Now we can not imagine our life without banks and loans. Apartment on credit, car on credit, household appliances ... the list can go on forever. Entrepreneurs actively use borrowed funds as capital to start and develop their business. What can we say about the everyday use of loans, when the economy of whole countries is held with credit funds.

Every year, the volume of lending is growing. Loans are becoming more affordable. Nevertheless, the modern credit system, despite all its relevance, has significant shortcomings.

What are the disadvantages of the modern banking credit system?

First, monopolism and centralization of power in the hands of the state and large banks, which dictate their conditions in the market of credit services. And we do not have another real safe alternative, unfortunately.

Secondly, the cost of loans. High-interest rates on loans and their uncontrolled growth at the discretion of major players.

Thirdly, low profitability on bank deposits.

Fourthly, the bureaucracy and the complexity of borrowing procedures, from collecting documents to formalizing a loan agreement and already the process of its execution. The procedure for collecting and verifying documents takes a lot of time and effort.

Fifth, the hostility of the system to the consumer services. The system of checking borrowers is inefficient and often leads to mistakes in making decisions on the issue of a loan or refusal. This all entails financial losses for both the banks themselves and their conscientious customers, as the bank, by raising interest and other fees are trying to compensate for its losses.

Sixthly, a complete lack of transparency in the actions of financial institutions.

Seventh, vulnerability to third parties personal data of borrowers, which are stored on the servers of banks.

An alternative solution for a cheaper, safer and more effective way of providing loans is the technology of blockchain. However, in order to create a full-fledged lending system for one blockchain, there are few, we need developed standards and infrastructure.

So, meet! On the scene Distributed Credit Chain!

What is the Distributed Credit Chain?

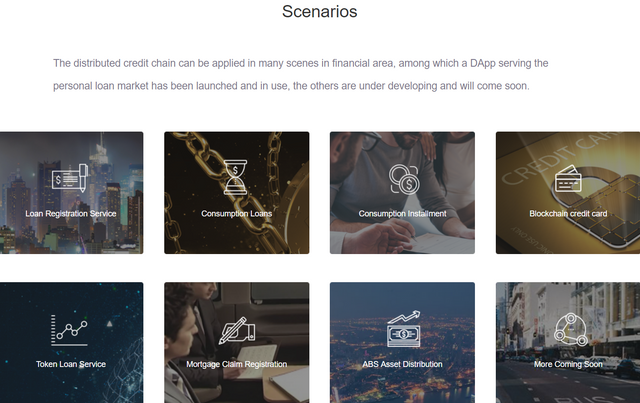

In general, the project is aimed at decentralization of the financial system as a whole, and in particular to solve existing problems of the credit sphere.

Distributed Credit Chain is a decentralized credit platform that will allow you to make any type of loan with minimal time and money. The ecosystem will bring together borrowers and lenders from around the world. Regardless of where the borrower is located in the world, he will be able to obtain a loan from a credit organization of any country in the world that will offer him the most favorable conditions. We, living, for example, in Africa, can get a loan in the UK.

To receive a loan, the customer must create his account on the site, providing the system with all the necessary personal data. For all operations and data on the platform, encryption will be used, at each stage of the process, digital signature technology will be used, which will ensure the security of all operations and the credibility of the system.

.png)

What positive changes will the project bring to the credit sphere?

The main thing that Distributed Credit Chain will do is ensure decentralization of the entire credit system and its return to market mechanisms.

The main advantages for borrowers are:

- the opportunity to get cheaper loans. Interest rates on loans will decrease, and the quality of financial services will improve. In conditions of competition, the user himself will be able to choose the most favorable and comfortable conditions for himself.

- the speed of acceptance of the credit decision will increase since the entire credit history of the client and information about the transactions that have ever been committed will be kept on the detachment. This will ensure the accuracy and reliability of information with the ability to quickly access and analyze data. Plus, there is no need to provide additional information on paper.- cross-border lending regime;

- full protection and security of personal data;

- more efficient and transparent credit system based on the application of smart contracts.

The project will benefit not only the borrowers but also the credit organizations themselves. I see the following benefits:

- The project will create on its platform conditions for a healthy competition of credit institutions. The working conditions will be formed by the market, not by the monopolists.

- the platform erases the territorial boundaries between borrowers and creditors;

- reducing credit risks, reducing fraud, delinquency, and non-repayment of loans. Within the system, all information about lending will be displayed on the blockchain and, thus, will be easily accessible and transparent. This will ensure a reliable credit history, which can not be faked.

- the availability of a common database, as well as the platform's capabilities for rapid analysis of each client, will significantly reduce labor costs and increase the efficiency of verification of each borrower;

- there is no need to contain a centralized server to store the entire credit history of customers.

Obviously, the project will bring significant benefits to both parties.

.png)

DCC and ICO TOKEN

The platform is based on the Ethereum blockchain system with DCC standard tokens ERC20. Tokens will act as a payment currency within the ecosystem. Interestingly, borrowers who returned credit on time will be rewarded with DCC tokens.

At the end of May this year, the ICO was launched. Hard cap was achieved in just 20 minutes! The company collected almost $ 49 million. And this is in the context of a recession in the cryptocurrency market when many teams cannot even collect half of the software. All this shows the relevance of the product and its relevance to the market at the moment!

Now tokens can be purchased on stock exchanges. They are already traded on Bibox, Kucoin, FCoin, DEx.Top, IDEX.

In general, I believe that the project has a huge potential and in the future will be able to replace the outdated banking credit system with a modern effective solution for blockchain.

To get acquainted with the project, you can click on the links:

Official site - https://dcc.finance

White Paper - http://dcc.finance/file/DCCwhitepaper.pdf

Telegram - https://t.me/DccOfficial

Author - https://bitcointalk.org/index.php?action=profile;u=1629766