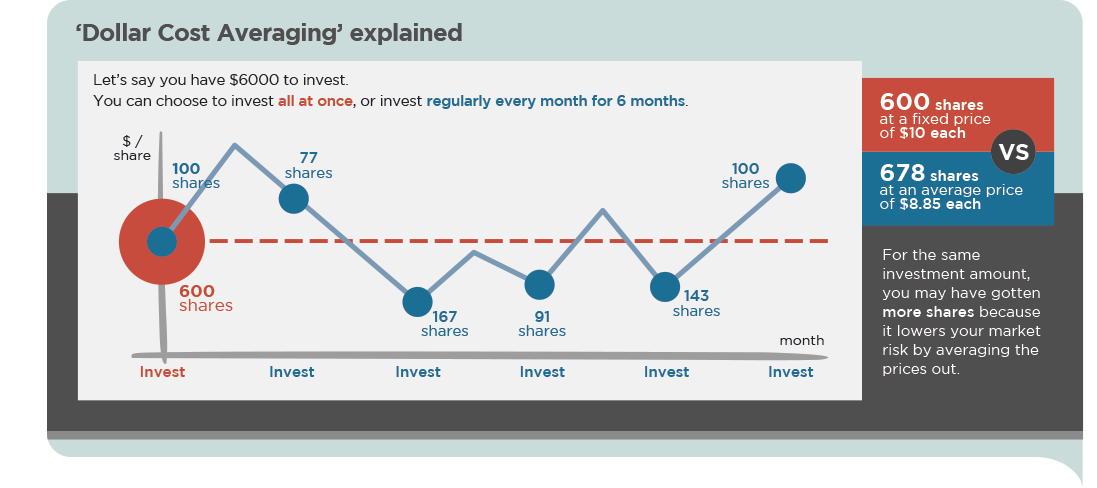

DCA or Dollar Cost Averaging

An investment technique where you invest a fixed dollar amount on a regular schedule regardless of the current market price, averaging out your buy in price over an investments life-time.

For example Suzy decides to invest in bitcoin. Suzy is a little hesitant and thinks that as soon as she buys the price is going to drop. Instead of investing all her money at once Suzy decides to budget $100 a month and purchase bitcoin on the 1st of the month regardless of the price. This removes the impact that a significant short-term price drop has on Suzy.

The biggest benefit DCA has it it automates our investment strategy and makes us less emotional investors. There is nothing wrong with entering the market with a large sum of money if you plan on staying and holding for the long term but from what I have seen most new investors that do this end up getting scared when their initial investment drops a few percentage and end up exiting the market with loses. Emotional investing is something that should always be avoided and any type of automation you can do with your investment strategy will help remove you from being emotionally involved with your money.

Below is a infographic explaining Dollar Cost Averaging (via JPMorgan):

If you would like more information on adding crypto to your investment portfolio please visit my website. If you enjoyed this article please resteem or follow! Thank you.

Thanks, good explanation. The chart at the end really drives the point home. I'll be using this strategy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit