Critically, the DeFi people group looks to make options in contrast to each money related assistance at present accessible.

These administrations incorporate things, for example : investment funds and financial records, advances, resource exchanging, protection, and substantially more.

DeFi keeps on assuming a significant function in the development of the money related part for some reasons. For one, DeFi extends the usefulness and reach of cash. Since everything you require to partake in the DeFi segment is a Smartphone, there is tremendous potential to grow the worldwide economy. Subsequently, investigators consider this to be as one of the most significant presently a work in progress in the crypto space.

This responsibility to the improvement of a DeFi biological system is anything but difficult to perceive. Critically, DeFi is the quickest developing segment in blockchain. As per late reports, DEFI tokens consistently outflank their partners. Also, since this time span speaks to the start of this reconciliation stage, the market presently has the remarkable chance to see a totally new industry bloom.

Since the ascent of Defi protocols, decentralized trading (DEX), through liquidity pooling have been picking up alot of foothold. When contrasted with concentrated trades, in any case, dex protocols appear to be extremely restricted in what they can execute. A genuine case of this restriction is with beginning startup financing and market section liquidity.

Today we are very excited to share the Poolz vision with you. With poolz, we envision a trustless crypto market, which offers prospective startups, unbaised access to a willing and liquid market, able to get the project of the ground. By extension, this takes away the need and cost for ICO and IEOs, as well as the regulatory requirements that follows.

Today we are very excited to share the Poolz vision with you. With poolz, we envision a trustless crypto market, which offers prospective startups, unbaised access to a willing and liquid market, able to get the project of the ground. By extension, this takes away the need and cost for ICO and IEOs, as well as the regulatory requirements that follows.

While there are several pioneering platforms offering liquidity pooling opportunities, the idea with Poolz is to make liquidity pooling available for the pre-listing phase of the project, and for existing assets too. So it takes out that initial barrier to entry hurdle suffocating great solutions without the means for a grand market entrance.

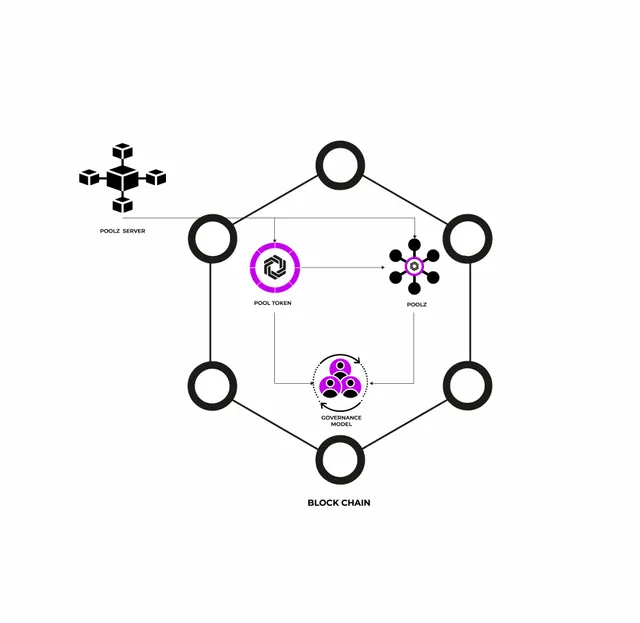

Poolz is a Layer-3 trading convention imagining a decentralized method of associating beginning phase blockchain-digital currency trend-setters and speculators. Its brought together interface permits venture proprietors to dispatch and oversee liquidity barters that are effectively discoverable by speculators on the stage.

Beginning with Ethereum, Poolz sets out on a drawn out mission to disturb and completely decentralize liquidity barters. The undertaking is worked with a dream to encourage more prominent interoperability through cross-chain cooperations, which thus, will additionally reinforce DeFi selections and worth.

Customarily, the way toward giving liquidity to a market is through market making. This is the place chosen high volume market players, give liquidity at a markdown in support of themselves. Anyway it accompanies custodial constraints and syndication issues.

Tragically, this is the technique been utilized by unified crypto markets. Actually, liquidity pools, depend on robotized market making, executed by the Poolz protocol. In this circumstance, any agreeable partaker can play market producer and get the chance to buy tokens at faries limit and still get remunerated by the protocol. Furthermore, this accompanies the trustless security of a Defi protocol.

An Overview Of The Poolz Ecosytem Operations

An Overview Of The Poolz Ecosytem Operations

Poolz is built as a DAO protocol on ethereum, and the premise of the Poolz operations and governance is that, the community gets to decides how governance and operations will evolve, going forward. So even though our team get to set the initial operations, the community still gets to decide how it eventually evolves.

Please note that, this overview is not an exhaustive representation of the overall Poolz operations. That will be available in the litepaper.

So what is captured here is a brief summary of the its operation:

- Poolz (POZ) token

This is an ERC-2O token, since Poolz is deployed on Ethereum. It will be used for incentivization, to pay for developmental cost goin forward and governance requirements. Also, POZ holders get to be discounted with pool entry and simply for being holders of POZ, so you get to earn more POZ for having POZ.

- Pool Type

There will be two pool types on Poolz, which is the direct sales pool (DSP), where the tokens are received by the investor, imediately after a swap, and the time-lock pools (TLP), where the pools have a lock-in-period, before the tokens are released to the investors.

- Poolz Market Players

There are two categories of players in the market, which are the liquidity providers (LP), technically the market makers, and those in need of the liquidity or Pool creators.

- Pool rule makers

Every pool on Poolz come with basic rules and the pool creators, which are usually the project owners, for new tokens, get to set the rules. The parameters for this rule includes choices like: relevant blockchain protocol and wallet for the swap, pool type, pool duration (in the case of a timelock pool,) available token for the pool or auction, the swapping ratio and several others.

- Planned Improvements

As an eventual milestone in the poolz functional agenda, there will be a cross-chain token transfer implementation, at a later stage of its developmental roadmap. This will allow for non-ethereum tokens to be swapped by the poolz protocol.

- Access to selective pools: as of now referenced, each pool on the stage is restricted to POZ token holders for an underlying length after its dispatch.

- Access to all the more likely trade proportions: Exclusive pools additionally offer uncommon limits for POZ token holders, hence improving the potential returns for liquidity excavators

MORE INFORMATION

Website: https://poolzdefi.com/

Medium: https://medium.com/@Poolz

Twitter: https://twitter.com/Poolz__

Telegram: https://t.me/PoolzOfficialCommunity

Telegram Announcements: https://t.me/Poolz_Announcements

Github: https://github.com/PoolzAdmin/Poolz

Our live code on Discord: https://discord.gg/8REVabc

Credit by Sinjokubhi

Wallet Address : 0x8bC9B2eDeFd8DF78a500f311a8BfEE8d544Dd8DB