Table of Contents

Digital Currency

Thanks to the development of information and communication technology, currency can be made digital and online. Digital means that currency can be implemented on computers where processes can be automatic and fast. Online means that currency can be used on the Internet which allows transactions and other usages from anywhere in the world at anytime leisurely. Today, digital currency is used for online shops and online payments. For example, I pay my electricity, water, phone, internet, and other bills from my home using a smartphone that is connected to the Internet. I also can order items, foods, and other stuffs from my home. Digital currency can also be used to conveniently participate in the global financial system such as loans, investments, and installments.

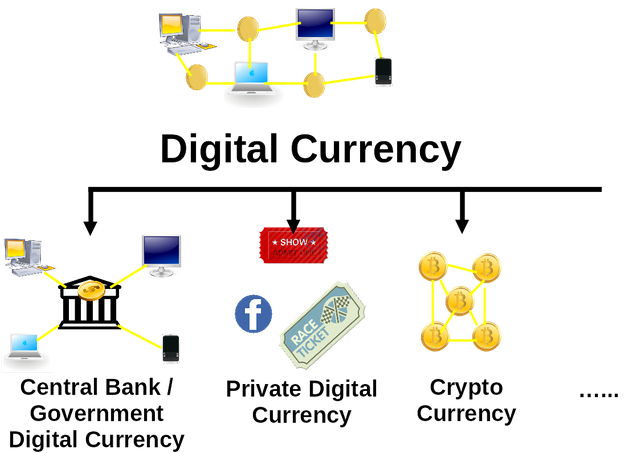

Due to the title of this book, you probably want to ask, what is the relationship between digital currency and cryptocurrency? Cryptocurrency is just one of digital currency. Digital currency is the general category. From my knowledge, I know the following digital currencies:

- Digital Fiat Currency: currency backed but centrally controlled by the government made digital. While for paper cashes the government needs printers to print and coins needs to be smithered, digital fiat currency can be created at a press of button on the government's server. While cashes and coins are distributed physically, digital fiat currency can be distributed digitally and online to the citizen's application. Since this digital currency is centralized, the government have complete control over. Other than being able to print and distribute, the reverse scenario is also possible which are deleting, taking back, and even denying citizen's of financial service. Example digital fiat currencies are digital dollar, digital euro, digital pound, digital yen, digital yuan, and digital rupiah.

- Digital Private Currency: currency made and controlled by an individual or group. These currencies today are mostly scene in companies such as Amazon points, cupons, and tokens.

- Cryptocurrency: currency based on crytographic technology which allows the possibility of distortion and manipulation resistance, distribution and decentralization, censorship resistance and unconfiscatibility, privacy, and openess.

Bitcoin The First Cryptocurrency

The easiest start to understand cryptocurrency is to understand Bitcoin. Bitcoin is the first cryptocurrency created by Satoshi Nakamoto in 2008. The ideal concept of Bitcoin is to have the properties of openess, borderless, censorship resistance, unconfiscatibility, distortion resistance, manipulation resistance, distribution, decentralization, and pseudo anonymous. Disclaimer that the mentioned concept is idealized and in reality may not be perfect. Also in this book contains no technical explanation about cryptography and other technologies behind cryptocurrency because this book is inteded for users only. Instead, only illustrations or parables are provided and may not be fully accurate.

Blockchain

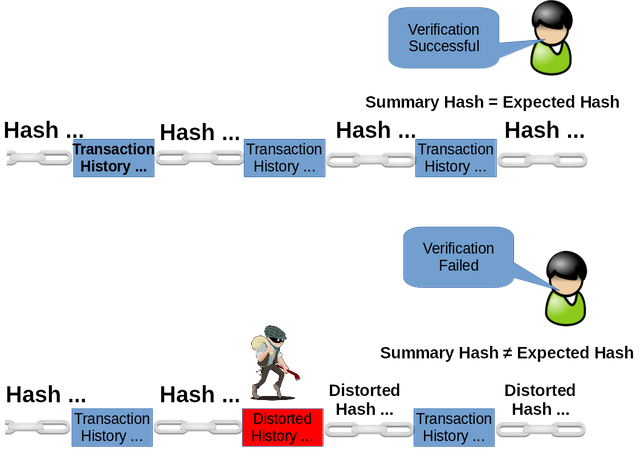

While in Bitcoin that blockchain is like a ledger that contains all previous trasactions secured from distortion or transmutability, as a user you can think of it as a history that is secured with a technology that can easily detect if there are slight changes or modifications with the purpose of preventing them. Unless you are a corrupted authoritive figure, you should agree the history should remain truthful as it is and should not be distorted. Blockchain is such a technology that prevents distortion of history where in this case preventing corruption of financial transaction.

Maybe you have heard about the latest Wirecard issue where one billion dollars was lost, or previous scandals such as seven billion dollars accounting error by Worldcom, Enron's hidden debt, or even the Charles Ponzi scheme back in the old days. If not, most probably you have heard of financial corruptions happening in your country or local area. I still remembered my teen days in Indonesia where there was Century Bank scandal. Nobody knows where the money went and the rich people who put their money their lost all their savings. I remember seeing the news that once a rich woman must know work as a laborer at any construction sites. Who knows if there were any that have to work as a maid or as a slave after losing their savings. I firmly believe in the absolute energy theory where energy does not disappear but transferred out. Obviously, the money did not disappear, someone must have taken that money. With blockchain technology, transactions can be securely recorded in details, preventing these kinds of scandals.

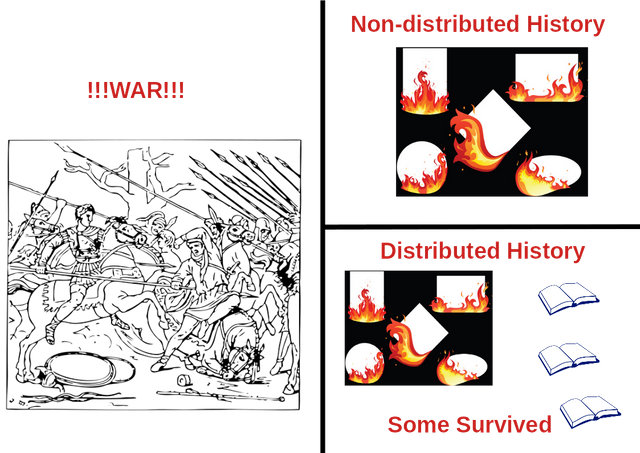

Distributed System

Blockchain is a good way to record history due to the mechanism that a slight change can be easily detected but unfortunately, blockchain alone is useless. If there is only one copy of blockchain in one server, how to know modifications if there are no reference? Well, you can just have backup of the blockchain or record the modification that occur but do you really trust the entity to be honest? They can just corrupt the copy and the modification record. This is where distributed system comes in. Blockchain does not only exist on one server but many servers that are distributed and able to verify each blockchains.

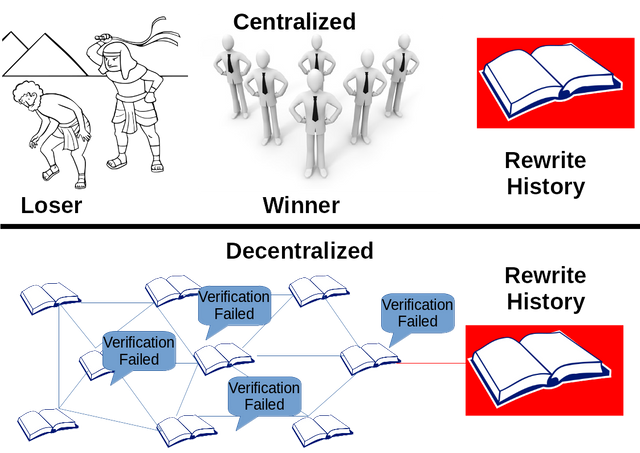

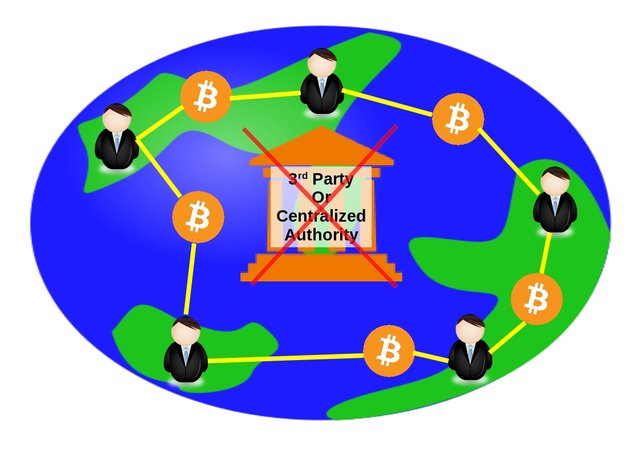

Decentralization

After inventing the blockchain and implementing distributed system, Satoshi Nakamoto invented proof of work which is some sort of mathematical algorithm to emulate working in computers as people sweat when working. By combining blockchain, distributes system, and proof of work invented decentralization where any computer nodes can process transactions and other nodes can verify. While the current financial system requires intermediaries to build trust in transactions, Bitcoin does not require intermediaries as the algorithm allows every node to reach a concensus. While the current financial system is centralized where decisions are made by the top authorities, Bitcoin is decentralized working solely on algorithm, meaning that no entity can control.

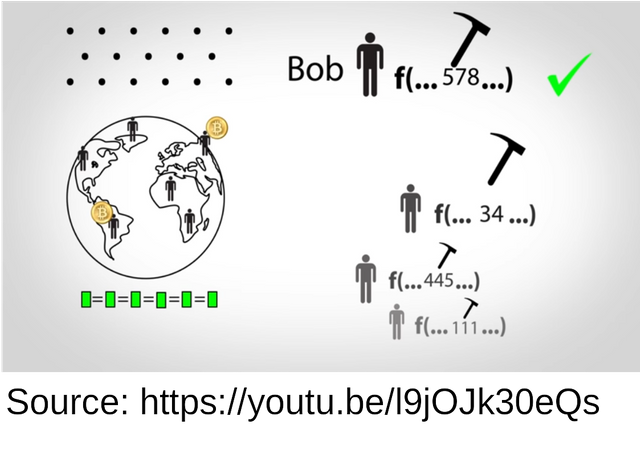

Mining

The proof of work is like a competition to solve mathematical problems which are too technical to be included in this book. If you are curious, read the 2008 white paper by Satoshi Nakamoto or find other sources. Those who works are rewarded with Bitcoin which is why the process is illustrateable to mining. This is also how Bitcoin is generated.

Open and Transparent

The whitepaper is open for anyone to read currently at https://bitcoin.org/bitcoin.pdf.The source code is open for anyone to use currently on https://github.com/bitcoin/bitcoin. It is even possible to fork the code and start a new coin. The Bitcoin network is open for anyone to participate whether as a user, a node, and/or a miner and transparent for anyone to see. All transactions are transparent, who mines and received Bitcoin supply are known, and the total supply of Bitcoin in existence is also known and determined which is 21 million and will be never less or never more. Therefore, Bitcoin is neither deflationary nor inflationary overall.

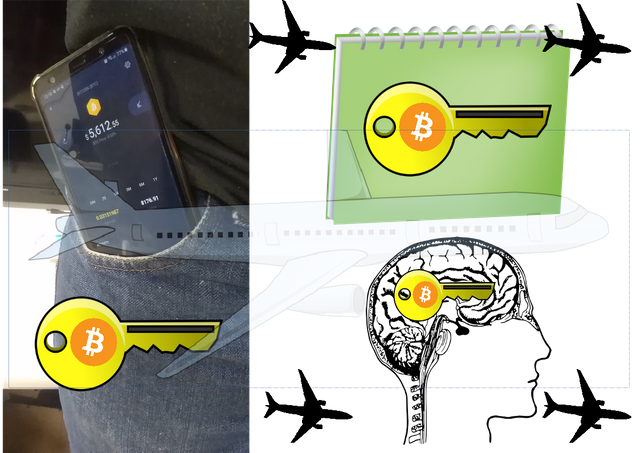

Unconfiscatible

Your Bitcoin are safely stored on the network and nobody except for those who knows the keys can access and ideally, only you should know the keys. By keeping the keys safe to yourself, no even the highest authorities can confiscate your Bitcoin. This surprisingly works well in oppressive regions where the governments who were suppose to serve the people grew corrupted in power. The private keys used to be a large complicated set of characters but now there are keys in form of seed phrases. This is also related to borderless, where you only need to remember the seed phrases in your head and you can travel to anywhere in the world without the needs to carry your funds physically and most of the time without anyone knowing. It is like keeping the funds in your brain. However, there is also a risk where if you lose the keys, you lose access to your funds forever. Therefore, self responsibility is also raised to the max.

Borderless

Bitcoin uses peer-to-peer (P2P) network where for as long as there is a peer nearby, anyone can connect to the network to perform transactions or other activities. The Internet is included in this network where for as long as you have a computer device connected to the Internet, you can use Bitcoin. If you are unfortunate to not have Internet, there is still an opportunity to any broadcasting wave for example use radio to broadcast your transaction. Anyway, with the world today from almost anywhere in the world you can access Bitcoin meaning that you can access your funds.

Uncensorible

Again Bitcoin is P2P where for as long as there is a peer node nearby, you can connect to the network even if Internet is censored. Authorities can always try blocking every nodes but good luck in blocking emerging nodes daily. If you have used any Bitcoin wallet, you probably wondered why they give many warnings of not to make mistake in inputing the receiver's address. That is because the transaction is irreversible not only to prevent distortion and manipulation but to prevent censorship. If a transaction is reversible, authorities can easily demand to reverse your transaction if they do not like it.

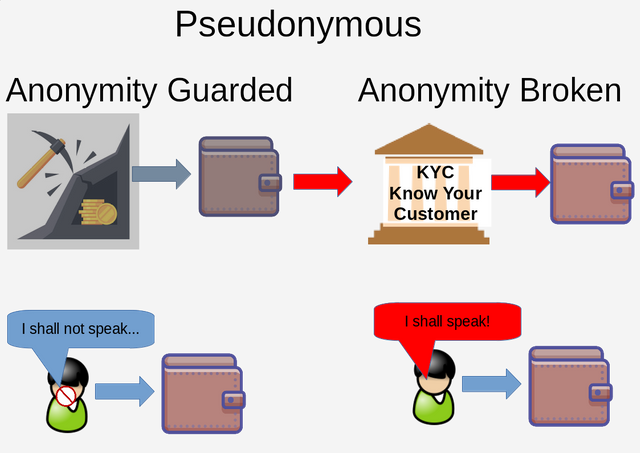

Pseudoanonymous

Bitcoin is pseudoanonymous where the anonymity depends on how you use the coins. You can choose to be identified from the start but if you choose to be anonymous, you need to know how to use the coins correctly where the basic is just not to send your coins to any address that may expose your identity. If you have to do so, then create a new address and get new coins from another source.

Bitcoin to Other Coins

Bitcoin maximalist may say that other than Bitcoin are scam coins, only Bitcoin is the truth, but in my opinion, that thinking will only cover one of the beauty of Bitcoin. The beauty of Bitcoin is that it is open source where anyone can reuse the code and modify. If anyone wants to build something different or just does not agree with some function of Bitcoin, then they can freely create another coin and take a different path instead of fighting to change Bitcoin which isn't that the same as war?. Then let the people choose which coins they prefer. The freedom to choose is one of the beautiful contribution of Bitcoin.

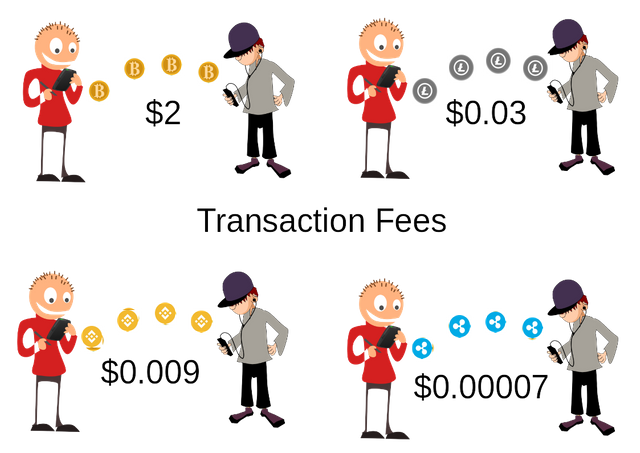

For remmittance, I do not use Bitcoin because currently is at least $5 more expensive. Five dollars are maybe a small amount for people in developed countries but for us in developing countries is the cost of 4-7 meals. Bitcoin maybe the cheapest option in developed countries but in places that I went to which is remmittance from Japan to Indonesia, Brastel Remit which is non-crypto is cheaper. For my case, using Litecoin is the cheapest. Although there are BNB and XRP which are cheaper, the exchanges that I used in Japan does not have them or offer only expensive rate. If your argument is that because I am using fiat, that is an irresponsible argument at least in this time because almost all of us earn in fiat. If your argument is that because I measure in fiat, I will answer because almost all items are measured in fiat for example, would you spend $5 in transaction fee to buy $1 of coffee? See Chapter 3 for more details. There is already a layer 2 solution which one of them is the lightning network but we are still waiting for the technology to develop and for merchants and exchanges to implement.

Alternative Coins

You probably have heard that there are thousands of alternative coins (altcoins) out there and are growing to millions. With many coins out there, how do we study all of them? Well there is always a way of studying them one by one but as a starting user, the simplest way is to study Bitcoin first because most of these coins have the properties of Bitcoin but with few or many twists. Here are some examples:

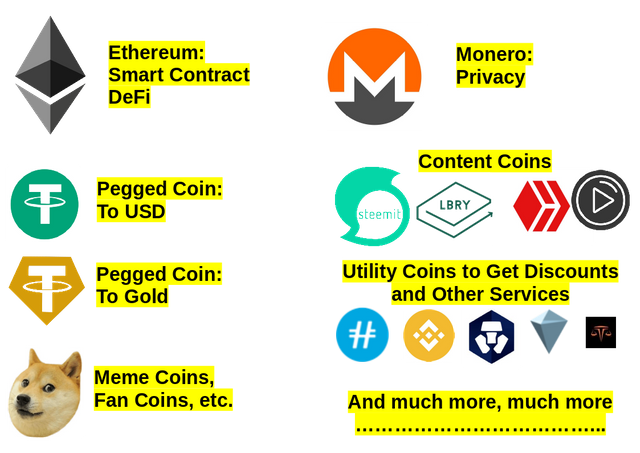

- Ethereum: the first coin for decentralized application and services which includes decentralized exchange (DEX) and decentralized finance (DEFI). I heard that the story behind this that one of the founder Vitalik Buterin wanted to build these on Bitcoin but the Bitcoin developers disagree because it will spam the network and other reason. The Bitcoin developers stated that they only want Bitcoin for transaction only. This is way Vitalik Buterin went different path and created Ethereum instead.

- Monero: the first coin that focuses on privacy and anonymity. Bitcoin is pseudoanonymous where if you send to certain addresses may expose your identity. Monero uses an algorithm to make the transaction untraceable ideally. Monero also resist application-specific integrated circute (ASIC) and graphic processing unit (GPU) mining so that regular people can have a chance to mine using their computer processing unit (CPU).

- Stable coins: coins that are pegged to certain values usually by having the assets in reserve. Example fiat pegged coins are: USDT, USDC, and TUSD are coins pegged to dollar where one coin is worth one dollar, EURS is a coin that is pegged to Euro, BKRW is a coin pegged to Korean won, bitCNY pegged to the Chinese yuan, BRZ pegged to the Brazillian Real, and IDRT, IDK, BIDR pegged to the Indonesian rupiah. There are also coins such as DAI that are not pegged but uses algorithm to adjust themselves to certain values. An interesting type of stable coin that emerges today are commodity stable coins such as XAUT and PAXG that are pegged to physical gold.

- Content coins: coins where the blockchain is specified for sharing social contents. The early projects are Steem and Hive where they build a decentralized blogging platform. The new ones today on this writing are LBRY and BitTube that are well known for focusing on multimedia contents. Recently new ones emerged which are Blurt and Revain

- Various mining algorithm: Bitcoin uses SHA256 proof of work (PoW). There are many other coins using different proof of work algorithms such as Equihash used in Ethereum, Scrypt used in Litecoin, Cryptonights which favors GPU and some CPU, and Yescrypts which favor CPU. Other than proof of work, there are proof of stake (PoS) which the algorithm is based on the amount of coins locked where Peercoin is the first one to implement and Ethereum is said to migrate to PoS in the end of 2020. The other one I know is proof of capacity where it uses the amount of hard drive storage. Many more algorithms are emerging.

- Utility coins: the properties of these coins are usually the same to many coins but they offer special services to their platforms. For example exchange coins such as CRO, BNB, HNST, AWC, TWT, KCS, and TOKOK gives you discounts if you use those coins. If you use MCO (deprecated and now just CROTernio, you can get their crypto powered debit or credit cards. You need BitTube as a payment to buy more storage on their platform.

- Fan coins: for example DOGE is initially created as a joke currency where the label uses a cute Japanese dog called Shiba Inu (Hachiko if you know) which is intended for a fun community. If you like sports then you probably should take a look at CHZ.

There are many other coins like there are many companies out there where you need a whole team to research them all. You can legitimately get rich buy investing into altcoin because the concept is the same that you invest in good things before anybody knows. For example I bought $70 worth Statera when I saw there post and read that they are a deflationary coin on defi and when I saw that price was still steady, I estimate that they are still early and finally my Statera once worth over $200 and sold $70 to return my capital and now I'm in profit. Also altcoins are the most dangerous investment I know because new stuffs have a high risk of not surviving for example I bought almost $100 of Inmax as a random gamble and for years they have not launch their exchange and $100 plummelled to $1 meaning that I completely lost the gamble. Also, beware of scams that anyone today can make their tokens, they could even name them Bitcoin for example if you buy these named Bitcoin token it cannot be used on the Bitcoin network because they are not the same. Therefore, always do your research first.

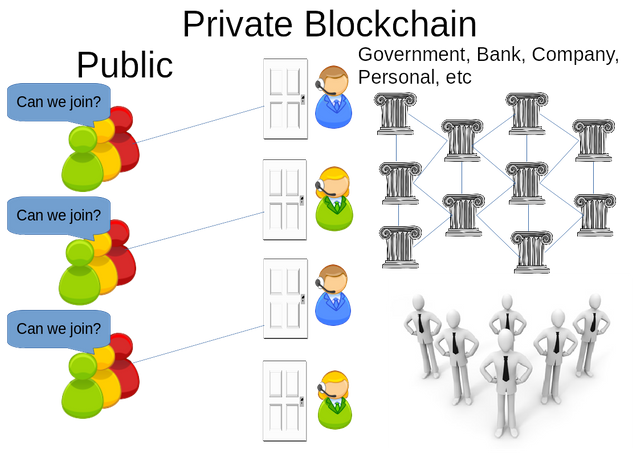

Government and Other Private Blockchain

The governments, banks, and companies said they are interested in implementing blockchain. You often heard they said yes to blockchain but no to Bitcoin or blockchain has value but Bitcoin does not have. What do they mean? They like the blockchain and the distributed system but they do not like the decentralization, openess, censorship resistance, unconfiscatibility, and privacy. They are in control of the global financial system, implementing Bitcoin means the same thing as giving up control such as their ability to print currency, their ability to distribute to whomever they want, and their ability to enforce monetary policies.

In summary, they want to develop a currency that uses blockchain and distributed system but centralized, censored, closed, and controlled. While the general cryptocurrency are open for anyone to participate, government blockchain currency development are closed to the government only such as the distributed nodes are only governmental nodes and if there is mining then only the government nodes can mine which means that only government nodes are allow to process and verify transactions. I am not sure what their motives are but in my opinion probably to increase the security when they implement digital currency and to prevent internal corruption but still have the power to manipulate the blockchain if they deemed necessary and to have monetary control over their citizens such as who can use, who cannot, what services are allowed, and freeze or even forcefully take the citizens' balance when necessary. What about company blockchain? Like Facebook Libra, while government blockchain are closed to the government, company blockchain are closed to the company where the company decides who can enter the space and have control.

Correlation to Our Lives

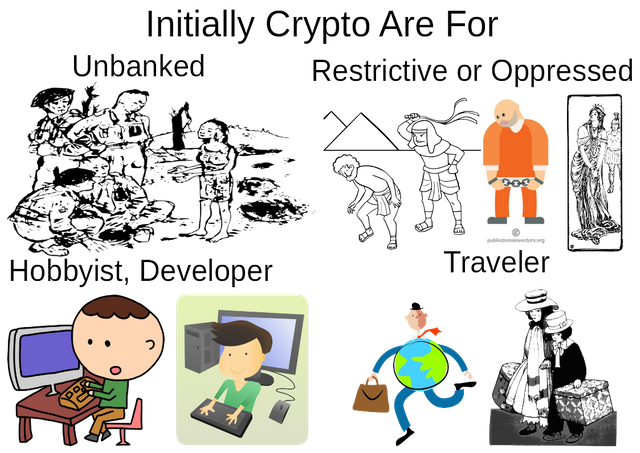

Now that you know how amazing Bitcoin and other cryptocurrencies are but unless you are hobbyist, follower of economic news, or have faced financial turmoil before, you probably asked, what does cryptocurrency have to do with our lives? In rough questions are so what, what about it, and then what? You maybe living very well right now. You have a large amount of cash in your pocket and balance in your bank account and you can buy what you need or even what you want and now, you are even fasinated that you can swipe your debit and credit card anywhere for payments or you can purchase online. Then, why do you need cryptocurrency? For starters, there are people out there that are not as fortunate as you such as people who have their local currency value destroyed, denied access to banking or banking services are just not available, have banking but currently restricted due to oppressive authorities, or in anyway denied participation in the global financial system. Mainly cryptocurrency are for these people. Other than that, cryptocurency are for developers, visionaries, supporters, opportunist, educators, tech geeks, speculators, and more. To truly understand cryptocurrency, it is necessary to know about the previous and current financial system.

Financial Value

Most of us are probably born with fiat currency or public simple term cash accepted as money which is a tool to communicate value. Simply with money you can buy anything and most of us believe that money is our primary necessity which is not true. Money is just a tool, it is what we can get with money is our true necessity. If you cannot understand that, then you lack history lesson or logic. Ask yourself a question, does money always exist in the past? The answer is no. If you go back in time and give people dollars, they would think you are crazy. Why would they give you stuffs for a piece of paper?

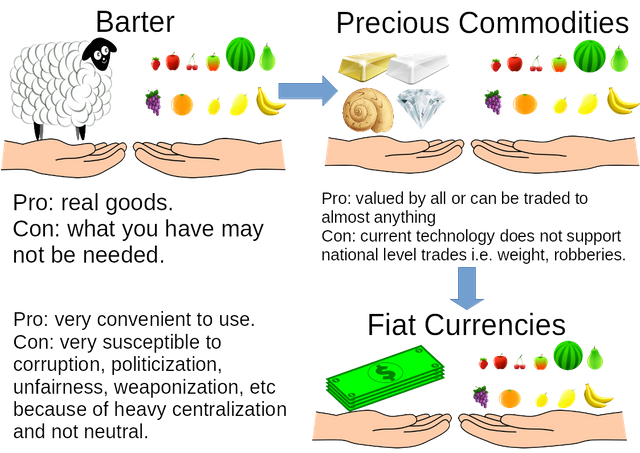

The oldest form of trading is barter. I need water and you need food so I trade some of my food with you to get some water. However, barter have scaling, practibility, and divisibility problem. I have food but not everybody needs much food, you have clean water but not everybody need much water, and someone have clothes but not everybody need much clothes. I need clothes and found someone who has that also needs food. I have to negotiate how much food to give and how much clothes that person will give. Very impracticle and people began to demand a single unit that can measure the value of every item or an item called money that can buy anything.

People began experimenting with salt, sugar, crops, shells, and other commodities as currencies but only one type was admitted through out history and that is precious metals. Mainly gold and silver have the property of immutibility which means no one today can create gold, you have to mine gold. This means today that gold is scarce which is known to have limited supply. The property of gold also cannot deteriorate which the form of gold you have now will remain the same almost forever which indicates a good commodity to store. Gold is divisible where items can be valued in weight of gold for example a meal is worth a few miligrams (mg)s of gold. People began to create gold coins that makes trading much more practical then before.

In my opinion, for average people, gold was doing well as a currency but gold was not practical enough to be used on nation scale for example it is very heavy to carry for massive transaction not forgetting to mention costly as well and risk of being raided or anything that can lose the physical golds. Dividing gold is still not easy for regular people where you need smithing which means that there is a limit to the divisibility. Say that I carry a few mg of gold but I only want to buy one candy, usually I cannot but have to purchase many candies or other items.

This is where paper money comes in. Instead of carrying heavy gold, we trust banks to store our gold and receive a certificate or a kupon where each of them represents an amount of gold. That is the good dollar I knew, where each dollar can be exchanged to fixed certain amount of gold. Paper money are easier to carry and easily divisible and vice versa. It is also practical enough to be used as a medium of exchange on a nation scale. Then comes banking, the digital age, and online transactions and you know the rest.

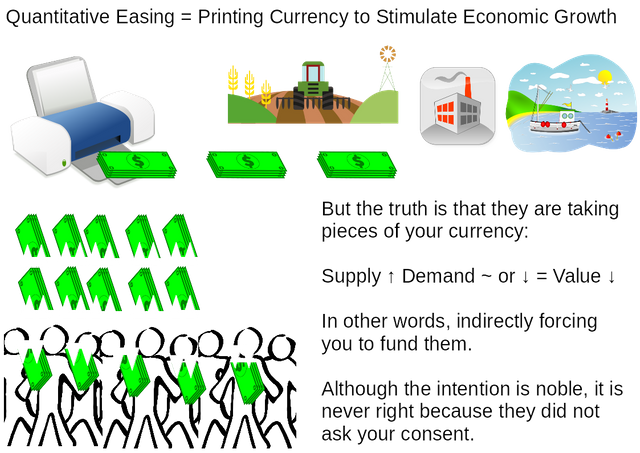

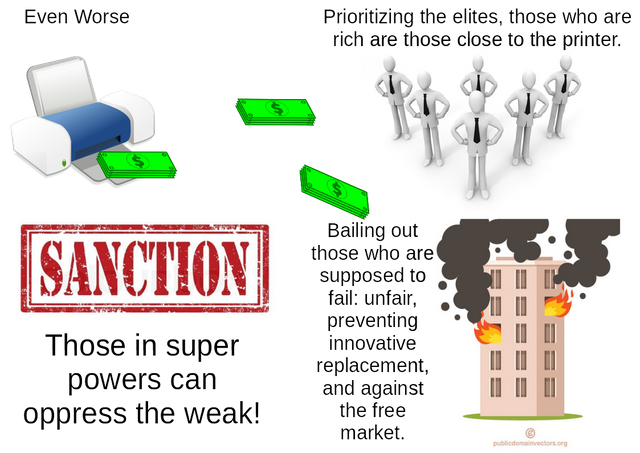

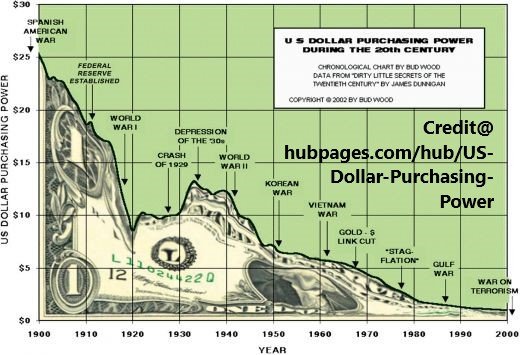

Everything is well when the government and their partners are righteous but what if they are not? In 1971, Nixon ends the Breton Woods system by taking the Dollar of the gold standard. This means that the Federal Reserve will no longer exchange the fix amount of gold to the Dollar. The deeper meaning is that they can print as much Dollar as they want whilst previously they need the gold to backup the printing. At least they should have some goods to backup the Dollar but they do not and print out of thin air. Now, they have the capability to do quantitaive easing. Although the intention is noble which is to stimulate economic growth, the reality is indirectly forcing you to fund their projects. You should agree that donation cannot be forced nor without consent.

Most of us in the open crypto world are sarcastic of banks at that with similar statement of why should the banks be afraid of taking risks if there is the government to back them up? If they win huge profit in their investment then most of the profit is theirs but if they lose then the government will save them by printing fiat currency in giving it to them and do you even know what that means? That means devaluing the cash that you hold which is the same as giving pieces of the cash to them. Logically, is not the government who bailed out the banks but you the citizens who bailed them out except for those who sold their cash and bought physical goods. Think of it like this, you worked hard in a gold mine to get physical gold and then there are many alchemists who can create a lot more gold very easily from nothing. Usually the amount you mined is enough to get a decent amount of food but these alchemists also needs food. These alchemists offers a lot more gold for the same amount of food that you demand. Now, who will the food seller sells the food too? Ofcourse the alchemists, now it is the norm that food cost a lot amount of gold, how much food can you get? Almost nothing, all that hard work in the gold mine suddenly becomes useless since the birth of many gold alchemists. This is what you call inflation. The Dollar and other fiat currency are now the same, where the federal reserves, central banks, or government are now the alchemist. They can create cash as much as they want give them to whomever they want.

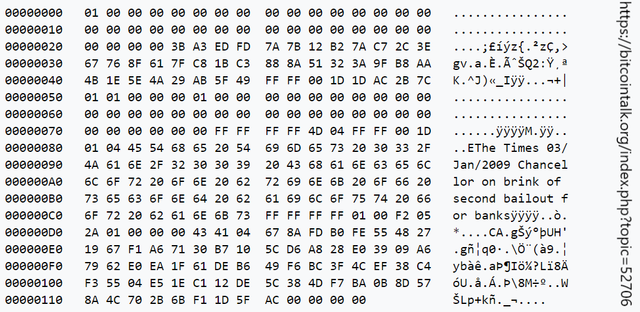

In the banking crisis of 2008, they perform alchemy and transmute papers into Dollars and give them to the banks. Bitcoin might not have been invented if they bail out the citizens instead of banks or the least just let everything collapse, accept their mistakes, and build a new better system. If you see the message in Bitcoin's genesis block which is the very first transaction, it states discontent of the second bail out. The exact message is "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks". In my opinion, Bitcoin was a protest for the government's irresponsible control of the fiat currency so Bitcoin was invented as a currency that no one can control or politisize.

Before proceeding, let us take a look at some other currency debasement history. Most of the information I got from Guide To Investing in Gold & Silver by Michael Maloney and I strongly recommend watching his Hidden Secrets of Money Episode.

The fall of the Roman Empire in this perspective is caused by the overfunding of conquering other regions where the government ran out of funds. They started by debasing their coins by embedding less gold and silver and ended by forcing the merchants to lower their goods' and services' price. Naturally, the economy fell. Before the Roman Empire, there was Athen where they also find a clever to overfund the war by mixing 50% copper into their gold and silver coins and perform deficit spending.

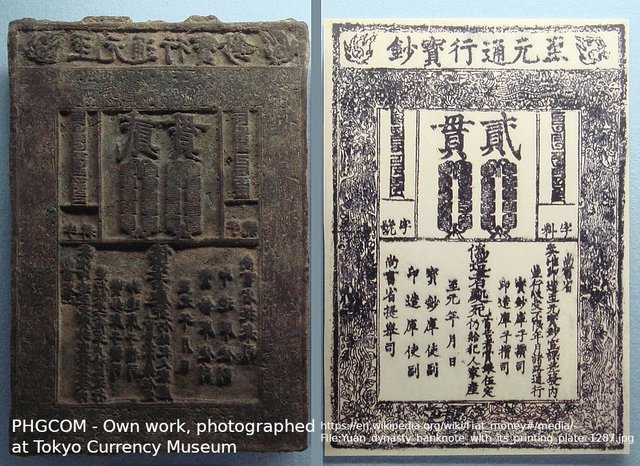

It is known that the first paper fiat currency emerges in the 1370 during the Tang Dynasty in China. Merchants who does not accept the paper currency receives the Death penalty. Not long afterwards, it went into hyperinflation.

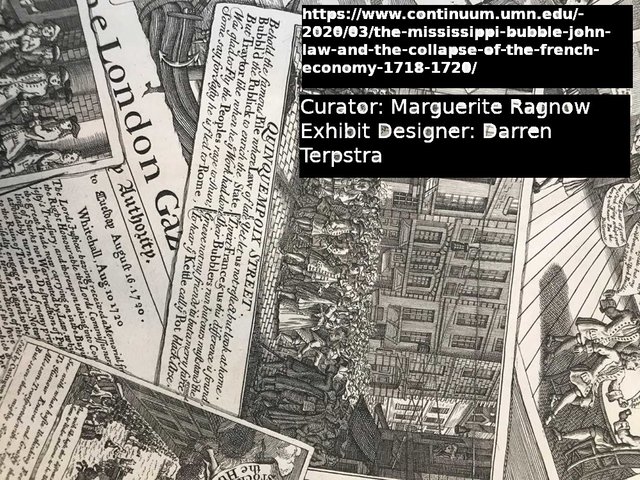

Around 1716 France was in great debt that even the taxes could not cover the interest. John Law proposed paper currency and economy prosper and everyone lived in great wealth. However in the end, the system began to collapse when a royal exit the system by redeeming their paper currency to gold. Then everyone started to follow, if there were no gold then silver were given, and if there were no silver then copper were given until everything collapse. The paper currency did save the economy at one time but they blew it up by irresponsible spending and more printing, or they are just living in delusion that they are using imaginary assets or in my opinion future spending power, or the reason they succeeded in the begining was quitely and indirectly they were using the wealth of the citizens by printing more currency which is actually the same as increasing the taxes many times fold but the citizens were ignorant of the truth.

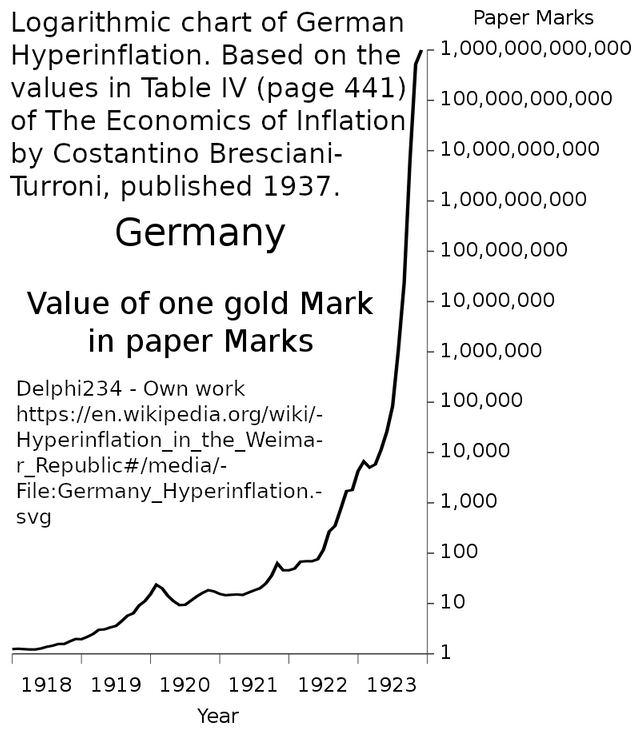

At the beginning of World War 1, Germany conducted heavy currency printing out of thin air but inflation was slow to follow. This was because of dire times that the civilians were conservative therefore, less currency in circulation, and they believed in the currencies purchasing power so they save them meaning higher demand for currency and less demand for goods and services. When times got better, the demand were reversed. Everybody wanted to spend and in no time hyperinflation followed.

After the 1900s, the Dollar and similar fiat currency went through similar events which are overfunding of wars. In the end, they exit the Breton Woods system by cutting the Dollar off the gold standard. Today they can print as much fiat currency as they want. As the previous explanation about the 2008, the authorities decides who should be rich and who should be poor like a deity deciding who lives and who dies manipulating the natural law of the free market which was no doubt unfair.

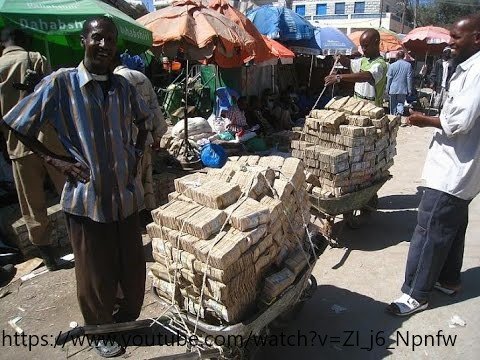

Even today, Zimbabwe is still a well known case of hyperinflation where they print their fiat to oblivion that you can even find markets selling mountains of cash as souvenir. Today, Venezuela is in the lead for hyperinflation.

Bitcoin and other cryptocurrency can be a solution because their supplies are transparent and more fair than the current fiat currency. However, there are other solutions for this issue. The oldest form of money that have survived for centuries are precious metals such as gold and silver. If your goal is only to preserve your wealth, then buying gold and silver have proven to be a great solution historically. Other than precious metals, you can go back to the basics of money and ask the question of why you need money in the first place, and that answer is because you want to buy goods and services. Simple examples are stocking food supplies, have shelters which include houses, and buy items that you need and items that you think will be useful in the future. To go further, start being self sustainable such as grow your own fruits and vegetables, build a farm, secure your own water supply, or even build your own electricity source such as using solar panels, wind turbines, and other renewable energy sources. Once you become smarter, you probably want to start your own business instead of just holding those cashes.

Financial Freedom

This book does not emphasize cryptocurrency as a solution to financial value. You can find gold bugs in agreement with Bitcoin activists regarding the problem with the current financial system but does not agree with Bitcoin especially other cryptocurrencies mainly because they do not have physical form and many other reasons. Like this book stated previously that if the problem is only financial value, there are other solutions which proof historically effective. Eventhough these years Bitcoin and some cryptocurrencies have the best performance, regular people cannot handle the short term volatility. However, before the purpose of tackling financial value, Bitcoin and other cryptocurrencies are created for a larger purpose.

In my opinion, on the creation of Bitcoin in 2008, the value loss of fiat currency was not the primary problem. The primary problem is the global financial system heavily controlled and maybe politisize. Remember that the current local currency that we hold are no longer backed by any value and the central banks along with the government can print as much as they want, and remember that that kind of printing is taking value from you and giving them to others. They can decide who gets wealthy and who gets poor. I am aware that I am bashing the authorities one sidedly. If I were in their shoes, what would have I done differently? I do not know but this book is mainly for you users and citizens. I believe to put my friends, families, and myself higher priority than the nation, it is the default nature. Wise people immediately escape to precious metals and other assets but do you know that often when a country's financial system is about to collapse, they implement strict monetary policies. This book is about how to save yourself when they abuse the fiat system and not about whether their decisions are right or not. In fact, I do not really care about debasement, printing out of thin air, counterfeiting, inflation etc but I care about the freedom to utilize and manage our own wealth however we want or to join and exit the system whenever we want which is why I am in cryptocurrency. The previous subsection discussed only the intial phase of falling economy which is debasement. When debasement starts to fail, the following usually happens which happened in all the debasement examples of the previous subsection:

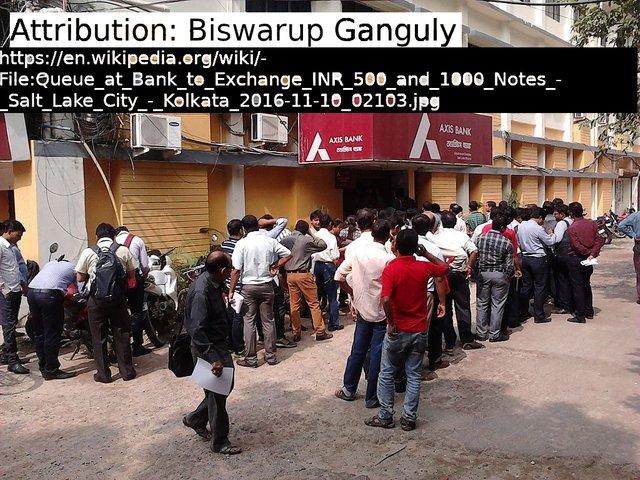

They may demonetize bank notes. Although theoretically there should not be any changes but in reality may indirectly affect the citizens. For example in India 2016, there were shortage of cash, long bank queues, and short deadline where there were citizens who did not have the opportunity to exchange their bank notes. This means they are now holding useless paper cash which means they got their wealth stolen indirectly.

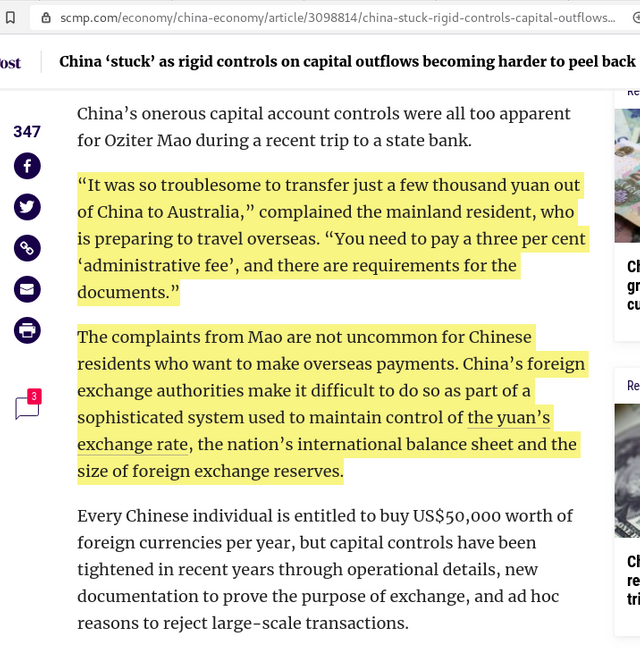

They will start to ban exchanging and trading assets other than their fiat currency, for example they banned transactions in gold and other foreign currencies such as the Dollar. Other examples that are happening during the writing of this book are China discouraging its people from buying precious metals, FDIC discourage you from withdrawing cash from the bank, the global stock market closes temporarily during the black swan event due to COVID-19, and more severe example is Zimbabwe permanently shutdown its local stock market accusing it to be responsible for the collapse of their fiat currency once again and also they block all electronic and mobile payments.

They implement stricter travel rule for example rumors of China not allowing its citizens to bring their wealth outside of its country without the government's permission.

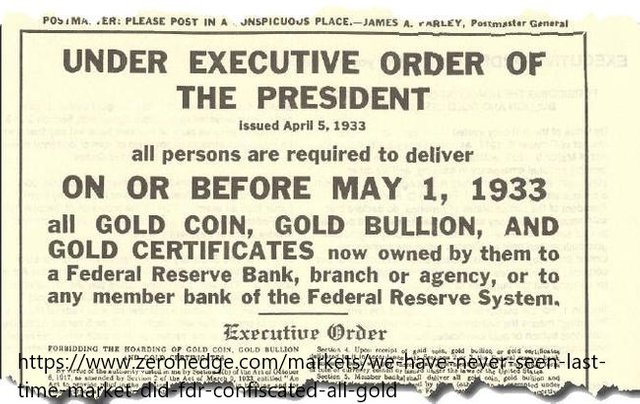

When it gets worse, they force exchange your assets into their fiat currency such as the Executive Order 6102 that confiscates citizens' gold.

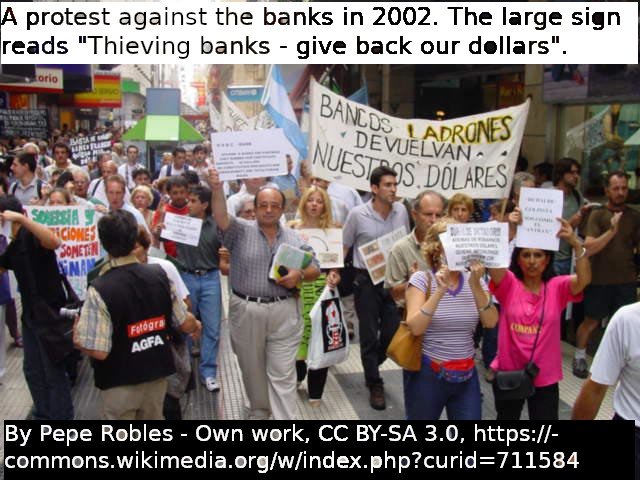

Even worse is the Corralito Affect in Argentina where they frozed the citizens bank account forcibly covert 1 Dollar to 1 Peso which then they released the peg and immediately 1 Dollar became 4 Peso and got more expensive. The worst case is that they truly confiscate or seize your asset like how Cyprus in 2012 seize bank deposits where seizing only normally happens to criminals.

The last thing that they will try to do is to force control the price of the market to their fiat currency. This happened a few years later in the United States after President Nixon no longer supports the convertibility of the Dollar to gold. The worst was near the end of Roman Empire where they released a law that citizens are forced to work and continue family business but at a controlled price punishable with Death.

With Bitcoin and other cryptocurrency, regulatorily can be banned but technically cannot be stopped or censored, technically cannot be confiscated where the only way is to persuade, pressure, or social engineer the owners to hand over themselves, both the supply function and distribution are algorithmicly and mathematically defined which ideally is neutral and not controlled by any single entity, and also most are open and transparent

Mirrors

- https://www.publish0x.com/cryptocurrency-101-for-users/cryptocurrency-101-for-users-chapter-1-the-freedom-of-financ-xjjwldn?a=4oeEw0Yb0B&tid=steemit

- https://0darkking0.blogspot.com/2020/09/cryptocurrency-101-for-users-chapter-1.html

- https://medium.com/@0fajarpurnama0/cryptocurrency-101-for-users-chapter-1-the-freedom-of-finance-and-wealth-5978cb49f123

- https://0fajarpurnama0.github.io/cryptocurrency/2020/09/22/cryptocurrency-101-chapter-1

- https://0fajarpurnama0.tumblr.com/post/629953087966248960/cryptocurrency-101-for-users-chapter-1-the

- https://hicc.cs.kumamoto-u.ac.jp/~fajar/cryptocurrency/cryptocurrency-101-chapter-1.html

- https://0fajarpurnama0.wixsite.com/0fajarpurnama0/post/cryptocurrency-101-for-users-chapter-1-the-freedom-of-finance-and-wealth

- http://0fajarpurnama0.weebly.com/blog/september-23rd-2020

- https://0fajarpurnama0.cloudaccess.host/index.php/uncategorised/68-cryptocurrency-101-for-users-chapter-1-the-freedom-of-finance-and-wealth