As a trader, every day we come across some terms that have become a part of our lingo. On top of that, traders are always creating some new acronym or misspelling their way to a new buzzword (here’s looking at you, HODL). It can all be a little overwhelming for those who are just stepping into crypto trading.

In order to help you ease into the game, we’ve created a list of cryptocurrency trading terms that you should be familiar with at all costs.

We hope that these will help you understand what traders and crypto educators are talking about on forums, blogs, and elsewhere so that you can take advantage of the news they’re passing on.

Altcoin

An altcoin is literally an “alternative to Bitcoin”. Altcoin refers to any cryptocurrency that is not Bitcoin. Few examples of the biggest altcoins are Ether (Ethereum), Ripple, Bitcoin Cash, Litecoin, and Monero. People create altcoins because:

• Bitcoin has several technical problems (high transaction fees, long processing time) which allow room for cryptocurrencies that can keep all the pros of Bitcoin while getting rid of the issues. Recently, a $99-million Litecoin transaction took only 2 minutes 30 seconds to process, with a fee of $0.40.

• Several companies are making awesome use of blockchain technology to create real-world applications which are very different from Bitcoin’s applications. They release altcoins to support their platform and entice people to become a part of their ecosystem. An example of such a platform is Ethereum which issues the altcoin Ether.

• Many people are hoping to repeat Bitcoin’s success with their own altcoins and print money when their cryptocurrency catches on. There are several joke cryptocurrencies on the market that don’t really add any value and more continue to be created. DogeCoin is one such cryptocurrency with a market cap of $232 million.

Bagholder

A bagholder is a person who bought several cryptocurrencies early on which have gone down a lot in value. Usually, bagholders are forced to sit with coins that have gone below their entry point and their crypto portfolio is said to be in negative.

An example of such a person would be anyone who bought Ripple (XRP) for $2.57 early on after CNBC hyped it up. They’d be forced to hold on to their Ripple coins as it currently trades at $0.31, loss of 88% in value.

The term “bagholder” is properly used only when it has a negative connotation attached to it. Bagholders are compelled to hold on to their coins because they’ll suffer a huge loss if they sell them off now.

If you want to desperately get rid of your coins but you’re stuck with them, you’re a bagholder. If you’re holding on to your coins because you’re optimistic about their future value, you’re a HODLer.

Buying the Dip

Buying the dip is a trading tactic that is very viable in cryptocurrency trading. The world of cryptocurrencies is very volatile with several peaks and dips showing on the trading charts every day. When someone advises you to “buy the dip for ZCash”, they want you to buy a substantial amount of ZCash when its price falls below a certain threshold.

A better way to buy the dip is to increase your buy volume in an incremental fashion as the price of the cryptocurrency keeps falling. This way you’ll be able to increase your profits as compared to buying the whole desired volume at a price point which isn’t the lowest in a given trend.

You can even create a simple trading strategy that involves buying the dip. You can follow this simple strategy to get some easy, early wins as you learn about trading cryptocurrencies effectively.

Fundamental Analysis

Fundamental analysis is a way to measure the innate value of a cryptocurrency. This is usually done by examining the qualitative and quantitative factors that the idea behind the cryptocurrency affects.

There are four fundamental utility points that affect the perceived value of a cryptocurrency in the market:

Real-world application: A coin should have a useful purpose and should solve some real-world problem which will make it hard for people to ignore.

Permeability: A coin should have a significant market size, the technology or idea behind it should solve a problem that is widespread so that many people would like to get on board.

Adoption strategy: The team behind the coin should have a good strategy that allows them to gain users. An experienced team will have this as an integral part of their development roadmap.

Growth potential: A coin should have room to grow in value as its development progresses. The roadmap should include items that will continue to interest investors and the general public in the coin’s potential.

Fundamental analysis is focused on understanding “why” something might happen rather than finding out “what” might happen.

HODL

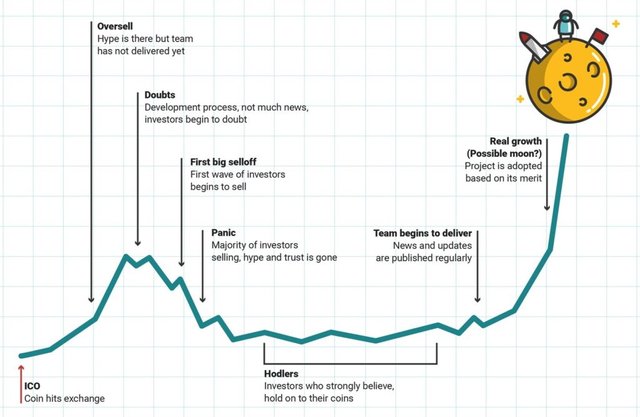

This cryptocurrency trading term is probably the most popular of them all and also heavily misinterpreted. It was first ever used by a Bitcoin forum user who misspelled “hold” in the topic of a thread. It doesn’t mean “holding on for dear life” as popularized by some crypto journalists and media companies in the mainstream.

When you’re holding on to your coins during a downturn, you’re HODLing. HODLers are optimistic about market conditions. They’re regarded as selfless cryptocurrency loyalists who have faith in the potential of their coins.

HODLers are an important part of the cryptocurrency ecosystem. They prevent the coin price from falling too much during bad episodes of market panic.

Sats

Sats is short-form of satoshis which is the smallest unit of Bitcoin. A single satoshi is equal to one-hundred-millionth of a Bitcoin or 0.00000001 BTC.

Technical Analysis

Technical analysis is all about predicting what direction a coin’s value will take by analyzing historical price charts and trading volumes. It is in technical analysis that we try to answer “what” might happen to the market and leave the “why” to fundamental analysis.

Technical analysis is a vast field with several systems and methods that inspect how the market has moved in the past and how it might move again. It’s important to understand the theory behind a method first so that you know when it is appropriate to apply it and when it would lead to gross miscalculation.

To the Moon

When the price of some cryptocurrency is an all-time high level, it is said to be rising “to the moon”. “How much time till moon?” is something you’ll often see in crypto trading forums when traders want to know how long they’ll have to hold a coin before selling it for a fat profit when it moons.

In the world of cryptocurrency, speculations run high and traders often claim that a certain cryptocurrency might “moon”, prompting others to buy that coin ASAP. Such extraordinary claims usually lack extraordinary evidence and add to the FUD or fear, uncertainty, and doubt in the market.

Our advice is to take such claims with a pinch of salt and do your own research before putting money on forum chatter. Technical analysis and fundamental analysis are your friends when such rumors come your way.

Whales/Market Makers/Institutional Investors

A whale, market maker, or institutional investor is someone who has off-the-chart purchasing power and hence the ability to directly influence the cryptocurrency market. The large players that are being referred to here are usually hedge funds and investment funds that make their presence known by drastically moving the markers.

Some of the whales that have been spotted causing waves in the market are:

-Bitcoin Investment Trust

-Binary Financial

-Pantera Capital

-Coin Capital Partners

They manage a large number of Bitcoins by strategically investing them, out of sight of the common trader. They have the ability to move the market at will.

FREE Crypto Class For Beginners - Learn How To Trade Cryptocurrencies TODAY!

If you’ve booked your session above, we look forward to speaking to you soon!

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Live from the Platinum Crypto Trading Floor.

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.platinumcryptoacademy.com/crypto-trading/commmon-crypto-trading-terms/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit