DafriBank could be a branchless financial innovation organization giving changed monetary administrations, installment approach arrangements

Our customer, DafriBank, related to United States to induce their net banking entrance fabricated. The bank is planned to figure through internet based mostly suggests that just, that created having a robust advanced framework basic for them. A predominant shopper expertise on each versatile and web interfaces was likewise critical, as these are the most direct client touchpoints for DafriBank clients.

we have a tendency to created the foremost reliable and difficult engineering for the DafriBank web based financial entryway. This ensured that the bank is systematically accessible to serve their purchasers. due to DafriBank' advanced simply monetary foundation, the clients ought to check their character on the we have a tendency tob. This was one in all the foremost agitating functionalities to coordinate. Nonetheless, we approved of finishing up this as we've in-house FinTech specialists at Nimble AppGenie.

The Technology Stack:

Business Challenge

the best test with this venture was to construct the most reliable and robust banking application approach within the restricted budget and time span. it's unconventional for out and away most of FinTech improvement organizations to construct such quality arrangements inside the distributed financial plan and timetable we have a tendency to were volumed with. Be that because it may, we found out the way to do per se whereas fostering a convincing shopper expertise for the onboarding system.

THE Solution:

Wireframe planning

The initial step is to create low and middle constancy plans, and subsequently you'll begin to rejuvenate them. Our creators utilize Adobe XD to make surprising models for the application. As we utilised the Agile advancement process, we utilized a uniform input circle among DafriBank and our improvement group.

Consistent Onboarding:

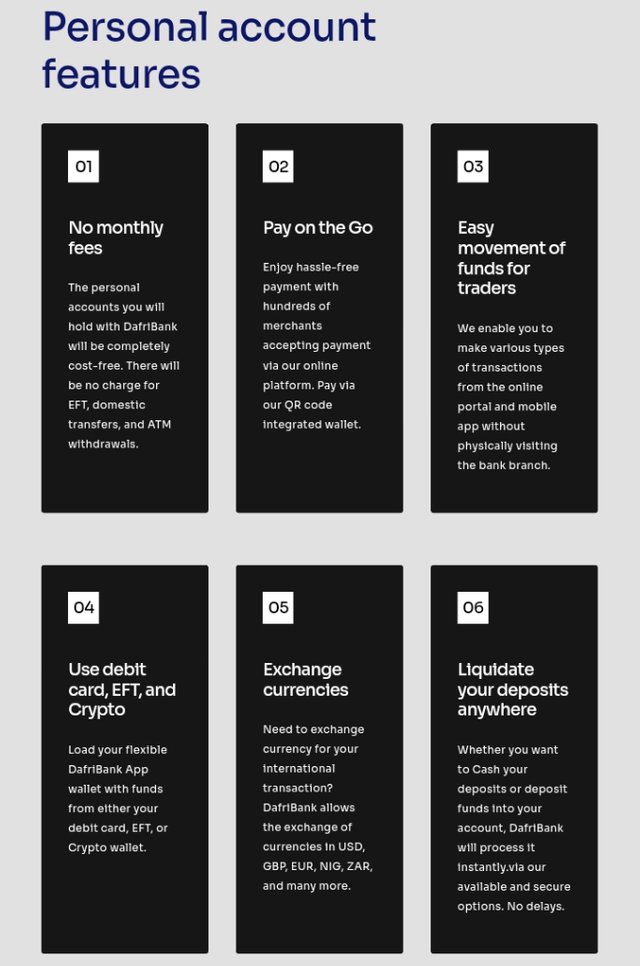

to alleviate out the KYC cycle, we have a tendency to permissible purchasers to either choose in or to avoid the interaction till they have to learn the monetary administrations. This sceptered shoppers to effectively get to knowledge known with the administrations that DafriBank offers. Additionally, forward that clients have noncommissioned their versatile variety or email, they're then permitted to create exchanges of upto $250.

dead Intra-currecy T/F

because the DafriBank entrance upholds various monetary forms, we wanted to allow clients to make intra-money installments. Subsequently, we executed a money trade screen, that springs up consequently just in case the client makes an attempt to make an exchange to totally different financial standards.

cryptologic cash Management

we have a tendency to dead the digital money exchange associated use utility the DafriBank entryway. The purchasers are permissible to supervise 3 digital types of money: BTC, ETH, and DBA. purchasers will likewise utilize these digital forms of money to prime up their DafriBank wallet.

Highlight Set:

Outsider Bill Payment

The DafriBank entry permits clients to hide numerous types of bills by suggests that of their net based mostly gateway. The bank is consistently band beside many outsider organizations, subsequently, the entry can uphold considerably more later on.

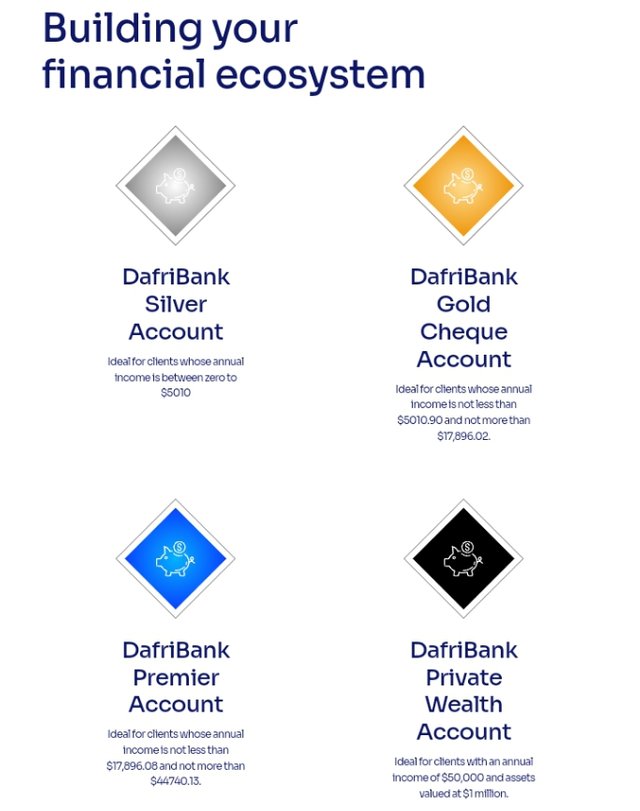

many forms of Accounts:

From individual banking to business sector level, DafriBank obliges everyone that's underprivileged for advanced banking. The approach flaunts functionalities like totally different record varieties (Silver, Gold, Platinum), that purchasers will profit obsessed with their exchange esteems.

Digital currency Exchange:

still as supporting BTC and ETH, DafriBank has its own digital currency named DBA. The bank entryway permits clients to purchase/sell and store digital currencies.

Intra-Currency cash T/F

purchasers can build installments in every money that the entryway upholds. At present DafriBank permits installments in NGN, ZAR, EUR, GBP, and USD.

Project Management Approach

At the hour of venture inception, DafriBank didn't have their requirements plainly determined. so we have a tendency to utilised Agile item planning and Careful item necessity creation {to ensure|to build sure|to confirm} that DafriBank gets the item that they were proposing to get. The run based mostly improvement approach permissible us to ask the progressions that DafriBank has requested that we make since the endeavor was started.

adroit assisted us for the duration of the undertaking, significantly on the events once DafriBank required to gift another arrangement of elements. we have a tendency to isolated the complete venture into many runs, wherever every run went on for around seven days. we have a tendency to accustomed lead week once week gatherings with DafriBank to remain up with the most recent with the development interaction. to ensure the entire venture was completed in an exceedingly manner that's robust with the DafriBank vision, our PM (project administrator) was in consistent bit with the involved people from DafriBank.

https://www.dafribank.com/

https://twitter.com/DafriBank?s=09

https://www.facebook.com/DafriBank/

https://t.me/DBATalk

https://www.dafribank.com/investor-relations

https://www.linkedin.com/mwlite/company/dafribank-limited

Author information

Bitcointalk username; janimani

https://bitcointalk.org/index.php?action=profile;u=2560888

0x269228c6F9897c181E58D7879AD6955634A8573d

#DafriBank #DafriBankDigital #OpenBanking #DigitalBanks #DigitalPayment #OnlinePayment #PaymentSolutions #CrossBorderPayment #DigitalEntrepreneurs #InvesInAfrica #Bitcoin #InstantMoney #InstantPayment #eWallet #Binance #MobileMoney #DigitalMoney #CryptoBank #Forex #Foxcampaigns