Following on with the series where we have covered EOS and Steem, today lets look at the potential prices that Power Ledger could achieve on its current projectory.

For those who don't know who Powerledger is, they were Australia's first ICO raising over $34M during ICO and have also secured part of an $8M funding from the australian government to further trial their micro-grid electricity distribution project. The company has been around for a few years already and comes into this space with a working product already, rather than just a promise of a product.

The company is currently working on trials with Origin Energy and Tata in India. there have also been rumours of a partnership with Tesla.

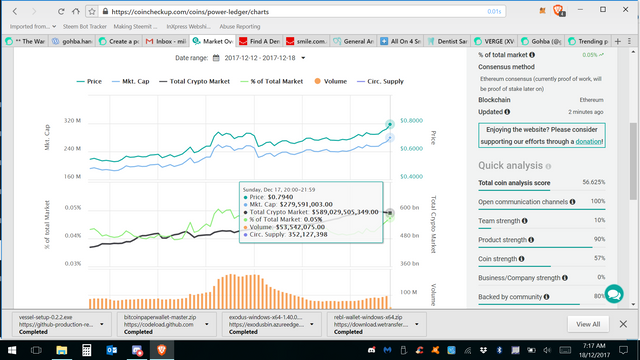

So looking at the main chart, we can see Powerledger has a current market cap of $279M, leaving plenty of room for it to move into the Billion dollar club.

Powerledger currently holds about 0.05% of the entire Crypto market. As a purely niche functional token I wouldn't expect this to hold a huge percentage of the market compared to business building coins such as Ethereum and Steem. But this coin has some room to improve still as the minnow coins fade away and POWR tokens gain greater use.

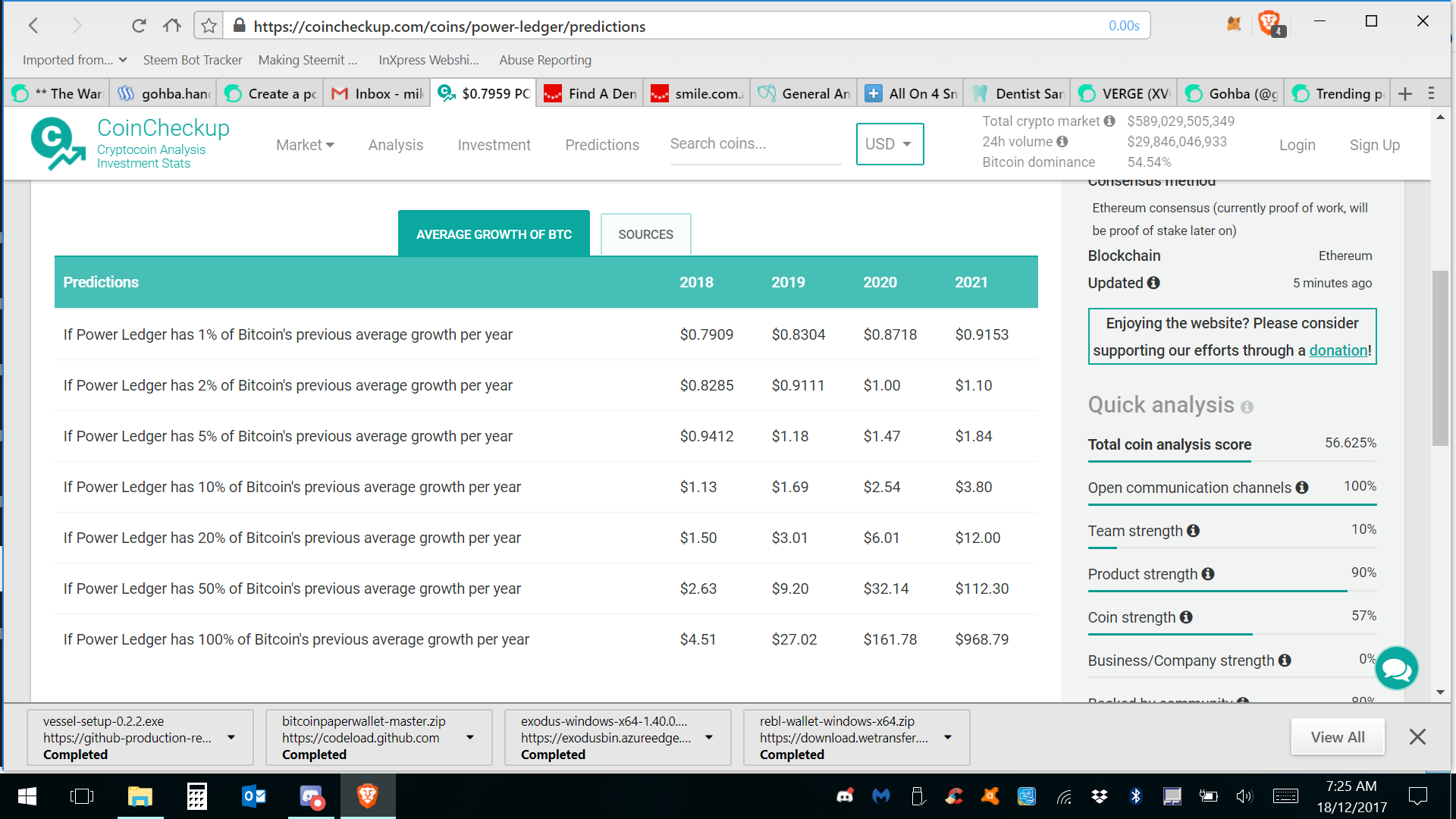

Now if we look at the potential growth predictions compared to Bitcoin, and again using 50% of the average Bitcoin growth rate, we can see that by 2021 we are on track to hold valuable coin, but couple this with its destined market share increase we should see this price being 4-6X higher than that if their trials and partnerships deliver everything that is promised.

As always, there's no recommendations here, just some statistical data to assist you in doing you own research.

Have a nice day. ~h!

Out-bit coin

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received gratitude of 1.00 % from @jout

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've had a brief look at this crypto and I'm unimpressed. I doubt the numbers add up and whilst it's presently running up on all the hype, it will ultimately fail.

Just my 2 cents worth.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

what sets this one apart from others i beleive is they are a pre-existing company and they already have the product that is already working. Its already streets ahead of other coins that have a higher value.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Is it a loss-making product @gohba.handcrafts?

That's the first thing everyone should look at! I briefly assessed it's financial viability and decided it would fail.

Kudos to you if you did buy in early!

I watched it go from 9c to above $1 on the hype. An active trader would have profited very nicely from the naive exhuberance!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Are you telling me that selling your excess solar energy to other people for crypto will fail?

Interesting.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, just like any other business which fails to make a profit.👌

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So I guess Steemit will fail as well, what a shame about all those investors.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the post. It's definitely a long term project but they've already accomplished more than most crypto projects out there.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The fact that they have an actual working project is what I like the most about them. It's the same concept as STEEM where I see them both still massively undervalued simply because their name isn't out there... yet. Get on board.

Also, we've gotta back the Aussie here, don't we? ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit