Since all major ALTs are positively correlated with BTC they will repeat what it does just exacerbating the amplitude of its moves.

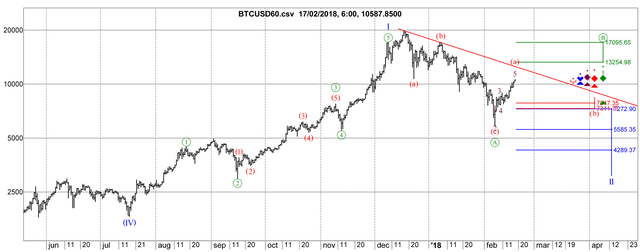

I think Bitcoin has completed wave "a" of the corrective "B" wave up and now we are going be retracing the last up leg in wave "b" to the lower $7K with the following final push up in wave "c" to around $13250 (or even to $17100) to complete the wave "B". Upon completion we will have a final push down in wave "C" to the recent lows or may be even exceeding them all the way down to $4300.

CORRECTION

The last push up makes me think that we have already had (b) wave (it was a truncated (b)) and currently are moving up in the wave (c) of B.

https://www.mql5.com/en/charts/8331209/btcusd-h1-simplefx-ltd

Thanks as always for sharing your thoughts.

You are ultimately proposing an extremely bullish setup with this count if I am reading it correctly. In my mind that would be the healthiest scenario for the long run.

I am curious about how this longer term outlook intersects with your previous update from last week though. You had mentioned in a comment that if we have a weekly close above the $12k mark in the short-term that it would signal a new bull market. In my mind, a new bull would imply new ATHs without a lower low, but this analysis shows that a lower low is likely and that ATHs would be months away at a minimum.

I am mostly curious to know if your outlook has changed at all or if this is just a difference in projection horizons that I have noticed. I.e. 12 day, 12 wk, 12 mo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As anybody else I may be wrong. Especially with EW analysis. But there are certain points which make me think that we are still in correction:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

All solid points. Plus, the weekly chart for BTC just looks like it is begging for a C wave down.

It's always possible that the accelerating adoption/speculation rates could keep the bull running, so it'll be fun watching things unfold.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Incredible Srezz, thanks again for your awesome work and honest opinions. Keep it up!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you srezz for all the hard work you put in😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, srezz. You are the one who uses working TA approach with volatility-based targets, and it works most of the times. You predicted the two biggest sell-offs from 5k to 3k and from 20k to 5k (it was 6k on the actual market, but who knows what waits for us in the future..)

Thank you very much for your work.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Looks good as usual Srezz! I think your (C) wave low might be a bit high. I see the support is heavily based on wave 1. I think we might see a low in the 3000s.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Happy to see you around Larry. There's a very strong band of support between $4300 and $2850 levels made of congestion of the Gann's square of 9 weekly cycles.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yep im a complete noob in ta, i will learn it. but it will take time..lots of. Id like to ask if its possible to see from the chart when the pullback will happen...im probably just too newbie or blind to spot it. And yes thanks alot for the charts youve been providing!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Tentatively - yes, it's possible because nothing in markets is certain and all forecasts are probability based. If you are serious about learning the art of market analysis I'd suggest to begin from here.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

just a quick "thank you!" for your recommendations on where to start with TA basic and for continuously providing your valuable insights, kudos!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the correction update in your post Srezz, are the targets for wave ''c'' maintained? B.T.W. You have suggested some literature to me in the past, and I am happy to report I am slowly and steadily learning more about TA, Elliot Waves for example. I really start to enjoy it the more I learn. I noticed you keep helping new people with links and information about where to start learning the basics. I would like to thank you for helping us out and all your charts you post here for us. Nice to see Larry is around here, too. GLTA!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice to see you too. Corrections always have a multitude of interpretations. The wave count presented in the head post is the easiest one. And it is the easiest one on purpose - to avoid being overly technical. Realistically speaking I think we are in at least WXY type of a correction.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Srezz - do you believe with the increase in marketcap over the last couple of days can change things, or I guess what I am trying to ask is if you ever use the marketcap as a tool when doing TA

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

One of the key TA premises is that at any given time the price reflects all known information. Therefore only the price action concerns me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree, I can ideally see BTC hitting 12k or 13k before a major pullback, the RSI will also most likely be oversold at those levels as well. Followed you since I do TA updates as well!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting! Thanks for your analysis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@srezz Thank you for the chart

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @srezz

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks again srezz!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My hat off to all of you who thank me.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

When is there going to be a new update from you SREZZ?

-curious to know, hopefully soon.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello stoppilow. My understanding is that btc is in the process of completing c of B. With a target between 13-17k. After completion of this the expectation is that wave C will retrace back down to prior short term lows in the 5k range.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I see. Why do we always have to go down so much lol i always thought that once we are up we would only get small corrections, but sometimes it plummets down hard. That's crypto. Thanks for sharing .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Did you all misss the 6k buy in? There is still time. That is an absolute out of norm analysis. It’s not going back to 4K. The correction lasted almost 2 months. Common now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Religion is not the best tool for the market analysis and I don't argue with true believers. Up until recently your herd has been piling up bullish triangles on the top of the previous dozen of layers of bullish triangles and nobody among you saw even $6K coming your way.

We have 2 month of a correction of the 2,5 years long wave up. Timewise it is nothing by any measure. But again, what's the point of arguing? Let's see what the market does for only its action will prove me either right or wrong in my forecast.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

True, but I believe we will have our ups downs in the up. But too thought we would see 4k but sentiment wins at the end I think. With all the fud news gone and all the positive news coming from south korea about them adopting licensing like NYC bit license and congress hearing that we heard where U.S authorities recommended a sound approach to crypto. There was a lot of fud going around before which created a bad market sentiment I think. Now nothing but positive news, to me it seems almost a sort of manipulation. Start fud in january, whales buy low and then start a new uptrend and start fud in summer after they sell and 30 days or so correction and then buy low again and nothing but positive news until end of the year. It almost seems like a cycle.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi Srezz , since we now broke 11k ,are the targets for current (c) of B around $1325-17095 ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Are we looking at another wave down to retest the previous low of $5800 given the downtrend action the past few days?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

im also wondering this

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Do you not see the head post or do you not understand it?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Do you still think we already had the b and c wave of B and are now in C? Is it possible this current drop is actually the b of B?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, it could be.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So is this drop actually the minor drop b of B or the big drop of C?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

At this point in time it's impossible to tell.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Does the TA factor in shorts and futures also?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey @srezz !! I think ABC for bigger wave is done and the current wave is the retracement (wave 2) of 6k-11800 wave 1. currently it broke 0.618 fib level nd should be headed to atleast 0.5 or 0.382 levels which should be around 8850 and 8173. What do you say?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's the problem with EW - you always have a multitude of plausible counts, especially in corrections. That is the reason I don't rely on EW and prefer volatility implied targets. I need to see today's close.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agreed. Also, the way trend lines are converging on daily chart I think coming week could be highly decisive for price directions. If my EW count is correct then this mini bear phase should be over by 1st week of march.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit