In the crazy low interest rate world of today, where bonds yield negative interest rates, governments spend massive deficits globally, and Quantitative Easing(QE) is always just around the corner to bailout bad risks. Any rational person would see this house of cards is about to fall, so if you are rational what is your hedge?

Hard assets is the right answer, but what hard assets? Real estate prices are largely dependent on mortgages which have been cheap and bountiful, driving market prices back to housing crisis era levels. So that leaves 2 primary hard assets, precious metals (gold) or cryptocurrencies.

Historically speaking the answer is obvious, gold.

Gold is the most stable valuable asset in the world, historically. But, the world has changed, I bet you couldn’t even get a millenial to buy gold at half price, they have hardly even used cash. And whether you like it or not, young people are set to inherit this earth, and they have been using digital money all of their lives. Cryptocurrency, is just a hard asset gold like form of digital money.

So the argument comes down to investing in the past or the future?

The Past: Gold

Gold, as we all know, is a very rare metal, so there’s also just a very limited supply. It also costs a lot of resources to obtain and mine. Mining gold will produce a shiny metal, an element that can’t be contaminated. Therefore making it very valuable last longer than other metals. Making it very ideal to store wealth, as we have throughout history.

Commodity

Gold like cryptocurrency is 90% speculative. If gold was priced only for its value as a commodity for jewelry, computers, and other applications the price would be far, far lower than it is today. However, the fact that gold is still used as a commodity even though the price is speculative shows its has staying value as a shiny non-corroding metal.

Gold vs Cryptocurrency

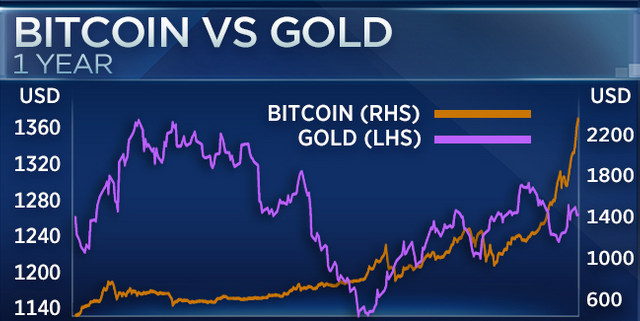

Stability, gold has been a much more stable asset to bet on throughout the ages. It had thousands of years to stabilize and maintain its value while cryptocurrencies is still a birthing technology giving it the volatility that it has. Gold has established its credibility as an investment. The current market cap of gold for reference is around $7T (compared to Cryptocurrencies $250B)

Cryptocurrencies are still very new to the market, so it carries a lot of risk. Old people tend to go for gold or stable assets and not otherwise because they can’t afford to lose their holdings as they won’t be able to recover from it.

Young people can bet on assets with higher risks for higher rewards because if they lose everything, they still have a long time to recover and can still go back and start over. Also cryptocurrency is just more useful to young people. They all know how to use the internet, shop online, use their smartphones for everything. A digital asset easily fits into their life.

The Future: Cryptocurrencies

If you are reading this you probably have a general idea what cryptocurrencies are and generally how they work. Cryptocurrencies have become very popular despite the huge price swings due to market fluctuations and perhaps manipulation. It has the potential to become the new global digital money. There are thousands of different currencies today, but this all started from Bitcoin back in 2009.

Although it’s been 10 years since Bitcoin started, it’s still at its early stages. That being the case, its price/value can still be easily affected by the usual volume of trades. Both selling and buying BTC affects its value. Bitcoin cannot simply be created out of thin air and has a limited supply of 21 Million, making it economically a much better sound finite money. Distributed over time in a parabola approaching 100%.

What people Miss: Bitcoin is a Commodity

And here is your reward for reading to the end of the article. While the rest of the world treats Bitcoin as a 100% speculative asset with little value besides as a money, like gold’s use as a commodity at any price, Bitcoin also has an ace up its sleeve. Data.

Data is the most valuable asset in the world today. It’s the information age, and nearly all information is online and accessible to the whole world at any moment. But, the way the current internet works all of that data is free, and like anything free it suffers the tragedy of the commons. When data is free, you are going to get way too much of it and lots of low quality data, because its very low cost.

So the internet is littered with advertisements, spam, scams, and you name it. Bitcoin, is an unalterable financial storage layer for the internet. That is its commodity. Bitcoin is information, just like money is information. $100 bill isn’t worth anything to you on a hiking trip, but when you interact with other people, that $100 piece of paper is information of value you (or someone else who gave it to you) delivered to another person at another time.

Bitcoin is a database of this information, and contrary to popular opinion the technology does scale and will store, and make valuable the whole internet worth of data at scale.

So the answer is easy, which is more valuable. Shiny rock old people like, or the internet.

Congratulations @cryptoroi! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit