There are two camps in Cryptosphere. Bitcoin Maximalists and Altcoin champions. I first came across the below image when Bitcoin hit an ATH of 7400 during the month of November. Bitcoin rose steeply and many altcoins got butchered. It kind of captured the mood of Bitcoin maximalists very well.

Bend the knee and I shall have mercy

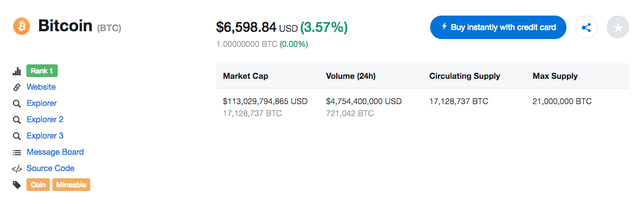

Bitcoin

Bitcoin Details on July 4, 2018

Bitcoin Details on July 4, 2018

What is Bitcoin?

For the uninitiated Bitcoin is the first widely used peer-to-peer electronic cash. What we mean by peer to peer is that there are no trusted middle parties in the transfer. The ledger of balances that are held by various accounts/parties is maintained by a group of computers called nodes. Since the ledge All these nodes use an algorithm called Proof of Work for consensus. Consensus is coming to an agreement regarding the order of transactions. The order of these transactions is critical as it makes sure that you cannot the spend the money you don’t have. You can also rephrase not spend the same money twice which is generally referred to as “Double Spending” in cryptosphere.

Though there has been references to peer to peer electronic cash for long, 3rd January 2009 (when Bitcoin was introduced and the Genesis block was mined) can be considered as the official start of cryptocurrencies. For a technology that is barely 10 years old it has made many heads turn and has given sleepless nights to many governments and institutions across the world.

What is Altcoin?

All cryptocurrencies other than Bitcoin are called Altcoins. At the time of writing this article there were 1607 coins listed on CoinmarketCap. The fact that you can create a new token in couple of minutes using various token creation services only exacerbates the problem of innumerable coins/tokens popping up each day.

There are 1607 coins listed on Coin Market Cap

There are 1607 coins listed on Coin Market Cap

What is Bitcoin Maximalism?

This tweet of mine tries to summarise Bitcoin Maximalism.

Bitcoin is the flag-bearer of cryptocurrencies and my guess is it will remain so for at-least another couple of years. While there are many factors that contribute to the value of a cryptocurrency(or network) the primary factor is still the security of the network. Different camps attribute different factors that represent the security of the network. Some camps attributes security to the amount of POW, a few others attribute it to how distributed a coin is, a few others to vested parties(in DDOS) etc. Considering that Bitcoin has the highest marketcap and highest exposure it is also subject to maximum scrutiny. Security of the Bitcoin network leads to its higher share of Market and higher marketcap makes it more secure. So until something miraculous happens Bitcoin will remain the most secure cryptocurrency network.

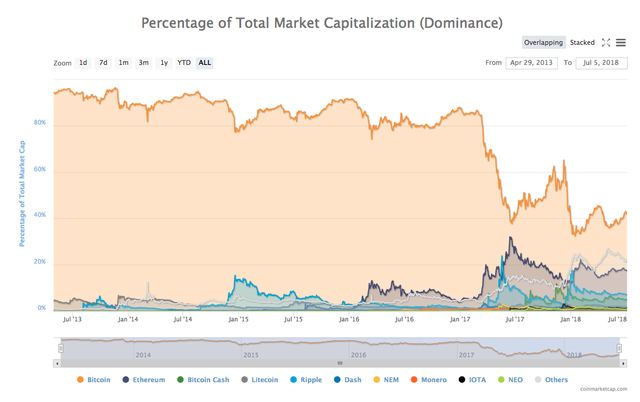

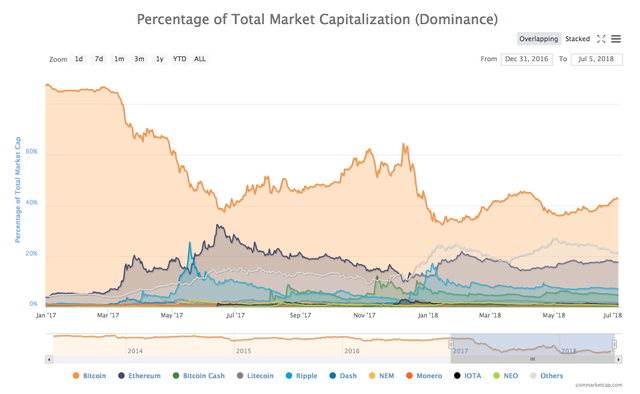

Bitcoin Domainance

Bitcoin Dominance since

Bitcoin Dominance since For the majority of cryptocurrency lifespan Bitcoin has maintained a dominance of more than 80%. It would be a fallacy to consider Bitcoin Dominance as a unified factor for making any analysis. I think it would make sense to split it into two parts as of now. Pre-March 2017 and Post-March 2017. Though cryptocurrencies were called Smart Money most of their use-cases only went on to prove that they were Dumb Distributed Digital Money. With Ethereum showing the advantages of programmable money and smart contracts the dominance of Bitcoin naturally started falling. I strongly have a feeling that Bitcoin dominance will never cross 80% again. If bitcoin solves its scaling issues it might get back to the levels of 60% dominance again. (This article was written a month ago and looks like Bitcoin is very close to crossing 60% dominance) That would also mean that many of the Bitcoin forks which claim that they are better than Bitcoin or address particular issues of Bitcoin will be further slaughtered.

It is only natural that as the time progress Bitcoin dominance will reduce but it might still remain the dominant coin for at-least foreseeable future(which is crypto is couple of years). For Bitcoin to maintain its dominance above 40% and to reach the figure of 60%, the second layer apps/services on Bitcoin network should drastically increase which doesn’t seem to be the case now. POET is one good project that is moving from Bitcoin testnet to Bitcoin Mainnet. If more project choose this approach Bitcoin will definitely maintain its dominance. The recent occurrences of 51% attacks on various nascent networks and Bitcoin clones only goes on to further prove that it is very difficult to keep the network secure until a hit a critical mass. It would make sense for new projects to choose the most secure network to base their workflows on and may be consider moving to other networks if more advanced secure networks come up at a later stage.

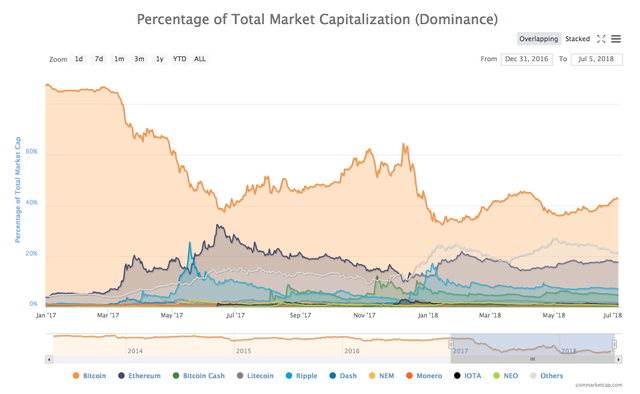

Dominance chart post March 2017

Since we are splitting the dominance charts as pre and post March 2017, let us look at the dominance chart for post March 2017.

Bitcoin Dominance post March 2017

From the above graph you can see that though Ethereum rose to 30% during the month of June 2017 due to the craze around programmable money, smart contracts and ICOs it gradually reduced from there and is consistent around the 15% to 20% band. You can observe from the above chart that there is a broadly a inverse correlation between Bitcoin and Ethereum dominance. Whenever the Ethereum dominance increases Bitcoin’s dominance decreases and vice versa. This is no surprise as they were the top two cryptocurrencies. Together they have had a market dominance of 75% till May 2017. After the decrease in December 2017 to a 46% dominance, it has been consistently above 50% till date.

The emergence of “Others” post March 2017

“Others” which were at a meagre 4% around March 2017 has seen a considerable increase in the share till date. It is interesting to see that “others curve” has a general uptrend from March 2017 to till date. There are couple of dates which stand out in this timespan and gives us a better idea of the nature of the so called “others”.

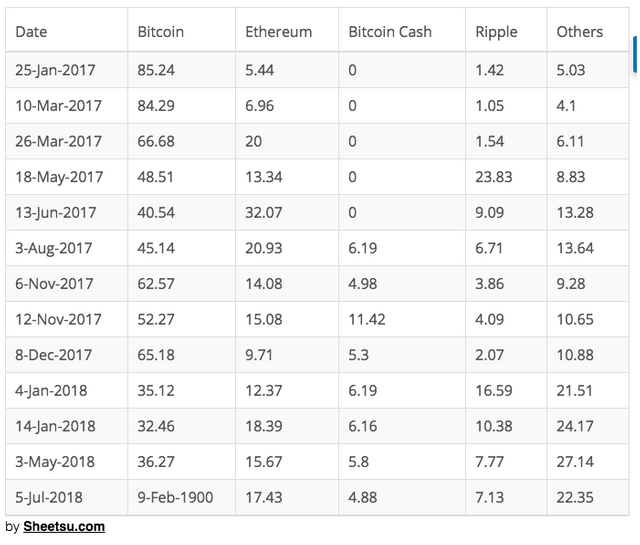

The data for the above table has been fetched using a script I wrote for sampling data from the Highcharts on CoinMarketCap website. You can read more about it here

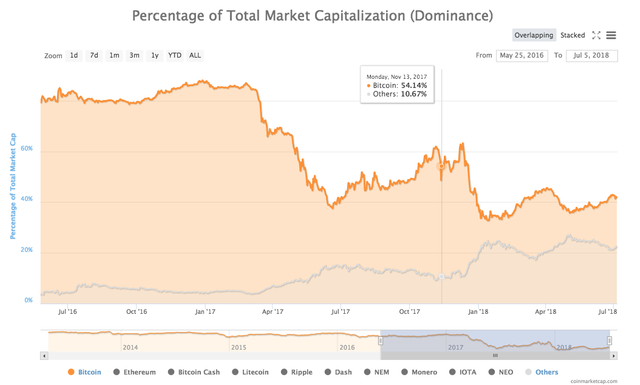

Try to read the data from the above table and take a look at the chart below to make better sense of it.

Bitcoin Dominance post March 2017

Bitcoin Dominance post March 2017

March 10, 2017 — Bitcoin : 84.29 , Ethereum : 6.96 , Bitcoin Cash : 0 , Ripple : 1.05 , Others : 4.1

Nothing surprising here. I took this sample just to show how things where when Bitcoin was ruling. So not long ago Bitcoin had a dominance of close to 85 %.

March 26, 2017 — Bitcoin : 66.68 , Ethereum : 20 , Bitcoin Cash : 0 , Ripple : 1.54 , Others : 6.11

Well that was a drastic fall. Bitcoin loses almost 20% and most of it is gained by Ethereum. Ethereum raised from 7% to 20%.

May 18, 2017 — Bitcoin : 48.51 , Ethereum : 13.34 , Bitcoin Cash : 0 , Ripple : 23.83 , Others : 8.83

Ethereum looses some of its dominance. But there is a surprise here from Ripple. Ripple raises to a dominance of 28.83 %. Ethereum and Ripple together bring the dominance of Bitcoin to below 50%.

June 13, 2017 — Bitcoin : 40.23 , Ethereum : 32.45 , Bitcoin Cash : 0 , Ripple : 9.05 , Others : 13.26

Ethereum dominance raises to an all time high of around 32%. Bitcoins dominance is down to around 40%. The craze for programmable money and smart contract is soaring. ICOs become talk of the town. People start asking if Ethereum will overtake Bitcoin.

August 03, 2017 — Bitcoin : 44.67 , Ethereum : 20.84 , Bitcoin Cash : 6.83 , Ripple : 6.73 , Others : 13.55

Bitcoin scaling issues get hotter and Bitcoin is forked to create Bitcoin cash.

November 06, 2017 — Bitcoin : 61.64 , Ethereum : 14.28 , Bitcoin Cash : 5.28 , Ripple : 3.92 , Others : 9.5

As things start settling in, Bitcoin slowly regains its market dominance and regains upto 61% dominance. Ethereum, Bitcoin Cash and Others gradually loose their dominance.

November 12, 2017 — Bitcoin : 53.12 , Ethereum : 15.08 , Bitcoin Cash : 10.62 , Ripple : 4.01 , Others : 10.69

As Bitcoin mining becomes more profitable miners start supporting Bitcoin Cash. Bitcoin Cash raised its dominance to 10.62%.

December 8, 2017 — Bitcoin : 63.13 , Ethereum : 10.05 , Bitcoin Cash : 6.36 , Ripple : 2.28 , Others : 10.81

This is the time where Bitcoin is approaching ATH of close to 20,000 USD. Bitcoin regains its dominance as Altcoins are butchered by the pace of increase in Bitcoin value.

Jan 04, 2018 — Bitcoin : 33.34 , Ethereum : 12.34 , Bitcoin Cash : 5.39 , Ripple : 18.99 , Others : 21.79

Chris Larsen of Ripple becomes richer than Google’s founders. TV hosts start showing how to buy Ripple. Ripple is touted to be the next Bitcoin.

In a span of one month Bitcoin dominance reduced to 33.34% almost half of what it was in December 8th. Post this date looks like Bitcoin dominance might never cross the 60% mark. (Or it might looking at the current dominance :P)

Jan 14, 2018 — Bitcoin : 32.54 , Ethereum : 18.47 , Bitcoin Cash : 6.2 , Ripple : 10.44 , Others : 23.91

Ethereum is still facing scaling issues. Others consisting of Tron, IOTA, EOS, Cardano and Stellar keep growing consistently as they promise to enable DAPPS and ICO while addressing the scaling issues.

May 3, 2018 — Bitcoin : 35.93 , Ethereum : 16.29 , Bitcoin Cash : 5.79 , Ripple : 7.67 , Others : 26.98

EOS reaches an ATH of 20USD around this time. Others reach an ATH of 26.98. Others seems to retain their market dominance.

Today-July 05, 2018 — Bitcoin : 41.92 , Ethereum : 17.58 , Bitcoin Cash : 4.79 , Ripple : 7.02 , Others : 22.51

Bitcoin is slowly regaining its dominance. With more cryptocurrencies becoming stable and releasing their mainnets, I think Bitcoin will really have to give a huge fight to go past the 60% dominance mark. BitcoinCash is also trying to position it well by making it usable and user friendly. BitcoinCash might increase its share over the time.

Nevertheless Bitcoin will always have the first mover advantage and even today for many people Cryptocurrencies means Bitcoin. So if Bitcoin addresses its scaling issues and if second layer protocols like “The Lightning Network” become successful, Bitcoin will surely give many new cryptocurrencies a run for their money.

If you found this article please don’t forget to clap and leave comments. I have just listed some dates that I considered in the tug off between Bitcoin and Altcoins. If you think there are other important dates, do let me know in the comments section.

Disclaimer : I am a crytpo-enthusiast and am sharing my opinions for peer review. Please do not consider this as financial advise. The article was written a month ago and Bitcoin is very close to crossing the 60% mark today. Looks like I might need to eat my words. Bitcoin maximalists should be grinning now

Cryptocurrency is still in its infancy. Evaluation is difficult especially for younger coins as they take time to develop. The reality is something will always supersede the current best. Not to say bitcoin will fail but it will one day have to face the reality that there is something that can replace it. I do not know what that altcoin is but gut tells me bitcoin will not survive in the long run.

The current up and down is people trying to maintain bitcoin as an asset but in reality cryptocurrency is right now only liquidity. It can not hold a stable value so not many long term investors. People can trade fiat to bitcoin daily without losing a lot but to hold it for weeks or longer seems dangerous right now if one expects it to rise it may not for a while.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Most of the valuation now is because of speculation. I would be ok with it if there were say 100s of projects. But with 1600+ projects I don't think it is sustainable. Projects shouldn't do an ICO until it is required. For getting visibility and adoption they always have the option of airdrops. Only when they have proven a few things or have a working product they should ICO.

I am not a bitcoin maximalist. But I think it will maintain its number one position for quite some time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @gokulnk, i am very appreciating your contribution with this article and with your setting of bounty. Your post is very detailed and you explain exactly that over BTC, the rest are shitcoins! Yes, is sad but is true, how it possible that over 1700 coins are below 50% of total value? Because BTC is like the gold in stock exchange market, the value is keeped by whales which have already invested billion dollars, the rest are coins based on good ideas but without economic support, so just when there is bear market, all go to BTC or exchange shitcoins to fiat money.

Lets hope that 2018 will end like 2017, but i am worry will be not, i already lissen too many specialist forecast always mistaken...:(((

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good analysis. I would consider myself a bitcoin maximalist. When I entered crypto that was different. I was so excited about all the different projects. But often they are just hot words with little to back them up.

There may be innovation in new coins, but people underestimate the innovation that is happening within bitcoin. There is a lot happening on the base layer and bitcoin is also clearly leading the second layer development.

For now I remain very optimistic on bitcoin and I think that it may last for at least 5 to 10 more years.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That was insightful. Do you follow bitcoin development closely? Can you lead me to some resources for following the development updates?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

maybe you should split your portfolio similar to the market dominace data. if crypto in total is rising - your portfolio should too, no matter what

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is a good idea. With smart contracts we might be able to pull if off without much effort as well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You go into great detail with your dates and focus more on the positives than the negatives. The most important date of all was missed, so I can tell you're more of a programmer than a financial analyst 😸 CBOE futures launch date, December 10th and 17th, 2017. Since BTC futures were launched it's not so much about my coin is bigger than your coin, except on Reddit.

ETFs, Futures, Wallstreet and the big money has taken over. What's a few billion dollars to a FANG stock, they could pump obscure altcoins to the top ten for less than a days revenue.

Also look at major news releases like hacks and large public scandals.

On the positive side, I like to focus on publicity stunts, partnerships and exchange listings. These pump altcoins more than the announcement of some feature 99 percent of people don't understand or care to understand.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin really needs to solve its scaling issues. The first mover advantage isn't going to be something that can last forever if the speed of transaction problem isn't fixed, so high hopes for Lightning. The speed means that it is not possible to have widespread adoption, and adoption will be the thing that makes or breaks the coin (alt or btc).

I recently did a transfer of BTC, and I was reminded of how bad the speed issue was (after being spoilt by faster chains like Steem). I did the transfer, then had time to go to an embassy and make a visa application before it cleared. That is an extreme case of slowness, but it is not acceptable if it really wants to be currency of any sort, reserve or spending.

Unless Lightning rejuvenates the network, BTC will slowly fade into the background as an unrealised potential, hopefully not dragging the rest of the crypto sphere with it...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is true. But I think Bitcoin has an unfair advantage and hence can easily decimate other coins. Lightning is a key decider for Bitcoin adoption. But irrespective of use-case of value transfer, Bitcoin has the advantage of being ultimate store of value. So it has more time than any other cryptocurrency out there to fix its shit. Other alternatives like Bitcoincash, Litcoin, etc can gain some market dominance until Bitcoin solves its scalability issues. But we will know what will happen when Bitcoin cleans up its shit :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh, definitely. It has more time than most to fix it's problems, but if they don't get resolved then there could be a slow exodus to something else. I think the bulk of it's power comes from being it being the default trading pair. If that starts to dissolve, then it might be a turning point. For instance, with Coinbase starting to open up to other alts... People can easily go from fiat to something else without needing BTC as an intermediary.

Well, also a huge lead in hash power doesn't hurt either..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't like all the hate between bitcoin maximalists and the altcoin.

I think for the future of bitcoin dominance it will be important how the use of blockchain will be in the future.

If it focus on use as currency i think the bitcoin dominance will continue to rise. Bitcoin is still the best and secure crypto currency and other like bitcoin cash, litecoin, etc. have no chance to keep up with bitcoin.

But if other use cases of blockchain like smart contracts, dApps, etc. increase their usage i think the bitcoin dominance will decline and shift more to the altcoins.

And as you mentioned bitcoin and altocins are still moving very similiar. If Bitcoin goes down, the altcoins follow with a even greater decline of the price.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The only reason why Bitcoin is the king of cryptocurrencies is because it was the one introducing the new paradigm. If you look at btc and other alts, It's mostly likely that the alt performs better. Why? They probably forked btc, enhanced it and boom. Or as in many cases, it just inspired better ideas which make btc technologically deprecated.

At the same time, most of the altcoins are bought with Bitcoin, and that's why whatever happens to it the alts get similarly affected.

Now think about how inflated the cryptocurrencies marketcap is. It says 210 billion USD or whatever on coinmarketcap, but most of the coins are only bought with btc! which means they are counting the same usd multiple times...

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

And I dont' agree with your view on bitcoin.

At first you can't compare most altcoins with bitcoin, which goal is to be used as currency, as the aim at different use cased, mostly to pay the service offered by the blockchain.

And for the use as currency trust and adaptation is most important and no other currency like crypto comes close to bitcoin.

Bitcoin also gets improved over time so I still can compete with the altcoins.

And I don't know what you mean with your last point.

What does buying and selling of altcoins with btc to do with the marketcap and why are they counted mutltiple times ?

Are you talking about the volume ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well of course, you can't compare Bitcoin with Ethereum for instance, but you could do it to other altcoins that are meant to be used as a currency such as Litrcoin or Dash.

Well for my last point I'm not talking about volume but true market capitalization, allow me to illustrate: there is $100 billion in BTC and only BTC. You create an altcoin that nobody wants but gets somehow listed in a random exchange with the pair Xcoin/BTC. Out of thin air, the marketcap went from $100 billion to $100 + something. That something is not usd. No new usd entered the economy, instead the value of that coin is being calculated based on what a BTC costs, but it actually is traded via BTC, which means that cap is kind of imaginary. Trying to find a medium article on that I read once.

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There might be a sudden fall in Bitcoin's dominance (like in January), and it will let the alts thrive.

This was on 11 August, one year snapshot:

Click here to enlarge the image

Cheers!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very true. As you can see from the previous data whenever there is no confidence in the market, Bitcoin gains the dominance while butcherinng the altcoins. Once Bitcoin gains considerable dominance and market stabilises it leads to increase in price of Bitcoins, Altcoins rise up at a faster scale and Bitcoin dominance comes down again. We have seen this happening in multiple cycles. When you see red move to Bitcoin and once market stabilises move to altcoins might be a good strategy. I am learning more about stop losses so that I can set up auto trades based on this criteria.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Indeed, especially if you're trading in 'sats', or to gain Bitcoin value and not fiat.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Im a maxilmalist because I believe bitcoin will bring forth mass adoption. I like some alt-coins but there's too many scams to actually side with the altcoin community.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Way too many scam coins out there. But we have to bear with them as we have the opportunity to identify some real gems out there.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great statistical and graphical analysis...I think, your explanation about btc will be so effective....@gokulnk... In this time yesterday BTC was 6400 USD . But now BTC is 6500+ USD.. Almost $6600 .... Not only BTC all cypto are going to be high .. Specially STEEM increase 12.26% within 24 hours. Thats great update for steem holders and steemians also...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin dominance appears as though it will continue to grow to and perhaps past fifty percent in the near future, however in doing so, the alts have gotten slammed and are historically undervalued...this, combined with a possible short squeeze in BTC could mean a moonshot for the alts in the next couple of months!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

People who do not know any thing about bit coin before on reading this post i guarantee they will know more than enough.

The dominance of bit coin will last for years although etherum is trying in fact those two will dominate for long

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Fully voted.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@gokulnk has set 10.000 STEEM bounty on this post!

Bounties are a new way you can earn rewards irrespective of you Steem Power. Go here to learn how bounties work.

Earn the bounty by commenting what you think the bounty creator wants to know from you.

Find more bounties here and become a bounty hunter.

Happy Rewards Hunting!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You make the chances to learn ourselves

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The Bitcoin bulls will be fully aware of the rise in Bitcoin dominance over the week, reflected in the minor losses relative to the broader market, the support for Bitcoin certainly evident over the weekend.

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excelente información.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the information.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There's a lot of potential cryptocurrencies emerging now and that's a form of hope for the future

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Cheers...I very agree ...Now really a lot of potential crypto emerging now...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

#teambitcoin

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I used Bitcoin buying hosting same.. thanks for sharing this post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

it was amazing my friend.

I am new in here please help me and upvote me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like the content on your blog. I think I can also share something interesting with you. Please, subscribe to me! I've subscribed to you in advance.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I follow you, I hope for your reciprocity

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Maybe you must split your portfolio like the market dominace information. if crypto in total is rising - your portfolio ought to too, regardless of what

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

First I want to congratulate you for such a good summary and the easy way to make yourself understood. I thought it was great your journey through time and the variations in the values of dominance in the market of the main cryptocurrencies.

I am also a believer and enthusiast of cryptocurrencies, I think and I am sure that they are the future of world finances, no matter how many war banks and states want to make.

I also believe that there is a lot to discover from cryptocurrencies, because all this is so new.

But the BTC will not leave its domain for long, I do not think, based on the fact that most currencies are calculated from them. Of course, I know there are also calculations of others from ethereum, but nevertheless btc is still the mother currency, for much longer.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit