While everybody is pre-occupied waiting to see what Bitcoin will do, I find that it is Ethereum which I cannot keep out of my mind. Despite the fact that I remain bearish on Bitcoin in the short and medium term, when I look at the Ethereum charts I can't help but see a vastly different chart.

Bearish on Bitcoin

I've said it over and over by now but I still am convinced that we will see a breakdown in the price of Bitcoin sooner or later and I fully expect to see a Bitcoin below $5000 and perhaps even much lower even in the next half year or so. I base my predictions for a large part on the Logarithmic scale price charts which I feel portrays a more accurate picture of price development. For reference's sake I will re-post the chart I posted a while ago where I have drawn out the price channel that seems to exist in Bitcoin.

Based on this logarithmic price chart of Bitcoin it seems very obvious to me that we still have quite a ways to go before dropping to the bottom of the channel to find final support. Combined with my past experience of a Bitcoin bear market (winter!) I have no problem seeing the price fall as low as $3000 even before the bottom support of the channel is reached. Of course, the price doesn't drop down instantly by that much - it's a process that will probably happen in the course of many months, just like last time. Whenever I am asked for any predictions, I keep saying 'Maybe spring 2019' as the potential date for the end of the Bitcoin bear market. But, I digress: This article is not about Bitcoin.

Bullish on Ethereum?

Even in my earlier posts I referenced the difference between the price graphs of Bitcoin and Ethereum. Whereas Bitcoin looks to be well on it's way (about halfway through I'd say) in the bear market looking for a bottom it seems to me like the Ethereum charts paint a very different picture.Let's look at Ethereum's channel with weekly candles:

While Bitcoin's log chart clearly shows us quite some ways above the bottom support of the channel the Ethereum chart does not. This is in large part due to the lack of historical data for Ethereum as opposed to Bitcoin, which has an almost 10 year track record. Ethereum only started trading on markets sometime in the second half of 2016, after all, so we have far fewer data points to compare to.

The channel I drew above presupposes that Ethereum has already bottomed out, of course, which is a large assumption. If it drops any lower than the current price, then obviously the channel will end up being wider. I don't think it's far fetched that Ethereum may drop some more either, considering it hasn't hit important support levels yet. Yet, I rarely make my trading decisions based on the fear of short-term losses. I've grown used to the idea that whenever I invest I immediately thereafter incur a 20-30% loss in value due to market volatility. And in the grand scheme of things, these are minor matters too. In the case of a $20K Bitcoin, who cares if you bought Bitcoin at $400 when you could've gotten it for $200, if you had timed it right? The same logic obviously applies to other crypto's, like Ethereum, as well.

What's also interesting about the ETH chart is that contrary to BTC's volumes which seem to be drying up, ETH trading volume does not show a descending pattern like BTC does. This is even more clear on a chart with monthly candles like the one below:

Sure, the monthly candle ended up being red but that's a lot of trading volume.

Ethereum to lead the bull-run?

While Bitcoin is king and has taken most of the spotlight in 2017 I am not sure it is fair to say that Bitcoin led the last bull-run. Let's not forget that the Bitcoin train was rolling since mid-2015 for sure, but other projects went parabolic much earlier than Bitcoin did when it did late 2017. If my memory serves me right it was Ethereum which created waves first with it's ICO's, which brought in billions worth of fresh money into the markets and started the altcoin spring - profits which eventually cycled into Bitcoin to fuel it's run.Bitcoin as a payment method is nice but taken on it's own it can make it seem like it does not have much of a purpose. The arrival of Ethereum into the space changed that completely because through Ethereum it had suddenly become possible to create digital and decentralized assets, as well as other things of value. And the only way to obtain these assets is to enter the economy yourself as a participant - and thus had Bitcoin found (one of) it's purpose(s). So, why Bitcoin? Because you can't buy part of a DEX (for example) with dollars or gold, that's why.

Bitcoin being the de-facto digital currency of choice was the obvious winner at first because it benefitted a lot from the speculative action in the digital asset & altcoin space as most money entering those had to do so by entering Bitcoin first. Now that the bubble has died off and speculative investment is at a low point those benefits seem to be over. What remains is for Ethereum to start fulfilling it's promises - projects delivering succesful implementations - something that could very well spur the next investment bull-run, in my opinion.

The stars appear to be lining up but in the grand scheme, things simply take time. Especially when the scheme is particularly grand, like in crypto. Development is well on it's way though. The Ethereum Enterprise Alliance already consists of more than 500 members of the most impressive companies worldwide (seriously, have a look, it's insane: click here for the members list of the EEA) and while some other competing projects have done well in marketing it is still Ethereum on which most serious research & development is going on and which pushes the technology forward as other projects more or less copy their concepts, albeit with some tweaks. Constantinople is about to start being deployed, and Caspar and a fully functioning PoS is going to be a game changer in the token valuation (and probably significantly increase the token's attractiveness due to it's newfound dividend-feature). Token-sale stats taken aside, I'm also fairly sure that the Ethereum ecosystem itself is probably the best-funded and supported by institutions as well. Sooner or later it is going to pay off. Too much money and too many bright minds are working too hard for it to fail.

It is going to take until 2019 before the first real, serious projects are starting to deliver according to their roadmaps. I am thinking in particular about promising projects such as OmiseGO or the Basic Attention Token, whose success or failure could be the world's first serious blockchain proof-of-concept. The first to create actual value to people, as opposed to theoretical or speculative value, will be the first to prove to the world the value of digital assets as a whole, and may light a fire that potentially sets off the biggest FOMO the world has ever seen.

And let's not forget: Ethereum assets is what you buy, but it will still likely Bitcoin that you buy it with.

If Ethereum has a run, I'm sure that Bitcoin will follow just like last time.

Also, ❤️ Vitalik:

Great write-up, and echoes a lot of what I think about ETH.

Nonetheless, I think it will be a bumpy ride up, as there will always exist selling pressure from all the ICOs that still hold sizeable ETH reserves. If they can double, triple or 10x their runway, then it will be difficult for them to hodl.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree it'll be a bumpy ride, in crypto it always is!

Apparently about half of the ETH held by ICO's has been sold so far, so the worst could be over. I can't imagine them selling 100% of it all, there's bound to be a bunch of them who will hodl on to ETH so there can't be that many sellers left. But ETH isn't going anywhere, and patience is a virtue. I think PoS rewards are going to be a huge game changer economically for ETH - it has a huge drawing power to people looking for passive income and dividends

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting. Maybe ETH can decouple from BTC. Then again, when I checked the charts this morning, everything still followed BTC, except for XMR.

Crypto space is weird.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah it's still pretty tied together and always has been unless there is a temporary decoupling due to a bull run in either btc or alts.

But I don't look at crypto as a short term play.. it's not weeks or even months, but years that it's going to play out and always has been. So decoupling could happen sooner or later but that may very well mean many months ahead as well. Just hodl strong :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Have you seen anything about the new crypto futures trading company Digitex? They're built on the blockchain and using their own token to eliminate trading commissions. They're handling Bitcoin and Etherium. I like the zero fee idea!

Here's their website link https://digitexfutures.com/

and a short vid on some of their features

I'd be interested in your take on this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't know of them and to be honest I don't concern myself all that much with futures trading. So Digitex is new to me. However, when it comes to futures trading I immediately have to wonder: actual Bitcoins or just futures-derivatives? Since they operate on a blockchain with a token I assume it's going to be actual Bitcoin but I think there are regulatory problems surrounding stuff like this. I think the Winklevoss twins have been trying something like it for a while but haven't gotten permission, so what makes Digitex special?

Another thing that concerns me is the zero fees. There's no such thing as a free lunch, and especially if they are blockchain based then who pays the miners or nodes to keep validating transactions? After all, miners/nodes need to be paid in crypto or they will mine something else. So there has to be money made in some way, shape or form. If it's not from the trading fees then it will be from another source. It is very likely that their 'automated market makers' are in fact bots who will, without being transparant to the users, skimp off of micro-trades from every trade you make. Basically whenever you want to buy something for $100, you'll end up getting it for $101 (or something) due to bot interference. I think the popular Robinhood app in the USA does the same thing in order to finance themselves. On the interface it will say 0%-fee but what they don't tell you is that everything is just a tiny bit more expensive.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good observation @pandorasbox ! Volume and Channeling on the Log Charts seems promising on ETH... But...as you said,

if we see a bull run on ETH it would mean that BTC never would reach the lower line of the channel ? ;-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Or... we could see (finally?) a much-needed de-coupling? It's the latter I hope for actually

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting thoughts. I do think ETH will do a new run, I am just very curious on whether we won't first see another dump. The numbers of ETHs needed to participate in ICOs used to be larger than the amount of ETH sold by projects as a result of risk management and burn rate. I think we first need to see the number of ICOs increasing to get to this same situation. For the coming months we will probably see that the number of ETHs burned/sold by projects surpasses the raised funds.

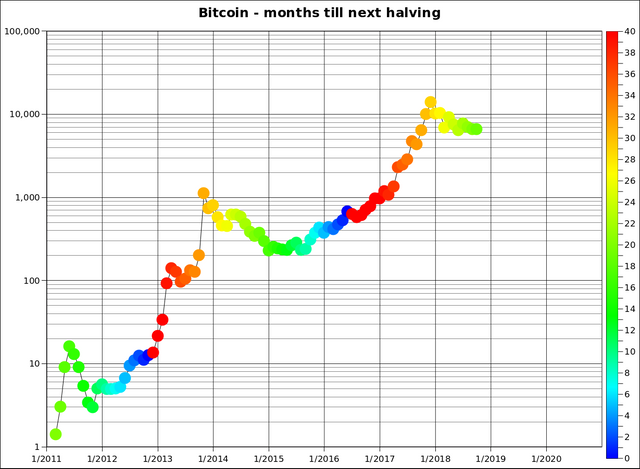

And btw, did you see this one?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting chart! I hadn't seen this one before. It does seem to fit my own predictions in terms of length and how far we are into the bear market. But I do wonder whether it's better to buy in one of those green periods orwait until the lightblue-ish periods? And if light blue puts us at 8 months before may 2020..that's a long time away still

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Waiting a bit until light blue seems safer indeed ;-) I euro-average in though...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I also think that Ethereum will grow stronger with time. Its market cap is around 10% currently but I think it will steadily rise in the future and not fluctuate as much.

However, I'm not sure that Bitcoin will lose its position as the leader in the crypto world. Not to mention that if Bitcoin collapses, all the other coins will probably collapse even more percentage-wise.

The price of Bitcoin influences the whole market at present and it will take a long time for the industry to mature enough for that to change.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think BTC is in that channel, though I disagree that it has to drop at all. It does indeed look like ETH, and indeed all the alts may well lead the next charge ahead of BTC. Honestly I am surprised that BTC made it back to over 50% dominance, it did not think that it would, it is only because the alts have been massacred so badly that this is the case. Of course this means that the alts are going ultra cheap, and many of them are fantastic coins, which in turn means they should fly upwards once positive sentiment settles back into the market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by pandorasbox from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit