The crypto markets have bottomed out, and analysts are predicting a sturdy rally from the contemporary stages to the give up of the year. even as Fundstrat’s Tom Lee believes Bitcoin will trade at $25,000 via give up-2018, impartial monetary consulting enterprise deVere group has forecast a fee target of $2,500 for Ethereum for the equal term.

The enterprise keeps to attract expertise from Wall street. The trendy hire is Steve Lee, a former portfolio supervisor at Goldman, who has joined the cryptocurrency hedge fund BlockTower Capital, based in 2017. The organization additionally employed a former Goldman Sachs vice president in January 2018, Michael Bucella, as the top of strategic partnerships and enterprise improvement.

among all the bullishness, let’s see if the cryptocurrencies can enlarge their pullback or are they due for a correction?

BTC/USD

If the bulls efficiently defend the help line of the ascending channel, a rally to $10,000 observed by means of a flow to the resistance line of the channel is in all likelihood.

In case the BTC/USD pair breaks under the ascending channel, it might discover support at the 20-day EMA; underneath this line, it will become terrible and slide to $8,seven hundred stages.

We propose raising the stops on the position to $8,six hundred because once $8,seven-hundred degree breaks, the charge might fall to $8,000.

ETH/USD

Ethereum has been shifting up gradually. For the past days, it has back from the $seven hundred stages. If the trendline guide holds, it'd lead to a breakout and rally to $745.

If the ETH/USD pair breaks down from the trendline, it is able to slide to the 20-day EMA at $six hundred, which should offer robust assist.

we shall provoke lengthy positions above $745 tiers. Our goal goal can be a pass to $900 and $1,000.

BCH/USD

After the pointy up circulate from the lows, Bitcoin cash is currently consolidating between $1,221 to $1,600. charges have remained towards the mid-point of this tight variety at the $1,400 ranges.

we'd see some greater days of this range-certain action before the bulls attempt to break out of the overhead resistance. The escape ought to bring the BCH/USD pair to $2,000 levels.

however, if the bears force a breakdown underneath $1,2 hundred degrees, the cryptocurrency can slide to the $1,000 levels.

There are no purchase setups on the cutting-edge stages.

XRP/USD

Ripple has didn't climb above the trendline for the beyond four days. it might now accurate to the 20-day EMA, in which it could discover support. A leap from there can again push costs toward the overhead resistance of $0.9377. A breakout of the resistance will resume the uptrend which could bring the digital forex to $1.08 after which to $1.229 degrees.

If the XRP/USD pair breaks under $zero.seventy six, it can slide to the 50-day EMA, that is close to the horizontal help of $0.sixty two.

there's any other opportunity of the digital foreign money final range bound among $0.76-$zero.94. it's far difficult to are expecting which state of affairs will play out, for this reason, we've got given the critical tiers to observe out for.

we will flip effective only above $zero.94. until then, there's no purchase setup on it.

XLM/USD

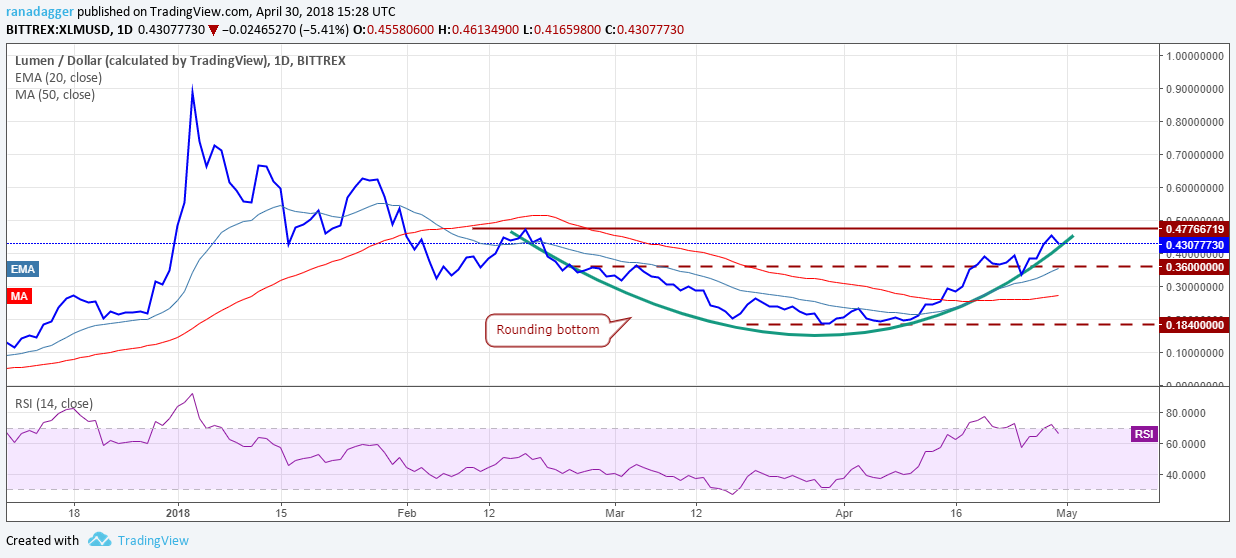

Stellar reached the overhead resistance at $zero.47766719 on April 29 in which it's far facing selling pressure. It has formed a rounding backside. If it doesn’t escape now, it would form a cup and cope with formation.

The pattern target of a rounding backside or a cup and take care of formation is $0.seventy eight. however, it is not going to be a one-way move because the XLM/USD pair will face minor resistances at $zero.sixty three and $0.sixty six

We don’t just like the growing poor divergence at the RSI, consequently, we’ll anticipate the breakout to preserve above the overhead resistance before suggesting any trades.

LTC/USD

Litecoin is checking out our endurance as it has been caught in a good variety of approximately $141 to $one hundred sixty five for the beyond few days, barring the breakout on April 24.

The LTC/USD pair is delicately poised due to the fact a breakout above $a hundred and sixty must propel it to $180 stages, whereas, a fall underneath $141 can sink it again closer to the lows of about $117.

We assume the moving averages and the horizontal line to offer a robust support on any decline, that’s why we suggest conserving on to the location with the stop at $140. The only issue traumatic us is the weakening RSI.

ADA/BTC

On April 28, Cardano broke out of the overhead resistance at 0.00003445, that's a bullish sign. we find that it has formed a bullish cup and take care of formation at the lowest, which has a pattern goal of zero.00005217.

The ADA/BTC pair can correct to the breakout degrees before rising similarly. however, as the breakout is robust, we shall purchase 50 percent of the preferred position at the contemporary ranges of zero.0000375 and preserve a forestall lack of 0.000029, simply below the lows of the cope with.

we will buy the opposite 50 percent of the placement later, after a a hit retest of the breakout stages.

We aren't expecting a retest and are shopping for half of the location now due to the fact once in a while, the robust breakouts don’t look again. therefore, we need to have a few chips in the game.

TRX/USD

With its large run, Tron has made it into the pinnacle nine currencies with the aid of marketplace capitalization, and that’s why we’ve blanketed in our analysis.

The TRX/USD pair have been trading inner a number of $zero.02382 to $0.05653663 from February to stop-April. It shaped a pleasant basing pattern and broke out of it on April 23. It had a sample target of $zero.08925326, which has already been crossed.

although the trend remains robust, it's far currently quoting at tiers that had acted as a strong resistance in mid-January of this yr. The RSI is likewise in overbought territory. We expect the virtual forex to go into a consolidation for a few days; this can give us an awesome stop loss point.

EOS/USD

Our assumption approximately EOS grew to become out to be wrong. although our entry became almost ideal, we exited way too early, leaving a large part of the profits on the desk. in the destiny, we will maintain a deeper forestall loss on the final 25 percent of the location and trip the up move till the very last.

The EOS/USD pair has visible a huge run-up, growing 286 percent from the lows of $5.961 on April 11 to the intraday highs of $23.0290 on April 29.

After this type of stupendous run, some income reserving may be anticipated. The aid stages within the occasion of a correction are $sixteen.5090 and $14.4950, which can be 38.2 percentage and 50 percent Fibonacci retracement tiers of the latest upward thrust.