In this guide, we will tell you about all of the events that led to the making of the Bitcoin Cash. This is purely for educational purposes.

Bitcoin is, without a doubt, one of the most extraordinary innovation in the past. However, it also gets a lot of criticism because of the problems that have caused many skalabilitasnya debate politically ideological patterned at once. Finally, on August 1, 2017, bitcoin passing the fork that gave birth to the Bitcoin Cash. We will not say which side is right and which side is wrong, it's really up to you.

How do bitcoin transactions work?

Bitcoin is introduced by a man/woman/group that is not known by the pseudonym, Satoshi Nakamoto in their research papers are now legendary, "Bitcoin: electronic money system for Peer-to-Peer". What is provided by bitco-to-peer digital currency system is decentralized. The whole system function bitcoin because the work was done by a group of people called the "miners".

So what do these miners do? The two biggest activities that they do are:

-Mining for blocks.

-Adding transactions to the blocks.

-Mining for blocks

All miners use their computing power to search for new blocks to be added to blockchain. The process is following the Protocol of "evidence of work" and after a new block is found, the miners who was responsible for the invention of the prizes, which is currently set at 12.5 bitcoin (it will be twice as diminished every 210,000 blocks), however, This is not the only incentive that possessed the miners.

-Add a transaction to a block

When a group of miners finding and mining a new block is new, they become the dictator of the block. Suppose Alice should send 5 bitcoin to Bob, he is not physically send him money, miners should really add this transaction to the blocks in the new chains and that's when the transaction is considered completed. To add this transaction to the blocks, the miners can charge. If you want your transactions quickly added to this block, you can give the miners higher fees to "cut the line" so that it could speak.

In order for the transaction to be valid, it must be added to the block in the chain. However, this is the moment problem, block in the chain has a size limit of 1 MB and there are only so many deals to be had at once at a time. These can be arranged in advance, but then something happens that makes this a big problem, bitcoin become famous!

The bitcoin scalability problem aka does size matter?

Yes, Bitcoin became popular and with that came its own series of problems.

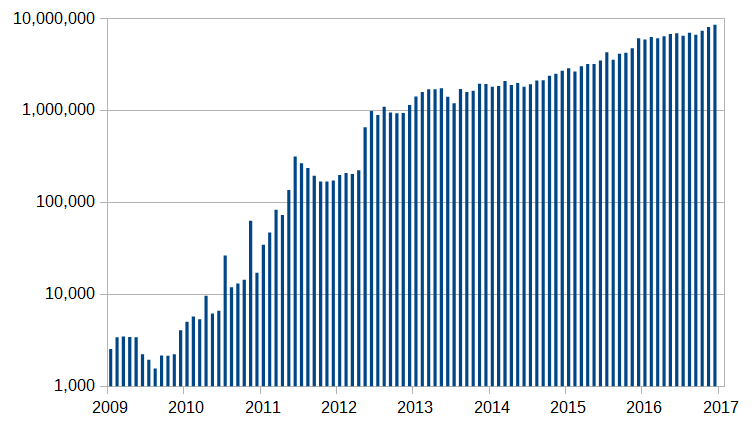

In this graph you can see the number of transactions happening per month:

(Image source: Wikipedia)

As you can see, the number of monthly transactions and only increased with the size limit 1 MB blocks currently, bitcoin can only handle 4.4 transactions per second. When first created, a Bitcoin developers set the size limit 1 MB with the design because they want to reduce the spam transaction that might clog up the entire network of Bitcoin.

However, due to the rapidly increasing number of transactions, the rate of increase of the block also increases. More often than not, people really have to wait until a new block is created so that their transactions will be running. This makes the transaction deposits, in fact, the only way for the transaction You prioritized is by paying a transaction fee that is high enough to attract and give incentives to miners to prioritize your transaction.

It introduced a system of "replace-with-costs". Basically, that's the way it works. Suppose that Alice sends to Bob bitcoin 5, but the transaction is not running because of the backlog. He can't "remove" transaction because of the inexhaustible bitcoins can never return. However, he could do a transaction 5 supercoin with Bob but this time with transaction costs high enough to give incentives to miners. Because miners put this transaction on the block, it will also overwrite the previous transactions and make it bogged down and no longer valid.

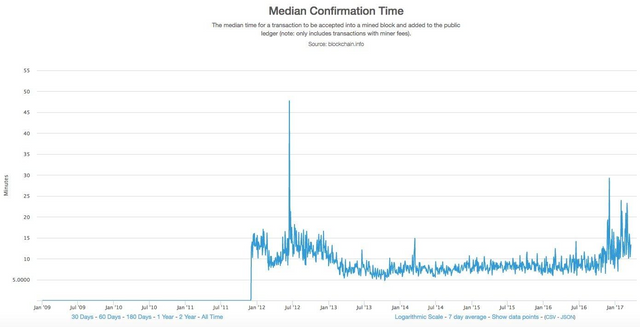

While the system "replace-with-cost" benefit for the miners, it is very inconvenient for users who may not be so good doing it. Actually, this is the graph of the waiting time should be owned by the user if they pay the minimum transaction fee may be:

(Image courtesy: Business Insider.)

If you pay the transaction fees as low as possible, then you have to wait for an average time of 13 minutes to allow your transactions successfully through it.

To remedy this inconvenience, it is recommended that the block size should be increased from 1 MB into 2 MB. As simple as it sounds, the suggestions are not easy to implement, and this has led to much debate and conflict with team 1 MB and 2 MB team ready to face each other with pitchforks. As already mentioned, we would like to take a neutral stance in the overall debate and we would like to put forward the arguments made by both sides.

Arguments against block size increase

-Miners will lose incentive because transaction costs will go down: because the block size will increase the transaction will easily be entered, which significantly lowers the cost of the transaction. There are concerns that this could eliminate interest in miners and they might move on to greener pastures. If the number of miners is decreasing then this will lower the overall hashrate of the bitcoin.

Bitcoin-should not be used for everyday purposes: some members of the public do not want bitcoin transactions used for routine everyday. These people feel that bitcoin has a purpose higher than just being an ordinary everyday currency.

-It will divide the community: Increasing the block size will definitely cause a fork in a system that would create two parallel bitli and therefore split the community in the process. This could destroy the harmony in the community.

-This will cause an increase in centralization: as the size of the network increases, the amount of processing power required for the mine will increase as well. This will take all the small mining ponds and gives strength to an exclusively mining on a large scale. This in turn will increase the centralization that is contrary to the essence of the bitcoin.

Arguments for the block size increase

-Increased the size of the block is actually beneficial to the advantage of prospectors: increased block size means increasing transactions per block which in turn will increase the total cost of transactions that can be performed from one mining miners block.

Bitcoin-need to grow more and more accessible to "ordinary people". If the block size is not changed then there is a very real possibility that transaction costs will rise higher and higher. When that happens, the ordinary people will never be able to use it and will only be used exclusively by the rich and big corporations. It's never been the goal of bitcoin.

Changes will not happen all at once, it will happen gradually over time. The biggest fear that when comes to change the block size is just too many things that will be affected at the same time and it will cause major disruption. However, the people that "increasing the size of the block pro" thought that it was an unfounded fear because most of the changes will be handled during a certain time period.

-There is a lot of support for an increase in the size of the blocks already and people who don't get with time may be left behind.

In order to solve the scalability issues there were two suggestions made:

-A soft fork.

-A hard fork.

What is Soft Fork?

The chain need to be updated whenever there are two ways to do it: soft or hard fork fork. Think of the fork gently as the software update that is compatible backwards. What does it mean? Suppose you run MS Excel 2005 on your laptop and you want to open an existing spreadsheet in MS Excel 2015, you can still open it because MS Excel compatible 2015.

HOWEVER, having said that there is a difference. All updates that you can enjoy in the later version will not be visible to you in the older version. Back to our analogy of MS excel again, suppose there is a feature that allows inclusion in a GIF in a spreadsheet on the 2015 version, you will not see the GIF version in 2005. So essentially, you will see all the text but will not see the GIF.

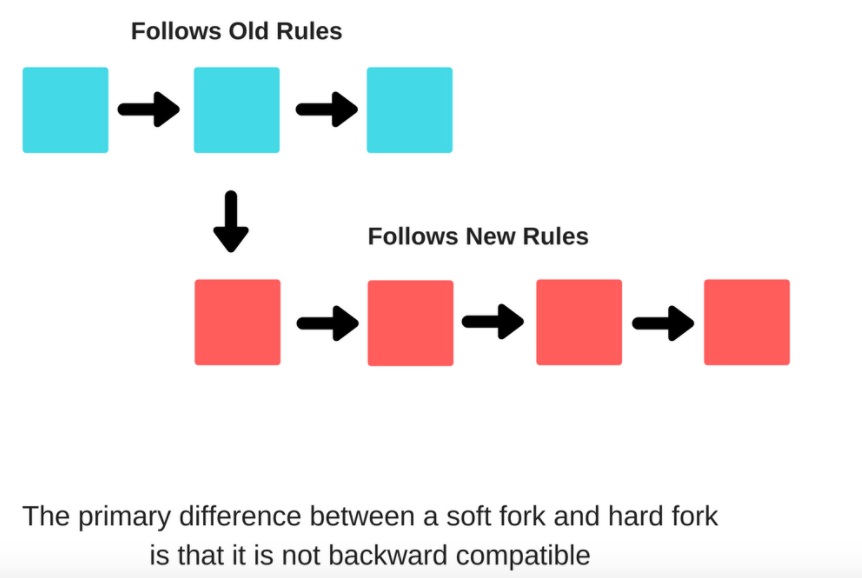

What is Hard Fork?

The main difference between the fork tender and hardfork are not compatible. After being utilized at all no one backed down at all. If you are not joined to an upgraded version of the blockchain you will not get access to new updates or interact with users of the new system. Think of the PlayStation 3 and the PlayStation 4. You can't play games on the PS3 and PS4 you can't play games on the PS3 PS4.

However, for each major change which occurred in the bitcoin system need to reach consensus. So, how does a decentralized economy reached an agreement about something?

Currently the largest two ways that can be achieved are:

-Miner-Activated: basically the changes voted by the miners.

-User-Activated.: changes are chosen by those with the active node.

Before we go any further, we need to understand what it is Segwit.

What is Segwit?

We won't be too far away go into what exactly segwit, but to get why a little cash comes in, it is important to have an idea of what it is. Just to repeat what we have mentioned before, we're not going to take sides in this debate, we will educate You about it.

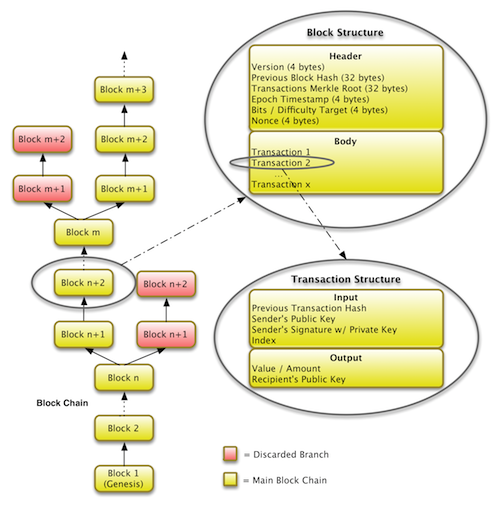

When you closely examine a block, this is what it looks like:

(Image Courtesy: Riaz Faride)

There is the block header of course which has 6 elements in it, namely:

-Version.

-Previous block hash.

-Transaction Merkle roots.

-Epoch time stamp.

-Difficulty target.

-Nonce.

And along with the block header, there is the body, and the body is full of transactions details.

So, what does a bitcoin transaction consist of? Any transaction consists of 3 elements:

-The sender details which is the input.

-The receiver details i.e. the output.

-The digital signature.

A digital signature is very important because that's what verify if the sender really has the funds needed to complete the transaction or not. As you can see in the diagram above, this is part of the input data. Now, while this is all very important data there is a big problem with it. It takes too much space. The existing space in the limited places thanks to a block size of 1 MB. In fact, the signature accounted for nearly 65% of the space is taken up by a transaction!

Dr. Peter Wuille has come up with a solution for this, he calls it Segregated Witness aka Segwit.

This is what will happen once segwit is activated, all the sender and receiver details will go inside the main block, however, the signatures will go into a new block called the “Extended Block”.

So what this will do is it will create more space in the block for more deals. Now that you have a very basic understanding of what it segwit, come check out the pros and cons.

What are the pros and cons of segwit?

Pros of segwit:

-Increase the number of transactions that can be performed by a block.

-Increase the transaction costs

-Reduce the size of each individual transaction.

-Transactions can now be confirmed faster because the wait time is going down.

-Helps scalability bitcoin.

-Because the number of transactions in each block will increase, it can increase overall costs overall that can be collected by miners.

Cons of segwit:

-Miners now will get a lower transaction fee for each individual transaction.

-Implementation of complex and all the purses need to implement segwit yourself. There is a big possibility they may not do it right the first time.

-This will significantly improve the use of resources because of the capacity, bandwidth, all transactions will increase.

When developers build SegWit they add a special clause for it. This can only be activated when 95% approval of the miners. However, this is a major change in the system and they suspect that getting the majority of super is the way to go. However, this causes a disruption of the system. Most miners don't want segwit is enabled. They are afraid because the space available will increase the block, then drastically will reduce transaction costs that they can get. As a result, they ceased segwit which in turn angered users and businesses are very much like segwit is enabled.

Eventually, they came up with the idea of a UASF aka User Activated Soft Fork called BIP 148.

What is a BIP

The proposal fixes the BEEP or Bitcoin is a document that introduces the various design design and network improvements in the bitcoin. There are three types of BEEP:

-Standards Track BIPs: Changes to the network protocol, transaction, and blocks.

-Informational BIPs: Dealing with design issues and general guidelines.

-Process BIPs: Changes to the process.

What is Bitcoin Cash?

Here's the web site project Bitcoin defines itself: Cash "Bitcoin Cash money is an electronic peer-to-peer networks to the Internet. This is completely decentralized, with no central bank and no need for a trusted third party to operate. "Did you notice the emphasis on the words" electronic money of peer-to-peer "? This is done by design because the primary motivation of the existence of cash bitcoin relies solely to do more transactions as indicated by Jimmy Song in the article of his Medium.

Because of the BCH was the result of a hardfork, anyone who has a BTC get the same number of coins in the BCH are PROVIDED, they do not have a BTC in Exchange and they have their private keys at the time the hard worker. So now let's look at some of the interesting features of the Bitcoin Cash.

How does Bitcoin Cash attract miners?

Each cryptocurrency rely heavily on penambangnya to run smoothly. Lately, cassette bitcoin has attracted many miners that have increased the level of hashnya significantly. This is how they do it. For this, we will ask for the help of a brilliant Song Jimmy again.

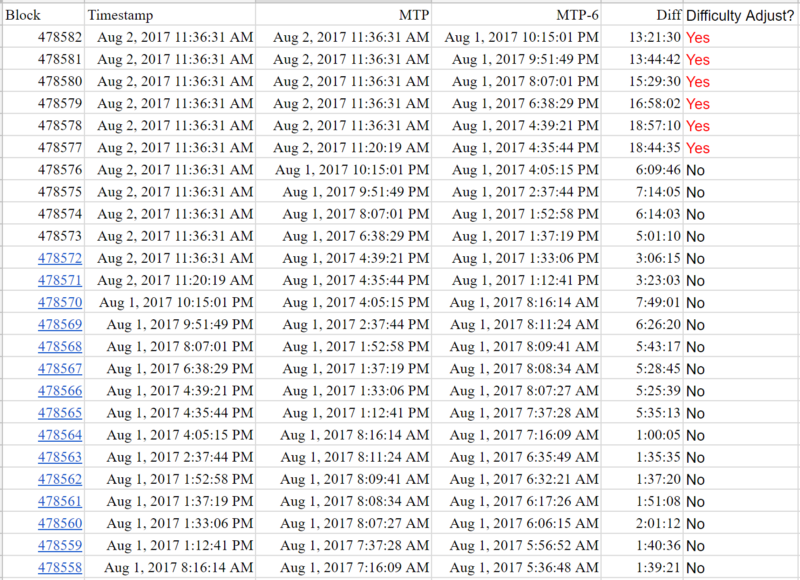

Bitcoin cash has a set rule as to when it decreases its difficulty. Before we see the rule it is important to understand what Median Time Past (MTP) is. It is the median of the last 11 blocks that have been mined in a blockchain. Basically, line up the last 11 blocks one after another and the time at which the middle block is mined is the median time past of the set. The MTP helps us determine the time at which future blocks can be mined as well. Here is a chart of the MTP of various blocks:

(Image courtesy: Jimmy Song Medium article.)

So, this is the rule for adjustment difficulties in cassette bitcoin: If the Median Time Past from the current block and the Median time of 6 previous block is greater than 12 hours, then the difficulty is reduced by 20% to 20% so that it becomes easier to miners looking for new blocks. This gave the miners some power to adjust the difficulty, eg. checkout the gap 13 hours between block 478570 and 478571. The miners might have done this to make the bloc more easy for me.

The other interesting thing to note is how and when the level of difficulty can adjust to crypto. This is a graph that tracks the level of difficulty of the BCH:

(Image courtesy: Bitinfocharts.com)

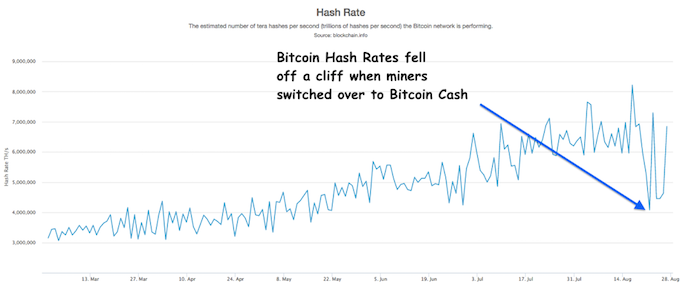

The level of difficulty adjusting to a number of miners in the system. If there is little miners, then the difficulty level is down because of the strength of the hashing the whole system down. When cash bitcoin began, a little bit of trouble getting the miners, as a result, the difficulty down drastically. This, in turn, attracted many miners who found an opportunity to be very profitable. This led to the exodus of miners from BTC so much that the strength of the hashing BTC halved, reducing transaction time and increases costs. Social media reports stating that the transaction was BTC takes many hours and even days to complete.

Here is the graph that shows the drop in hash rate of BTC:

(Image courtesy: Investopedia)

The value of Bitcoin Cash

When writing, BCH is crypto's most expensive second in the world behind BTC at $573.35 per BCH with a market share of $9.4 billion (which is the third highest position in the rear of the BTC and ETH). Its worth once surged more than $700. You can checkout the chart below for more details:

(Image Courtesy: Coin Market Cap.)

So what is the driving force behind the value of bitcoin cash?

Reason #1:

The more exchanges agree to take cash bitcoin. When first starting out most of the stock was reluctant to take on the BCH, but now more and more exchanges are accepted. This, in turn, gives credibility that increases its value.

The following are the wallets and exchanges which are supporting BCH:

(Image courtesy: Coinsutra)

Reason #2:

More and more miners are coming into it. As explained above, BCH currently is very lucrative for miners and many of them are coming in and giving their hashing power which in turn increases its value. At the same time, since the block size is 8 MB as well, it will enable more transactions within the block which will generate more transaction fees for the miners.

What is the future of Bitcoin Cash?

In short, we don't know. We don't know how cash bitcoin will change in the future and also we do not know the long-term impact that will exist in the BTC. All we know is that this is the first time someone successfully completed transaction records with BTC. What we have here is a very interesting experiment that will teach us many lessons continue. At the same time, the block size of 8 mb is definitely a very alluring aspect and remains to be seen how this affects the miners in the long term. This can really resolve all the problems of scalability? BCH can overtake the BTC and became the main chain? All of these questions is just speculation for now. We can say for sure is that we have a very exciting future ahead.

Thank you already visited this post, hopefully useful create friend steem.

Follow @wahyue

Source: https://blockgeeks.com/guides/what-is-bitcoin-cash/

Not indicating that the content you copy/paste is not your original work could be seen as plagiarism.

Some tips to share content and add value:

Repeated plagiarized posts are considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

If you are actually the original author, please do reply to let us know!

Thank You!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin Cash is a beautiful revision of Bitcoin. I'm glad there was a hard fork Bitcoin Cash can now expand and take the number 2 slot of top cryptocurrencies.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yesh BCC is a good invention too, but I wish more miners would be now. The price is to low to be very profitable to mine BCC. Hope in the future things will change totally.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post was resteemed by @resteembot!

Good Luck!

Learn more about the @resteembot project in the introduction post.

Your post was resteemed thanks to @blackbone

Check out the other content resteemed by @resteembot.

Some of it is really cool!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit