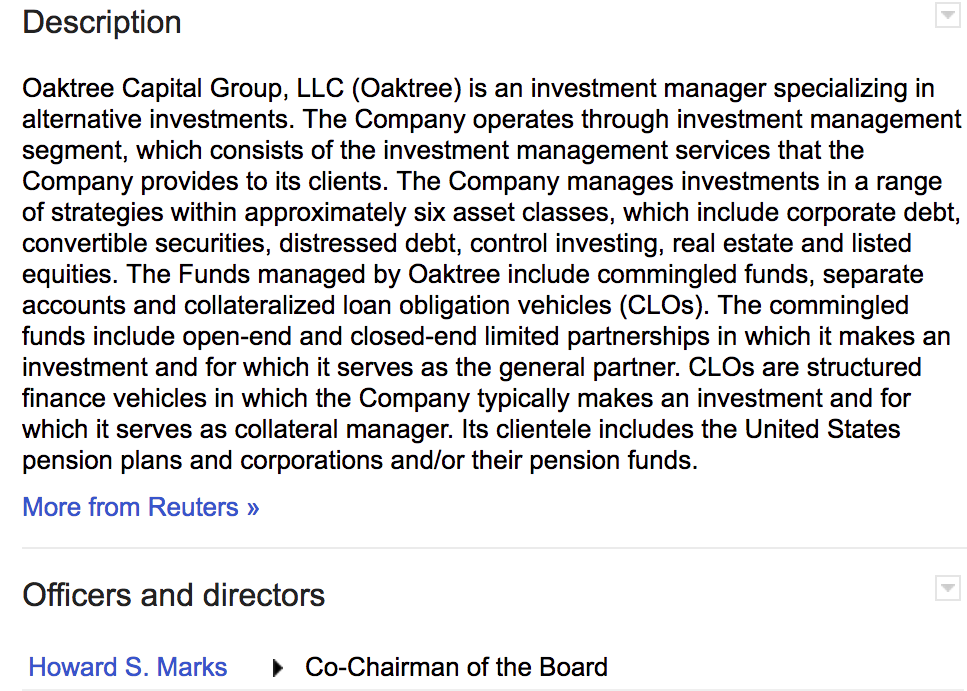

This morning I have read all over about Howard Marks and how he warns in a "Oaktree memo" about Bitcoin - "digital currencies are nothing but an unfounded fad (or perhaps even a pyramid scheme), based on a willingness to ascribe value to something that has little or none beyond what people will pay for it." continuing with "But they are not real!"

Being "intoxicated" by @dollarvigilante, I had to deep a little deeper into this and investigate; he is recognized as being one of the few who warned about the Internet bubble and the financial crisis.

So, I found the following statement very interesting: "Serious investing consists of buying things because the price is attractive relative to intrinsic value[...]. Speculation, on the other hand, occurs when people buy something without any consideration of its underlying value or the appropriateness of its price, solely because they think others will pay more for it in the future."

Now I was wondering, what is the intrinsic value of salt, or gold?

How about the paper bill?

Or what do securities base their value on?

And than this :)

To Bitcoin!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good article

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @newtocrypto! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit