Perlin is a decentralised supercomputer that leverages a network of underutilised computing power. Essentially it brings the sharing economy to computing power, and also allows for the development of DApps and smart contracts.

- The project has been operating in ‘stealth mode’ for the last six months and was only recently introduced to the project.

- A fair amount of the tech has already been developed.

- 5% of the token supply has already been sold to over 50 venture capital funds.

- Two community projects have been launched to get the developer community involved.

- Details of the public token sale have not been announced yet.

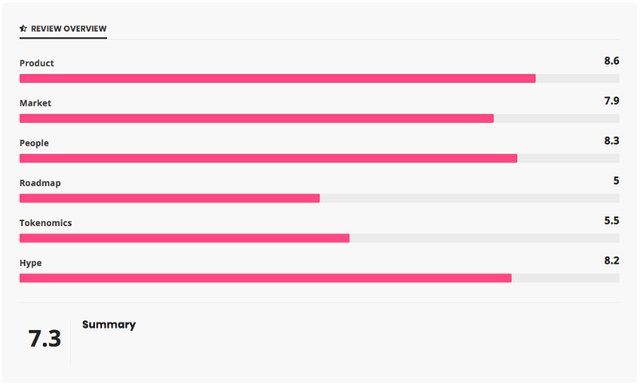

Product

Perlin is a decentralised network that creates supercomputing capacity by aggregating underutilised computing power. The network will support the development of DApps that are secure, scalable and stable.

Technical aspects

Perlin’s native ledger is a directed-acyclic-graph (DAG) utilizing the Avalanche consensus protocol. The objective is to have a very high throughput of 1,300 transactions per second which is necessary in order to make the sharing of computing resources possible.Avalanche is a leaderless Byzantine fault-tolerant metastable distributed ledger consensus protocol which was designed to be more efficient and decentralised than PoW or PoS mechanisms. In a test environment, Avalanche has achieved 1,300 tps on a network with 2000 nodes, with a median latency of 4.2 to 5.8 seconds. By comparison, Ethereum chives 10-15 tps with a latency of minutes to hours, though this is in a live environment.A compute layer is bootstrapped on top of the DAG-based layer. DApps can be developed on this layer. In Perlin’s case, developers would use Perlin as a ledger to bring finality and consensus to off-chain computing systems.The network consists of validators, miners, and customers. Miners provide computing power to the network, customers register computational tasks to be completed by the network and validators log transactions made between miners and customers.Several high-profile members of the crypto community have reviewed the code and said it is “significantly better than other blockchain projects we have reviewed (Tron, IOTA, Hashgraph, for example). Its quality and sophistication is comparable to typical code at a “big five” tech company.

Potential use cases

Researchers, developers and start-ups all use cloud computing power which can be very expensive. Perlin aims to lower the cost of cloud computing by creating a marketplace for underutilised computing power.DApps and decentralised computing systems can also be built on top of Perlin’s compute layer.

Market

In some ways, Perlin competes with smart contract platforms, while in others it competes with marketplaces for computing power. Exactly which role it fills in the future will depend on the evolution of both industries.Th most direct competitors are those creating marketplaces for computing power, namely Golem Network, SONM, and Gridcoin.

People

Team

Dorjee Sun is a Co-founder and Project Manager. He describes himself as a serial social entrepreneur and has a background in business development. He lists no less than 7 other blockchain projects that he advises on.Kenta Iwasaki is the other Co-founder and the CTO. He describes himself as a software engineer, game programmer, robotics engineer, and serial technical entrepreneur. He previously founded a crypto exchange which doesn’t appear to be operating anymore.Nine other team members are listed, mostly with backgrounds in software development and business development.

Advisors

Eleven advisors are listed, with most representing investment firms. Other advisors include the founder of TechCrunch, the CEO of Republic Protocol, a PR consultant, and a legal consultant. Overall, the advisory team is well balanced.

Investors

The website lists 55 VC funds that have already invested in Perlin. Among these funds are Blocktower Capital, Bitmain, GBIC, Juno and JD Capital.No specific partnerships are mentioned, although the team does appear to be proactively seeking partners.

Roadmap

Perlin has not released a roadmap of any kind. The project has been in the works since the end of 2018, and it does appear that some of the technology has been developed.The Github repository contains code for the two community projects, but not for the core product.

Tokenomics

The Perlin ecosystem is fuelled by PERL tokens. The tokens will initially be issued as ERC-20 tokens and will later be swapped for native tokens.The remote allocation of computing time and resource is cryptographically tied to PERLs. Smart contracts will use the network to either reward, deplete or release tokens, based on the provision of time, resource or signature. Unfortunately, no further details are provided on the way PERLs accrue value.

Token Sale

According to the website, a series of seed and private sales have already been held, and 47.5 % of the tokens have already been sold.The seed sale took place in December 2017, with 20% of the token supply being sold for $0.04. A further 20% of the token supply was sold in May for $0.12, and 7.5% of the tokens were sold in July for $0.20.No further details about the public sale have been made available.

Hype

The involvement of a long list of VCs and a series of private sale that has taken over six months means the project already has a strong following. The Telegram group has 30,900 members which is high for a project that has yet to announce details of a public sale.Two projects have been announced to incentivise engagement from the developer community.We would expect the hype rate to accelerate in the coming weeks and months.

Conclusion

Perlin has a strong team of advisors and investors behind it, and the team is heavily weighted to business development and community engagement. It appears they know what they are doing when it comes to a go to market strategy.It’s very difficult to assess the technology or the size of the potential market for the protocol. Only time will tellThere are two risks to be aware of. The first is that, even if the network is successful, it’s difficult to asses how much value will accrue to the tokens.The second risk is that at least some of the seed and private sale investors may be tempted to dump their tokens when the token begins trading. The token sale price is likely to be a lot higher than the price paid by many of these investors.On the other hand, if tokens are dumped early on by the seed investors it may provide a great buying opportunity for long-term investors.

Will we be investing?

We will wait for the details of the token sale, and compare the token price to the prices in previous rounds. We will probably be more interested in investing in the secondary market if tokens are selling below the public sale levels.

Links

Disclaimer: CryptoPig content is written by a team of blockchain passionate people. We are not registered as investor advisors. Don’t take the information in this post as investment advice and make sure you do your own research before investing. Cryptocurrencies are a very risky investment, never invest more money than you can afford to lose.