Cryptocurrency Arbitrage is buying low and selling high between exchanges within a short span of time. With so many inefficiencies present in the crypto market, there is an unlimited scope of arbitrage opportunities. Arbitrage is a less risky and more logical way of increasing your investment value rather than just holding your coins especially after knowing the fact that cryptocurrency is highly susceptible to time-volatility.

Why KoinKnight?

KoinKnight enables crypto enthusiastic users to have an edge on others by showing such arbitrage opportunities and helps in decision making all in real-time being quickest among all. Some of the distinctive features of KoinKnight are —

- Real-time arbitrage calculation.

- Trading charges and crypto withdrawal charges are included in the calculation of profit.

- 24 cryptocurrency exchanges and 320 cryptocurrencies are supported

- Alerts can be set on arbitrage on favorite exchanges.

- Alert notifications can be received on Browser, Telegram, and Email.

- Desired filters can be created and saved for arbitrages so that user does not have to go through selecting filters again and again.

- Arbitrage can also be saved in the ever-changing market so that user knows at what price they can buy and sell.

- Minimum arbitrage time is shown which a user will consume while performing that arbitrage.

- Support for inputting desired investment amount on which arbitrage can be done.

- Support four different types of arbitrage — Direct, Triangular, Loop and Intra-exchange which we will explain in more detail below.

We have specific algorithms dedicated to finding four different types of arbitrages. The arbitrages are -

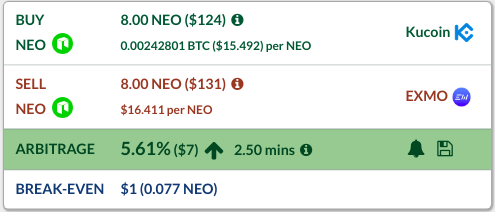

Direct Arbitrage — It is the simplest form of arbitrage where one buy a coin from one exchange at low and sell at high in another exchange. For example, in the image shown below —

- Buy NEO in Kucoin at 0.00242801 BTC in BTC market and send it across to EXMO.

- Sell NEO in EXMO at $16.411 in USD market to earn a profit of 5.61%. The profit includes all trading and crypto transfer charges.

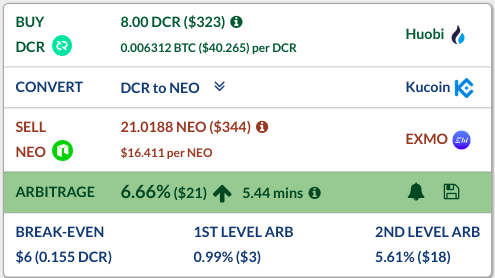

Triangular Arbitrage — It is little complex and little more time consuming than the direct arbitrage since it involves 3 exchanges. This tool is used generally where users see arbitrage between two exchange but they do not have money at the starting exchange. Let’s take an example — In above direct arbitrage, there is an arbitrage between Kucoin and EXMO exchanges. But the user does not have any money in Kucoin to start the arbitrage. But still, he/she want to complete the arbitrage to earn a profit. Let’s say, there is some money at Huobi and there is currently no profitable arbitrages originating from it currently. So basically arbitrage is present between Kucoin and EXMO but money is at Huobi. This is where triangular arbitrage can come to play. A user can search for arbitrage from Huobi to EXMO and find the best profitable route to do arbitrage. Using image shown below —

- Buy DCR from Huobi at 0.006312 BTC in BTC market and send it across to Kucoin.

- Convert DCR to NEO (sell DCR and buy NEO) and again sent it across to EXMO.

- Sell NEO in EXMO at $16.411 in USD market to earn a profit. The profit includes all trading and crypto transfer charges.

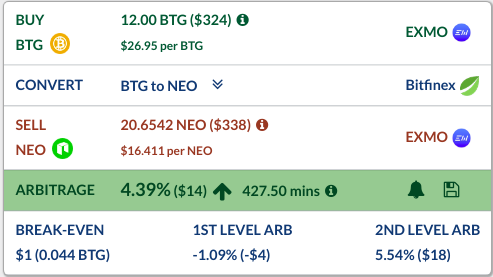

Loop Arbitrage — This is a kind of triangular arbitrage but with a condition that starting exchange and ending exchange is the same. This is required by the user when he/she wants to do arbitrage and also wants to bring the invested amount with profit back to the exchange from where it was started. Let’s take an example using image shown below —

- Buy BTG from EXMO at $26.95 in USD market and send it to Bitfinex.

- Convert BTG to NEO (sell BTG and buy NEO) and again send it across to EXMO.

- Sell NEO in EXMO at $16.411 in USD market to earn a profit of 4.39%. The profit includes all trading and crypto transfer charges.

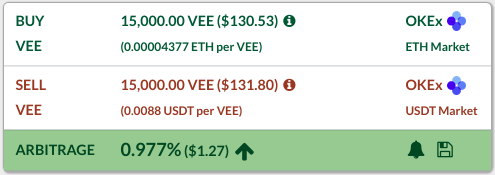

Intra-exchange Arbitrage — It is a type of arbitrage which is found within the same exchange between two markets. Let’s say exchange OKEx have USDT and ETH markets and a coin VEE which can be traded in both markets. Sometimes within these markets, there is a price difference of the coin between these markets. A coin can be bought in one market and sold in another market within the same exchange for profit without actually transferring it and hence avoiding the time delay which usually happens when a coin is transferred from one exchange to another. In the image shown below —

- Buy VEE from OKEx at 0.00004377 ETH in ETH market

- Sell VEE in the same exchange at 0.0088 USDT in USDT market to make a profit of 0.977%. The profit includes all trading charges.

Do let us know in the comment section or by emailing us on [email protected] for any concerns.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/koinknight/cryptocurrency-arbitrage-with-koinknight-53a7f48be718

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @koinknight! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit