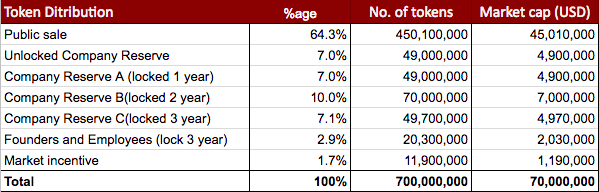

ICO Token: GLU

ICO Token price: 0.10$

Hard cap: $45mn

Pre sale: Private sale 10% discount , $10mn and minimum contribution is $25000

Token sold in ICO: 450mn tokens (64.3%)

Total supply: 700mn

Accepting BTC ,ETH, STRATIS, LTC for ICO

Update 19 March, 2018: GLUON Token Sale Rescheduled to May 2018 due to recent developments at the Securities and Exchange Commission (SEC). You can read the announcement over here : https://www.gluon.com/gluon-token-sale-rescheduled/

PROJECT OVERVIEW:

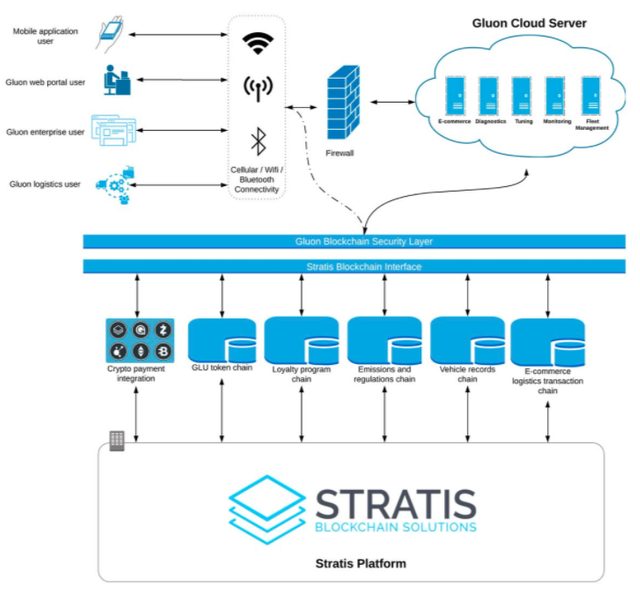

Gluon is the first verified ICO on the Stratis Platform. It is interconnected network of vehicles where individuals and businesses can monitor, track, tune, and diagnose the issues on them.

The use cases identified by Gluon does just that where blockchain will play the role of the keeper of truth. e.g. for fleet management, it would provide the benefit to remove fraudulent activity in reporting and compliance purposes. There is a requirement for the fleets to fill the DVCR (Driver Vehicle Condition Report) to ensure compliance. These DVCR’s have a lot of fraudulent activity in filing. Gluon is striving to automate this activity and record the necessary pieces in blockchain so it cannot be tampered. This would help Fleet Managers earn the trust of the Audit agencies thereby benefiting them as well as the enforcers of these regulations. Similarly, a potential exists for the other use cases identified by Gluon such as Vehicle Emissions which can then be expanded for commercial purposes.

Tuning: They have developed a patent pending device and app which plugs into the vehicle and allows the user to not only monitor the vehicle outputs (fuel, mileage, range, temperature, etc.), but unlike any other device in the market, it allows reprogramming of the actual ECU unit on a vehicle through the mobile app.

Fleet Management: Gluon also gives companies with large vehicle fleets the ability to monitor their entire operations from one location. A single dashboard can monitor where a vehicle is, how much fuel, range, vehicle health and upcoming services required.

Monitoring: Ecommerce connectivity plays off of the monitoring aspect of the device. They want customers to know exactly what issues their vehicle is facing, when a service is due and how much it will cost. With this information at their fingertips, They have partnered with top tier auto parts suppliers to bring the products at the best possible prices to our users.

Diagnostics: The ability to tune a vehicle is also the ability to alert a parent if a vehicle is not traveling within a known/regular path, or even allow a valet mode so one of your most valuable assets wont be taken for a joy ride when put into the wrong hands.

Payments: In addition to traditional methods of payment, Gluon is introducing blockchain payments into its platform. GLU Token provides advantages over other payment methods because processing fees are lower, fraud is reduced, currency conversions, chargebacks and settlement periods are eliminated, and they can be used as a reward system within the program.

TOKEN UTILITY: (Weak)

GLU tokens will not only be used as payment system but also for fees associated with running the side chains such as emissions, records and loyalty incentives.

Token utility is not convincing from investor point of view as the Consumers and businesses are also given the flexibility and security of exchanging payment in cryptocurrency, or traditional forms of payments.

TEAM, ADVISORS AND VC:

Team of Gluon has expertise in product but are doubtful on blockchain integration with the product.

Advisors are from Finance background and Chris Trew founder and CEO for Stratis

VC: ( no information provided)

TOKENOMICS:(Strong)

Market cap calculated on $0.10

Market incentive: For Future airdrops, Marketing expenses and Private Sale Bonus (Up to 10M Tokens)

Unsold tokens will be burned as well as an equal proportion from company supply

The company has strong tokenomics as almost all tokens are vested with (1–3 years) period but the drawback comes on Hardcap which in $45mn, since the product is already in the market and allocation of funds is not justified.

ROADMAP: (Not Defined)

Roadmap can be found on https://www.gluon.com/gluonroadmap/

Which consists of conferences in Q3'18 and Fleet management Beta version release in Q4'18.

GITHUB: (Weak)

Code for Gluon platform and product is proprietary but Blockchain code will be published in future.

MARKETING: (Weak)

Twitter followers: 6k

Telegram: 15k

Reddit: 51 reader

Fb: 14k

The marketing team is not active, Telegram team is hardly replying on product specific doubts which are creating concerns on execution of roadmap.

PROS/CONS:

PROS:

Existing product : Released enterprise product. The consumer product is going through FCC testing at the moment and will be available in just a few months.

CONCERNS:

$45mn Large Hardcap considering existing product.

No Blockchain domain advisors on list

Weak Github as Code for Gluon platform and product is proprietary

Token utility is not convincing.

CONCLUSION:

Company has rescheduled its token sale as earlier it was planned for march and later moved to May, also the company changed its token allocation to team which was reduced to 20 mn tokens.

However considering the token is not giving enough value to the project and the only hype it has is Stratis first ICO

We would rate Gluon 6/10.

We, at Ledgerfund run one of the biggest Crypto Hedge Funds in the world and give returns in bitcoins. To know more about how you can invest your bitcoins in this fund, refer to our website: https://ledgerfund.io

The original Analysis was published here: https://medium.com/ledgerfund/gluon-ico-analysis-3f5261efd7e2

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://bitcointalk.org/index.php?topic=2857163.0

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit