This post is a continuation of the Cryptocurrency Hedge Funds - Passive Investing for Passive Income, in which I listed the existing hedge funds. In this post I'm going to analyze the first of them, Iconomi.

First of all what is a hedge fund? A hedge fund is a form of investment in which the participants(investors) are putting some capital and they are delegating the power to decide in where the money to be invested, to a fund manager. Iconomi was started back in October 2016 as a platform in which cryptocurrency hedge funds can be created. For the moment there are 2 existing funds.

If you want to invest your money in the Iconomi platform you can do it by buying their Iconomi(ICN) tokens on several trading platforms. The ones with the biggest supply are Kraken and Liqui. You can also create an account to buy the tokens directly on their platform, using eth and btc.

ICN tokens are not paying any form of dividends. However, Iconomi announced they are using part of the profit to buy some ICN tokens from the market to destroy them. This is a form of indirect payment, because as the total amount of tokens decreases, the value of each token will increase. Until now ICN performed really well, bringing earnings of 3000%(one usd invested at ICO would value 30 usd nowadays).

However you might not be interested to buy shares in Iconomi platform but you might want to invest your money in a hedge fund. Currently there are 2 investment funds available on the platform.

ICNP

ICNP was started at the beginning of the year and it had a growth by today of approximately 10x (1000% in six month, not bad at all). In there own words:

"ICNP connects supporters’ digital assets with the best distributed economy startups and other lucrative opportunities. ICNP is an actively managed DAA with a higher performance target, lead by a team of experts conducting thorough research and due diligence."

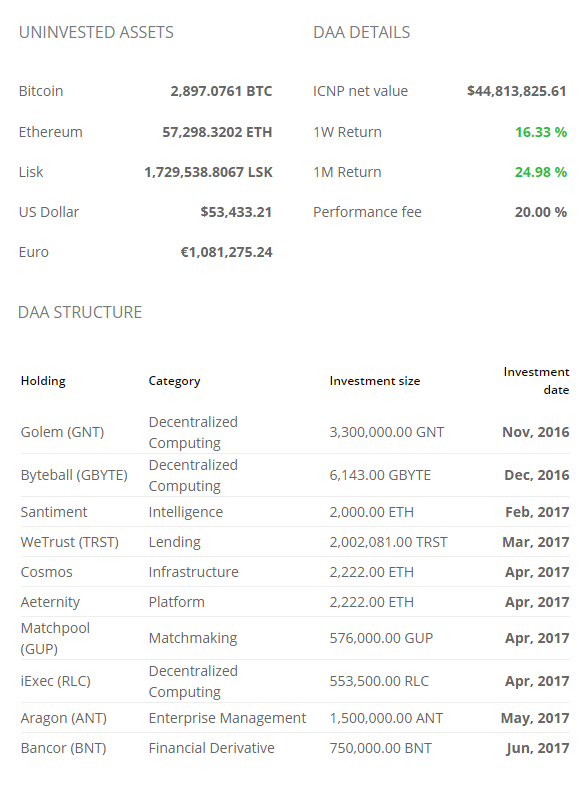

We can see here the performance:

And we can see the portfolio. :

ICNX

ICNX is a newly started fund so profits are negligible. ICNX has different criteria based on which they are picking the cryptocurrencies to invest in:

"The ICNX measures the performance of digital assets that meet certain eligibility criteria. The ICNX DAA constituents and their corresponding weights are updated on a monthly basis or more frequently due to the fast changing environment of the digital assets market. Digital assets currently included in the DAA represent 92% of the total market capitalization of all digital assets."

The performance in the first weeks shows some up and downs but was all the time a positive investment:

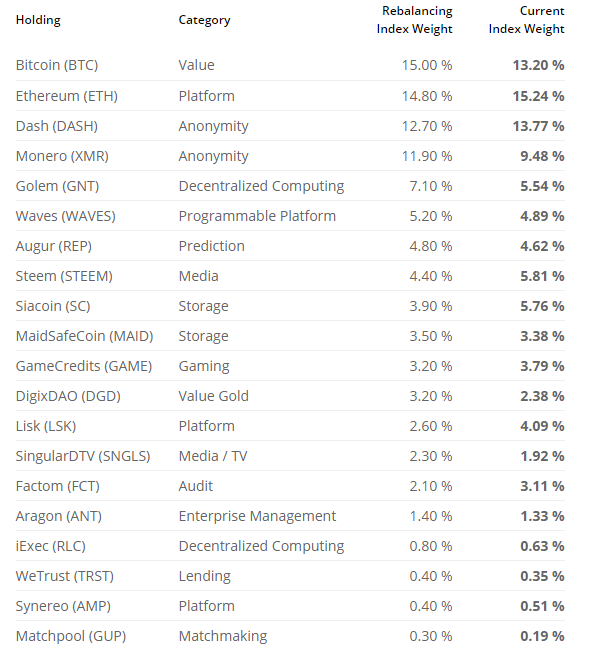

We can also see the portfolio containing some new coins with high growth potential:

I hope you enjoyed this review of Iconomi. I'm preparing for tomorrow a post about another hedge fund, taas. In the meanwhile up-vote this post if you liked, subscribe and don't forget to leave a comment.

you adviced me on this to look at but I am not a fan of letting my assets be controlled by an other person. a fee of 20% is huge and is unbelievable high and insane especially in a market this volatile I think. Iconomi also there is no security or governance to control them and we all know how hedgefunds play the games in the stockmarkets right? I'd rather invest myself to feel more comfortable and lower the risk of paying high fees and or get scammed where there is no single third organ to police them in case they do wrong to enhance their own wealth for the costs of ours

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

fuck these guys just do your own research! they're just another middlmeman

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post received a 2.6% upvote from @randowhale thanks to @steem-buzz! For more information, click here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is an interesting concept, the idea of counting on people that have more time and domain knowledge to spread your investment out over multiple assets, I will have to look into this more.

I know this is new, but can anyone comment on the experience with them?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I earned on ICN since ico 3000%, as I mentioned in article. For the funds the graphics get give you an idea...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit