CoinEx Smart Chain (CSC) | On-chain Staking Rewards Explained

Crypto staking rewards

Thanks to its high yields, crypto staking, a way to earn passive income, has quickly become popular with crypto holders. Staking is a process in which nodes stake their tokens and create blocks to participate in the maintenance of the blockchain network. In addition, the rewards a node receives from the network are often proportional to the amount of cryptocurrency it staked.

Some PoS blockchains, such as CSC, even allow anyone to participate in this process. On such chains, participants can engage in staking via on-chain validators as long as they can put up enough funds.

Earn passive income via staking

Speaking of passive income, we first think of depositing our savings. Most banks offer such accounts, with a fixed deposit rate. However, no matter where you are or which portfolio you choose, even higher-yielding savings accounts can only reach 2%-3% in terms of APR.

In comparison, staking typically generates returns of over 5%. Although this figure might differ from the ultimate profit, the yield of crypto staking is normally higher than that of savings accounts.

How do we stake cryptos?

To begin with, to stake our cryptos, we first need to pick a PoS public chain like CSC. The PoS consensus provides users with a new way to earn steady returns. It delegates native assets to staking nodes, which allows stakers to earn 5%+ APR on average.

CSC is a public chain developed by CoinEx Exchange. Based on the PoS consensus protocol, this EVM-compatible chain strives to build an efficient, decentralized financial system. The PoS consensus of CSC explains the “staking” abovementioned. Proof of Stake (PoS) is one of the two main ways for blockchains to reach a consensus. In the blockchain world, consensus refers to self-validation. After a transaction is sent to a blockchain network, the nodes will verify the transaction to make sure that the user initiating the transaction has enough tokens or does not bring damage to the network.

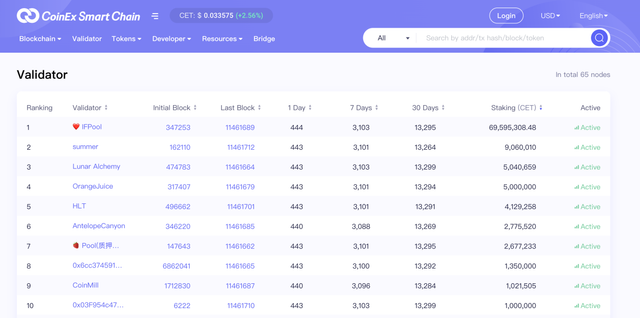

CSC allows anyone to join the chain and stake cryptos. On CSC, all CET holders can stake their tokens and become stakers via CSC validators. Moreover, anyone can stake CET to become a validator. The chain is designed to accommodate 101 validators, who are required to stake at least 10,000 CET.

Check out the CSC validators at: https://www.coinex.net/validator

The revenue of CSC validators is mainly derived from two sources: 1) block reward, and 2) fees incurred by transactions contained in blocks. On this decentralized public chain, all transaction fees are distributed to validators. In addition, CSC offers additional rewards to validators for block generation.

At the moment, CSC features 65 validators, and there are still many places available as the cap is 101. Additionally, users whose CET holding is below 10,000 can also earn staking rewards by joining an existing validator. Here, it should be noted that CSC rewards are distributed to validators, instead of the regular stakers. Therefore, if you plan to earn rewards by joining an existing validator, then you must negotiate how the rewards will be distributed with the validator to facilitate offline distribution after it received the CSC rewards.

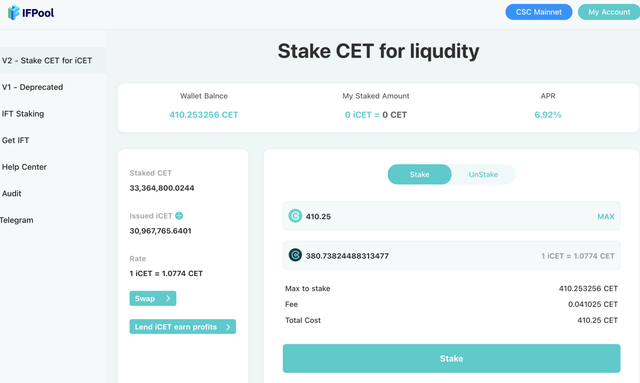

If you feel that negotiating with validators is way too troublesome, you may also engage in staking in IFPool, an application based on CSC. With IFPool, CSC’s first stake mining pool, even beginners can vote for CSC validators and stake their CET holding directly through MetaMask. In IFPool, staking generates returns for each share of iCET obtained, and users can claim the returns when withdrawing their CET. Through this pool, retail users can directly stake CET in their wallets to earn passive income, which is an easier, more convenient, and less limited approach compared to staking CET through CSC validators.

Stake cryptos at: https://ifpool.io/

Furthermore, the iCET earned through staking can be used in other CSC-powered DeFi projects, such as WaterLoan. On CSC, stakers may invest their iCET to earn additional profits.

Crypto staking used to involve an extremely complicated process, but it has been significantly simplified over the years. For instance, CSC has improved the user experience and streamlined the staking process via staking DApps. Right now, staking cryptos is as easy as creating wallets: users can start staking simply by clicking on one or two buttons after depositing the required cryptos into a wallet. After completing the staking settings, users will receive regular rewards proportional to their staking amount. In other words, the more tokens a user stakes, the higher yields he will make. With staking, crypto users can easily earn passive income.