What is SALT?

SALT is a membership based [Lending] & borrowing network that allows users to leverage their blockchain assets to secure cash loans.

What is the purpose behind SALT Lending?

Providing liquidity (cash) to the holders of blockchain assets (Bitcoin, Ethereum, etc). In other words, allowing the crypto asset owners to use their cryptos as collateral (a pledge for repayment) for access to credit

SALT Lending provides an asset-based loan, rather than income-based loan (unlike the loans you receive through banks or credit card companies) in which consumers' credit scores are accessed before any loans is granted.

Who Can Borrow from SALT Lending Platform?

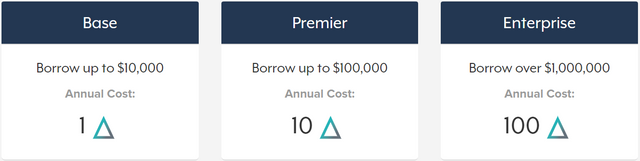

- Anyone. Subject to KYC (Know Your Customer) & AML screening. As individuals you can borrow up to 100,000 USD annually. As an enterprise you can borrow loans over 1,000,000 USD. Below is the membership tiers and the cost (in SALT) per each group:

Who Can Lend in the SALT Lending Ecosystem?

- Only Accredited Investors and qualified financial institutions (such as banks, broker-dealers, etc) can become lenders on the SALT Platform. All interested parties must complete the SALT Lending “Suitability Test” and meet a minimum investment threshold.

Individual, non-Accredited Investors are not eligible to lend on the SALT platform.

The market cap of SALT is currently at $678M with 54M SALT tokens in circulation. There will be total of 120M SALT tokens.

You can create an account with SALT lending platform here.

Source:

- https://saltlending.zendesk.com/hc/en-us

- https://membership.saltlending.com/files/abstract.pdf

- https://coinmarketcap.com/currencies/salt/

Please Upvote & Resteem!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit