Hello all,

My name is Zach and my goal with this article is to put forward an unbiased view of the current state of the cryptocurrency market while highlighting many very important key factors that will play a role in the evolution of virtual currency. I am not a financial advisor in any way and do not write this for anything other than pure education for all the fellow investors out there. Disclaimer: I do hold Bitcoin and Ethereum.

To begin we need to all take a step back and think about things long term. Many times we find ourselves very caught up emotionally in price action and short term thinking when we fail to see the much larger picture. Within this article, I will attempt to piece three key components together that may help investors put together a more realistic long term view on cryptocurrency.

- Time Value of Money

To understand this better I am going to show the power behind the concept of Time Value of Money and why this is so important financially to anybody. The Time Value of Money demonstrates the benefit of money now vs. money later.

For the purposes of this example we will assume the average rate is constant and no additional trades were made. The interest will be compounded monthly and this does not take into account dividends. This example is for pure simplicity.

The average annual return in the S&P 500 minus the average rate of inflation is 7%.

The average annual return in Bitcoin (since it's creation) is 220%.

---Scenario 1. Invest $1000 in the S&P 500 for 15 years @ 7% average annual growth. The Future Value of the initial $1000 is now $2759.03

---Scenario 2. Invest $1000 into Bitcoin for 15 years @ 100% average annual growth (Less than actual average). The Future Value of the initial $1000 is now $32,768,000. 32 Million dollars.

The power of money is very strong. As investors we must humble ourselves and realize that perhaps the days of 200% growth is gone in cryptocurrency, however these days may have just begun.

- Are we actually early adopters?

Human evolution has been a wild ride. We went from horses to cars. Landlines to Cell Phones. Physical media is now becoming all digital. Yet money was still physical until the birth of Bitcoin.

The truth is that money's only paper with ink. What was once backed by gold in the United States is now backed by nothing and is printed out of thin air.

Bitcoin is not physical and is only a store of value based upon what it is given. Here we analyze what actually is bitcoin? The closest representation I can find is that it is a store of value similar to gold (AKA Digital Gold). The advantage that Bitcoin has is that there is a finite supply (Scarcity increases value). This is what makes it so appealing to many investors.

The answer is that we are indeed very early to the party. As of 6/27/2018 the entire cryptocurrency market capitalization is +/- 250 Billion USD. As of 6/27/2018 the market capitalization of Apple is +/- 906 Billion USD.

This shows the youth of the cryptocurrency market. There is a reason many people predict trillion dollar market cap valuations and the main factor to keep in mind is time. Rome was not built in a day.

- Institutional Money

Ah yes, the good ol' "Institutions will bring so much money into the market" talk. The truth behind the matter is that the big players are on their tippy toes getting ready to splash into the cryptocurrency puddle yet they cannot jump quite yet. The big door will open from the introduction of a Bitcoin ETF (Exchange Traded Fund). The power behind an ETF for Bitcoin will be the bridge for the largest pool of money by a collective source.

Yet we see a brief pause while we anticipate this ETF. The elephant in the room is that it is hard for investors to find intrinsic value for Bitcoin at the moment. We still see a problem with scalability that has yet to be solved.

--- THE BIG PICTURE---

Is cryptocurrency going to be around to stay? Yes very much so. It is safe to say that we are on the brink of accepting this as a new norm in society. Decentralization seems to be the next trend that is gaining more and more traction (for good reasons).

Time Value of Money shows that investing long term has great rewards. Consider putting money into Bitcoin and Cryptocurrency and treating it like you would a traditional investment. Let your money work for you! Diversify with traditional markets as well. Overall saving money should be the end goal!

We are early adopters. Everything that grows will experience growing pains. Markets will cycle. The best mentality to have is that buying at low levels means even more to gain in the long term. The fundamentals point towards a great future for blockchain technology.

Markets will cycle and Institutional buyers will have a large impact on the space once factors such as regulation and road bumps to enter the market are cleared.

What should you do?

Save. Invest with what you can afford to lose. Financially prepare yourself for the future and realize the value behind every dollar you earn. Thank you all for reading and please tell me how you feel below!

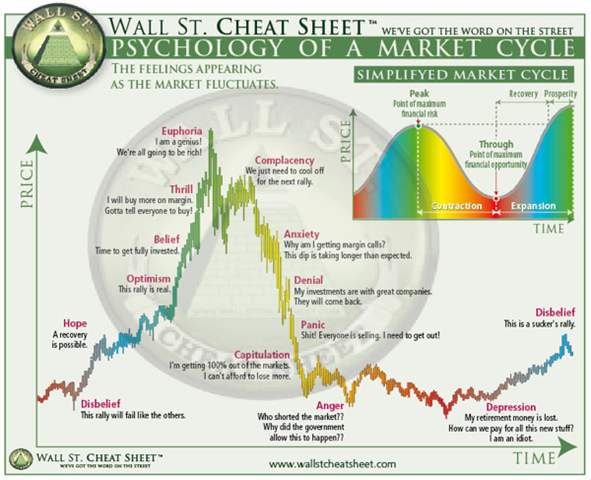

Below I have attached the infamous Wall Street Cheat Sheet that currently shows much similarity to the decline bitcoin has seen. At the moment we are showing oversold indicators meaning we have met the trough (Point of Maximum financial opportunity).

✅ @sergeantdanglez, I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Thank you in advance!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @sergeantdanglez! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit