This article compares Bitcoin versus Gold as investments including advantages and detailed shortcomings of each vehicle along with trading considerations.

Gold is an established asset with a long record of preserving wealth across generations. Few assets can make such a claim. Please see the chart below to see how gold has performed over the last 50 years of history and note the strong price appreciation over the period.

Advantages of Gold

- Gold is relatively scarce and cannot be simply printed by central banks. Gold requires large amounts of energy to extract from the ground and convert into gold bars or units suitable for investment.

- Investors may purchase physical gold bullion, which vastly reduces counterparty risk to external third parties who may be vulnerable during a financial crisis.

- Gold appreciated substantially during the runaway inflation of the 1970s. A future economic environment may arise where gold protects the wealth of investors, whereas other financial assets may be falling in such a scenario.

Shortcomings of Gold

- One problem with gold is that it is difficult to transport and use for day to day commerce An investor can’t simply walk around with $10 million in gold bars without attracting attention from authorities and or criminals. Furthermore, it is hard to subdivide a gold bar worth $10,000 and use this to purchase a loaf of bread or business suit.

- Physical ownership of gold will incur a storage cost either to the custodian of the gold or the cost of a safe in an investor's home. Storing gold at home creates a potential risk of theft, particularly if the investor in question is not discreet about their asset holdings.

- Yet another issue is that many investors own gold as an ETF which creates counterparty risk to the issuer of the ETF.

Nonethelesss, gold deserves consideration for any serious long-term investment portfolio given its record of preserving wealth over generations if we go back over history. There are numerous instances where the currency of an economy depreciated, yet investors were able to preserve their purchasing power with ownership of gold (1920s Germany, 1980s Argentina).

Advantages of Bitcoin

Bitcoin has numerous advantages including the ability to transact across borders without an existing banking relationship, increasing adoption (Japan approved BTC as a method of payment on April 1 and Australia is expected to follow in the summer), divisibility (divisible up to 8 decimal places), portability (may transport BTC in a hardware wallet the size of a USB), scarcity (only 21 million shares of Bitcoin will ever exist) and a growing number of use cases.

Use Cases for Bitcoin

- store of wealth with unmatched record of appreciation versus fiat currency

- reserve currency for the crypto asset world, used to price alt coins

- hedge for central banks that debase currencies or corrupt governments that tend to confiscate wealth, particularly in emerging markets

- censorship resistant vehicle for transactions with prohibited actors, e.g. Iran

- currency asset to pay salaries or consulting fees for first rate IT talent

- funding source for capital raising in blockchain industry (ICOs), along with Ethereum

- secure money transfers with relatively low fees vs traditional money transfer

What is the downside of Bitcoin?

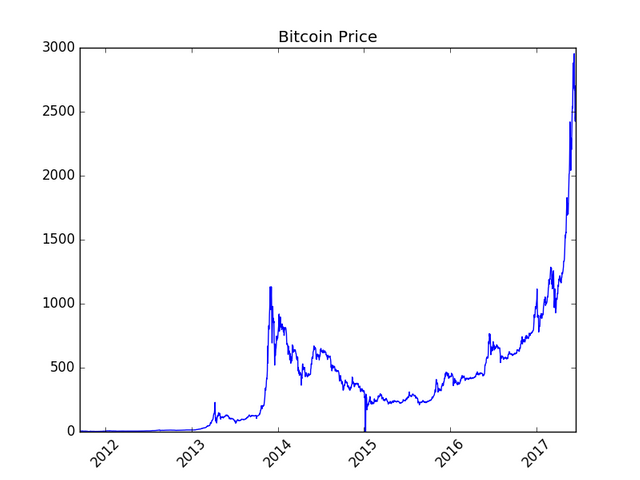

- The price of bitcoin is volatile with numerous 30% or larger drops in its price history, which creates risk of loss for investors. In 2013 after the developments around the Mt. Gox scandal, Bitcoin lost over 80% of its value.

- Due to network congestion of the Bitcoin blockchain, transactions are slower than they used to be. It may take hours to receive a transaction. This is due to technical scaling issues within the Bitcoin network that are outside the scope of this article.

- There is a learning curve associated with learning how crypto currencies and blockchains work, how to purchase Bitcoin, how to store it safely (e.g. hardware wallets) and where to spend it.

- Bitcoin relies on electricity and the internet. If both the electrical grid and the internet were down, for example due to a solar flare or an electro-magnetic pulse (EMP) event, it would be very difficult to transact with Bitcoins. Of course, if either event happened, fiat currency which is digitized and mostly held by banks would probably not be of much use either!

Currently the market capitalization of Bitcoin is about $43 billion (June 18 assumes $2620 price), which compares to $7300 billion for gold (assumes $1250 price). If there is any significant move away from gold, cash or equity markets toward Bitcoin, we could have a strong rally in Bitcoin prices to much higher levels. Given the above factors I have invested in Bitcoin and have been rewarded so far with the investment.

In closing it should be noted Bitcoin has benefited from nearly exponential appreciation in recent weeks since March 2017 when the Bitcoin ETF was denied by the SEC. Potential investors please beware, BTC may be profitable in the long run but in the short run purchasing near current levels could lead to short-term losses. The opinions on this blog post solely reflect the views of the author and do not constitute an offer to buy or sell or a solicitation of an offer to buy or sell any security, product, or investment.

Sources:

http://www.breakingbitcoin.com

https://fred.stlouisfed.org/

http://www.gold.org

https://www.quandl.com

https://en.wikipedia.org/wiki/Gold_as_an_investment

Note: The chart for gold was sourced from the Federal Reserve economic database (FRED).

Lite coin as well as maybe eth longterm will do better than gold and silver together % wise. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree and am long LTC as well. I also have a portfolio of micro cap currencies below $10m market caps including ABY, COVAL, BTA, DAR, MUSIC which I plan to discuss in future blog posts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Awesome Thanks for letting me know and I look forward to reading :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @warrenvee, i just posted an article Low Market Cap Crypto with detailed trading ideas on several of the cryptos I mentioned in this thread. If you find it useful, please upvote. Btw I have started following your blog.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit