subreddits” include:

- Coinmarketcap - Another very popular website for crypto-fans, where you can find most of the crypto, what price they are trading at, where you can trade them and more.

- Telegram - This is a chatting app for iPhones and Android devices that is most similar to Whatsapp. However, Telegram is very popular with cryptomaniacs and in it you’ll find groups for every cryptocurrency, and sometimes the founders of cryptos.

- CoinDesk - A popular news website.

- CoinTelegraph Another popular news website.

- SmithandCrown - A quick resource on ICOs with a very helpful section outlining past and present ICOs.

The Bitcoin Problem

The biggest, underlying problem with bitcoin is not that we might be in a bubble, the increasing costs of transactions, or the delay in transactions.

Bitcoin’s biggest problem is the uncertainty.

People are uncertain about whether bitcoin will continue to exist. People are uncertain of bitcoin’s value. People are uncertain of its benefits.

The quickest way is to establish confidence in bitcoin is to distribute it to people. Once they have crypto, they will see how easy it is to own. That will trigger their interest and desire for more.

This problem affects all cryptocurrencies, bitcoin is just the face of this business.

It is our duty, as cryptomaniacs and as educators, to make sure people understand how simple, easy, and real crypto is.

In Conclusion

You now have 7 easy steps to get started with cryptocurrencies:

- Understanding crypto.

- How you can buy your first crypto.

- Securing your crypto.

- Diversifying into altcoins.

- Checking out Initial Coin Offerings.

- Trading crypto.

- Keep learning!

You’re also aware of the major problem we all face with crypto: uncertainty. Please help cryptocurrencies stay alive by sharing the concept and helping others get started. One easy way to do that is by sharing the Crypto 101 podcast interview this is based off of.

-Dani | Founder of Decryptionary.com

1 By reading and continuing to use our site you (“You” or “Your) agree to the following disclaimer and Terms & Conditions. Nothing published by Decryptionary constitutes an investment recommendation, nor should any data or Content published by Decryptionary be relied upon for any investment activities.

Decryptionary strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions. Decryptionary cannot accept responsibility for any loss or inconvenience caused by reliance on any material contained in this site.

Please note that despite the nature of much of the material created, hosted and provided by this website, Decryptionary is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, Decryptionary strongly recommends contacting a qualified industry professional.

All materials within this article are for informational purposes only. None of the material should be interpreted as investment advice. Specifically, you agree to hold Decryptionary, its affiliates, officers, directors, employees, agents, and third party service providers harmless from and defend them against any claims, costs, damages, losses, expenses, and any other liabilities, including attorneys’ fees and costs, arising out of or related to your access to or use of Decryptionary, your violation of this user agreement, and/or your violation of the rights of any third party or person.

We will not be liable for any special, consequential, indirect, incidental, punitive, reliance, or exemplary damages, whether in tort, contract, or any other legal theory, arising out of or in any way connected with this agreement or your use of or attempt to use Decryptionary, including (but not limited to) damages for loss of profits, goodwill, use, or data. This limitation on liability shall not be affected even if we have been advised of the possibility of such damages. Some states do not allow for the exclusion of implied warranties or the limitation or exclusion of liability for incidental or consequential damages, so the above exclusions may not apply to you. You may have other rights that vary from state to state.

You agree to release us, our affiliates, and third-party service providers, and each associated director, employee, agents, and officers, from claims, demands and damages (actual and consequential), of every kind and nature, known and unknown, disclosed or undisclosed, arising out of or in any way connected to your use of Decryptionary.Any claim or dispute between you and us arising out of or relating to this user agreement, in whole or in part, shall be governed by the laws of United States of America and city of San Jose without respect to its conflict of laws provisions.

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit