This post requires prior knowledge about market and limit orders. If you're not sure what those are, check out my previous guide, Quick Start Pt 5: How to Trade on Exchanges.

While limit orders give traders and investors more flexibility than market orders do, it may be worth your time to understand how to place some of the more advanced orders. Stop & stop-limit orders allow you to put an order into the order book if an asset reaches a certain price, called the stop price. These orders can be used to help you reduce risk or to jump in and capitalize on an asset with upward momentum.

Sell Stop Orders

Sell stop orders are especially useful when you want protection from losing too much or you want to lock-in gains on particular investments. Even novice traders should be able to implement them into their strategy to mitigate risk.

Stop-Loss Sell Orders

Stop-loss orders tell an order book to place a market sell order if the stop price has been reached, meaning a trade will automatically be executed at the next available price if the market reaches your stop price. These orders guarantee a trade, but you do not have control of the final trade price.

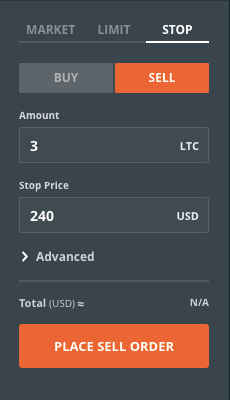

Example: Let’s say you just bought 3 Litecoin at $300 each. You think Litecoin will go up in price, but you really don’t want to lose more than about 20% of your investment. You can save yourself from further losses by setting up a stop order like so:

Example from GDAX.com

With this order, you will sell your 3 Litecoin at market price if the stop price of $240 is reached. You’ve effectively saved yourself any further losses if Litecoin happens to plummet.

Because it is a market order, the actual price at which you will sell your Litecoin depends on the next available best price at the time your order is put in (the sale price may be lower than your $240 stop price).

Stop-Limit Sell Orders

Stop-limit sell orders instruct an order book to place a limit order once the stop price has been reached. These orders allow you to set a price for the trade, but the trade will only be executed if it the current market price is within your predefined limit. In a fast-falling market, it is possible your order may not be placed.

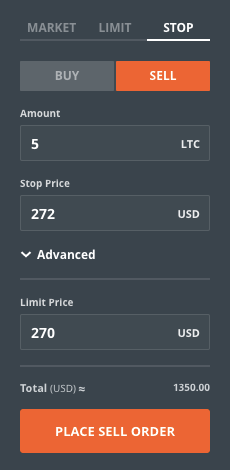

Example: You bought 5 Litecoin for $200 each last week, but now Litecoin trades for $305. You want to lock in some of these gains in case the price falls. You could place a stop-loss order at $270, or you could place a stop-limit sell order like the following:

In this case, a limit order to sell your Litecoin for $270 will be placed on the order books if the price falls to $272. Your order would then execute so long as the market price remained equal to or above $270. But, if the market price quickly fell below $270, it's possible your order might not go through.

Summary Thus Far

Stop-loss & stop-limit sell orders both allow for greater trade flexibility and mitigation of risk but have different advantages. Stop-limit orders guarantee a price, but they do not guarantee execution of the trade. Stop-loss orders guarantee trade execution, but they do not guarantee price. Which one to use depends on the trader’s strategy.

Buy Stop Orders

Buy stop orders are generally used to capitalize on upward price momentum, such as when an asset shoots up in a short period of time. Just as with sell stop orders, the order is placed on the order book once a stop price is reached, and one type of order guarantees price while the other guarantees trade execution.

These are more advanced trade types that are not recommended for novice traders, as there is great potential to buy into an asset at a peak in price. You should be confident and skilled at analyzing price movements before attempting to use buy stop orders.

Buy Stop Order Example

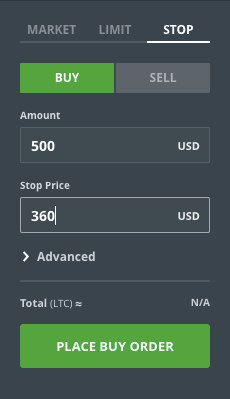

Litecoin is currently trading at $340. After thorough analysis, you believe that Litecoin will go on an upward run to over $400 if it can only pass the $360 level. So you create a buy stop order to purchase $500 of Litecoin (around ~1.4 Litecoin) once the price reaches $360:

In this case, GDAX allows you to purchase a dollar amount of the asset instead of a unit amount, guaranteeing you have the funds to place the order at market price.

Because this is a market order, if Litecoin reaches $360 you will purchase $500 worth of Litecoin at the going rate. Buy stop orders are risky because the price could easily fall back down – meaning you bought in at a price peak. In general, buying in at the top is not a recommended investment strategy and should only be attempted by knowledgeable investors with a higher risk tolerance.

Congratulations @embracetheswings! You received a personal award!

Click here to view your Board of Honor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @embracetheswings! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit