I used to day trade during the times of the Great Bull Run. However, days I don't much have time to day trade. Instead my Technical Analysis revolves around medium-term plays.

So I prefer to make moves every week or even every fortnight. This strategy allows me to remain fairly fluid whilst not taking up my time from my other responsibilities. I do intend to return to day trading when the market picks up but this set-up works fairly well for me now.

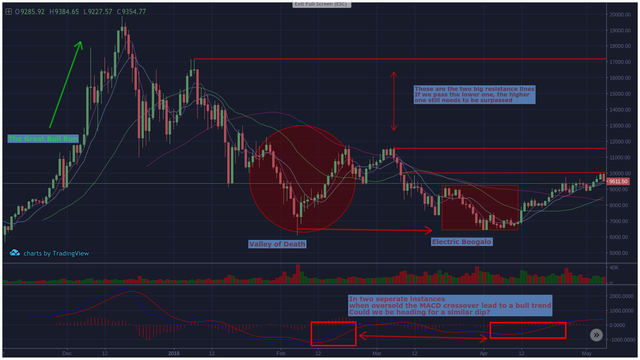

My chart for this month looks like this... Last week Friday we hit a strong resistance of 10k. We spent most of Saturday trying to break through yet amazingly it got rejected. The dip started and dropped below to 8.9k earlier the day before. That led to not so positive effects on traders morale.

I sometimes use ridiculous analogies for TA as I believe it relies primarily on human psychology and can relate to human experiences. For me, I visualise the 10k resistance as an attractive woman that a young, inexperienced boy may fall in love with. He tries to court her, woo her and bring him to her favour. Unfortunately she had better options and decided to reject you.

Ouch. How would you feel?

( )

)

Definitely emotional and a little hurt. The pricing afterwards may reflect that mentality. By that I mean, we may not lose complete confidence but prices will show much more volatility and perhaps further dips below 8.9k before we can regain our footing. Falling down down 8.9k from the 10k resistance would definitely be an indicator of that but also the fact that we have not accelerated past 9.4k.

I believe the MACD indicates this extremely well if we compare the bull-run that got us out of the 'Valley of Death' and 'Electric Boogalo'. So at least for another week, we should expect more sideways (but volatile) action and we may even creep near the 10k resistance. We may not creep over it for a while however and we still have a LONG way to go before we even get over 11.8k.

Keep patient folks and if you participate in short-term trades then be prepared to make money of the wild swings that may come our way.