Hi guys, trust you are all having a splendid weekend,

I want to take the pleasure of introducing Distributed Credit Chain (DCC)- offering blockchain-based financial services like loaning or credit scores.

INTRODUCTION

The financial industry is a place where funds are directly invested. ICO is also a new form of financial system where money is gathered. It is a new system in the framework of moving money just like finance before this act itself is in the block chain. And you need to know who is jumping into the block chain. Those who were interested primarily in the block chain. It is an early block-chain market participant who was interested in technology itself. They are people who have changed their occupations to the block-chain industry after they have passed and the block-chain boom has blown. For example, people working in the financial industry are starting new types of banking in the block-chain industry. They go into the block-chain industry with their networking and management resources. The service they want to create is actually there. The service that you create by applying block chains to finance is there, if not for the exceptional people to make. However, the fact that these services continue to be created is due to the existence of numerous investment companies. In any case, the service they want to create is there and there is a lot of money to come to them, which in the end depends on the network they have in place, and all those who are involved in block-chain financing have this network I think basically all the ICOs were successful.

WHY DCC

Cost-effectiveness and Efficient infrastructure

While it is not widely known, in the regular banking system, the bad credit score people are dialled into the reputable customers. Thus it doesn’t matter if you are paying your debt in time, you will pay a premium to cover the bank’s losses. Not to mention the streamlining of the borrowing processes as paper contracts are transferred to the distributed ledger.

Accessible Credit History on a Transparent Infrastructure

Nowadays, it is really hard to maintain a universal credit score, not to mention that these statistics do not work inter-banks and you have to go through the entire process all over again. With the DCC platform, however, your complete credit scoring and history is stored in a trustless way, backed by empirical evidence. Should you decide to borrow again in the future, lenders can merely query your account from the blockchain.

Self-sustainable ecosystem with reward mechanisms

Should any lender find that any loan application is not suitable for lending, they will be rewarded in DCC tokens for keeping the high-standard of the platform. Creditors can set their minimum DCC threshold for them to process the lending application. Borrowers can increase this limit thus climbing on the priority waiting list. This way, the processing efforts are distributed organically, prioritising the individuals with more funds available.

Worldwide available Credit Credentials

Thanks to decentralised nature of the platform and cross-border status, DCC can correlate with legal tenders of loans in multiple countries. Becoming the anchor platform for multinational lending is one of DCC’s core mantras as lending in different currencies will be available.

Reputable Data Warehousing and Data Marketplace

The users of the DCC platform also have the ability to sell their created data regarding credit spending. Financial institutions have a great need for such data as they are able to construct data products and actionable insights that ultimately grow their business. Interested parties can browse the available data on the DCC Data Marketplace and then initiate a blockchain transaction to purchase and use it further.

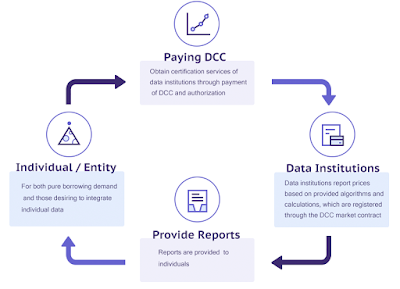

These are the ingredients of a successful financial institution worthy of the 21st century. Users have to register with the DCC app and submit a borrowing request; this request is then processed through the automated risk management system. The final lending institution then receives the eligible borrowers and provides the loan back if the credit score and provided information are in accordance with the risk assessment.

DCC TOKEN

Token name: DCC

The total supply of ERC20 tokens will be 10,000,000,000.

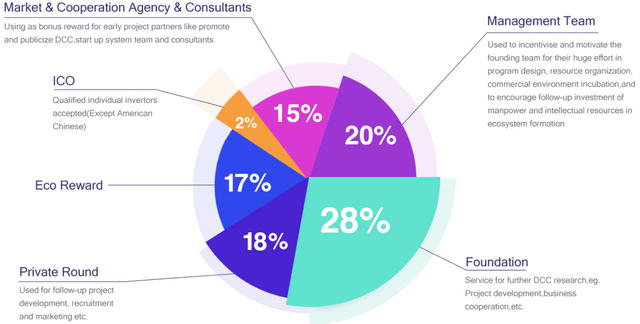

In the private round , famous qualified investors in the fields of credit and banking will be invited for the investment, with the fundraising percentage no more than 18%, and the investment amount of single investor no less than 100ETH. At this stage, DCCs will be locked, with 25% of the total to be unlocked before the opening of exchange, and another 25% to be unlocked every two months, with the full amount to be unlocked in 6 months.

In ICO round, 200,000,000 DCCs will be issued to Non-Chinese and American investors. All these will be directly circulated. DCC token will be exchanged by ETH. The contributions in the token sale will be held by the Distributor (or its affiliate) after the token sale, and contributors will have no economic or legal right over or beneficial interest in

these contributions or the assets of that entity after the token sale. To the extent a secondary market or exchange for trading DCC does develop, it would be run and operated whollybindependently of the Foundation, the Distributor, the sale of DCC and Distributed Credit Chain. Neither the Foundation nor the Distributor will create such secondary markets nor will either entity act as an unlocked in 6 months

TOKEN DISTRIBUTION

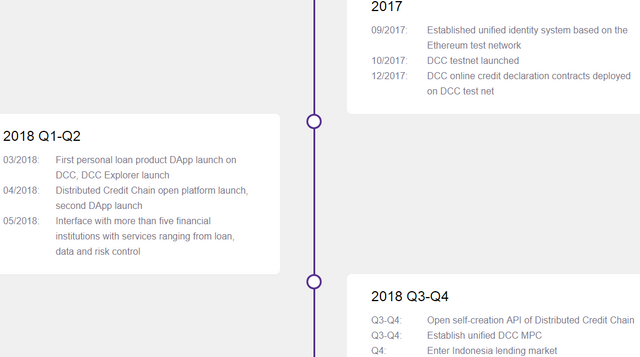

ROADMAP

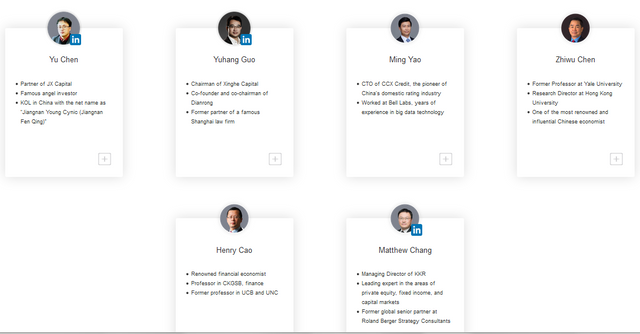

TEAM

Please download the whitepaper: http://dcc.finance/file/DCCwhitepaper.pdf and visit the website: http://dcc.finance for the full scoop;

Facebook - https://www.facebook.com/DccOfficial2018/

Twitter - https://twitter.com/DccOfficial2018/

Telegram - https://t.me/DccOfficial

Author

temillion

bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=1839623

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://steemit.com/blockchain/@maryhansen/distributed-credit-chain-will-disrupt-the-finance-world-here-s-how

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit