Everyone that has ever traded cryptos knows for sure that it’s the institutional money this is expected to change the game for the industry. There was a long wait for Bitcoin ETF but there is no result yet. Finally, the patience seems to be running off as the leading institutions including hedge funds have suddenly raked by their exposure to cryptos nearly doubling it over past months.

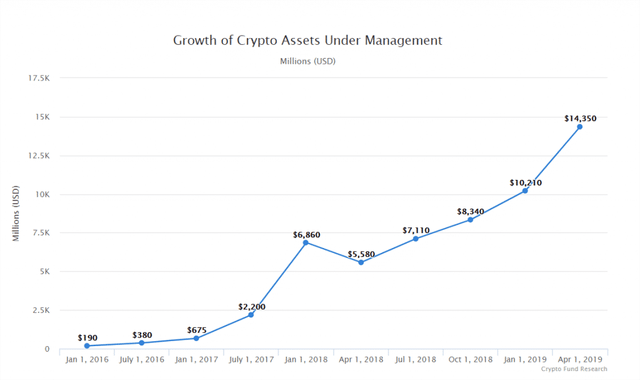

Crypto Asset Under Management has gone up from USD 5 bn to USD 14 billion over a year

Institutions are coming to cryptos. This is a statement which most crypto investors were waiting to hear all this while and it looks like this is coming through at least according to a new report by Crypto Fund Research. According to the report, there are currently more than 700 cryptocurrency/blockchain investment funds. The majority are set up as hedge venture capital funds, while a large numbers are hedge funds or hybrid funds.

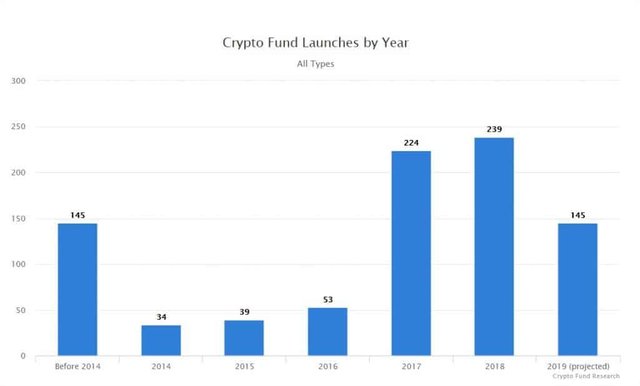

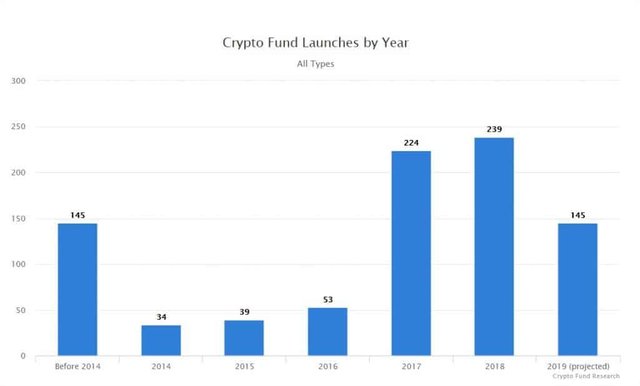

The statistics presented in the report shows that 2017 was a record year for the launch of new cryptocurrency funds with over 200 new funds including hedge funds and venture capital. This was more than triple the number of funds launched in 2016. However, 2018 has now surpassed 2017 in terms of crypto fund launches with more than 230. However, the new launches may see a slow down in 2019

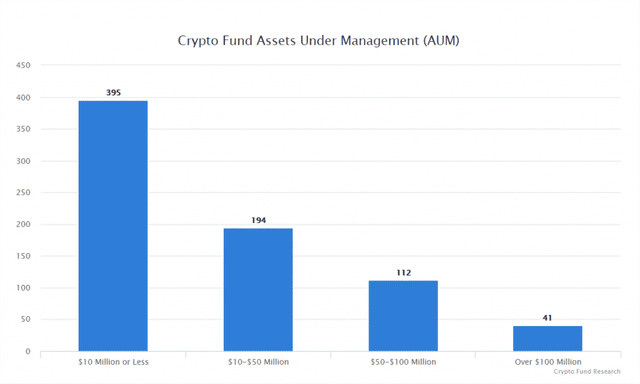

Source: Crypto Fund Research While the number of funds looks great, The vast majority of crypto investment funds are small. Half have less than $10 million in assets under management (AUM). However, there are a number of crypto funds with over $100 million in assets including Pantera Capital, Galaxy Digital Assets, Alhpabit Fund, and Polychain Capital, among others. Despite lower cryptocurrency prices in 2018, assets under management for crypto funds actually increased. Current crypto fund assets are still quite small. All crypto funds combined make up less than 1% of total hedge fund assets.

Source: Crypto Fund Research

Source: Crypto Fund Research On the private investment fund, venture funds have now surpassed hedge funds as the most common type of crypto investment funds. Existing tech/FinTech VC firms are expanding investments into blockchain startups and launching their own blockchain funds. As some blockchain companies mature, private equity funds are beginning to get involved. Hybrid funds – those funds investing in cryptocurrencies as well as initial coin offerings are listed above as hedge funds although they take on some characteristics of venture funds.

It looks like the institutional money is flowing into cryptos not just for trading and investing in coins but also in real business by way of the venture and private equity investment. This will definitely help in the creation of the ecosystem and one may soon see the prices of coins and tokens also rising.

What are your target for Bitcoin in 2019 with this institutional money coming in? Do let us know your views on the same

Posted from Coin Inquire coininquire.com : https://coininquire.com/raising-institutional-investment-bring-back-glory-days-for-cryptos/

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit