Unlike in other areas of the blockchain and cryptocurrency space, the whole DeFi craze in EOS has came about a little slower. Although EOS is beginning to catch up in terms of volume of DeFi applications out there, one very welcome addition to the space was the announcement and release of the Newdex seed funded Defibox project.

Defibox is made up of a number of parts all working towards the common goal of becoming the one-stop DeFi go to application platform on EOS. Offering swap, liquidity, mining functionalities for the BOX token, and the USN stablecoin, Defibox has risen the ranks in its short lifespan to encompass a vast proportion of the trading volume within the EOS space for a fairly substantial number of tokens. Let us then break this down and dissect exactly what the platform can do, how it works, and why it has become so very popular in it’s epic rise to the top ranks of DeFi in EOS so very quickly.

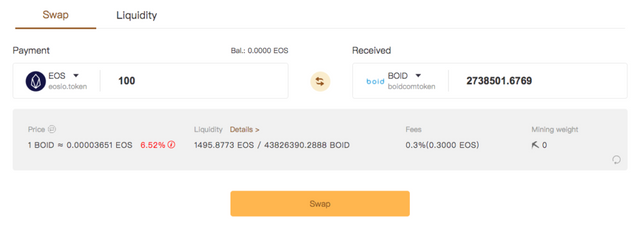

Swap

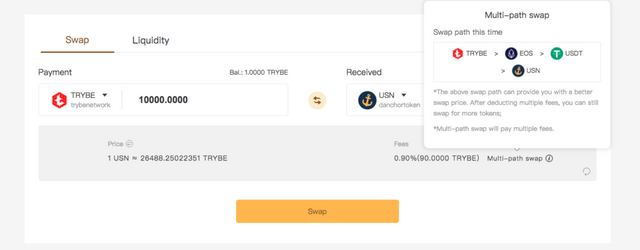

The swap function works as one would expect allowing quick, easy and seamless straight up swaps of one token for another.

There are a number of pools which have been set up for this purpose that appear below the swap function area, but even if there is no pool that has been setup that exactly mimics the desired swap, the application will find the best swap route of the existent pools to complete the transaction as desired.

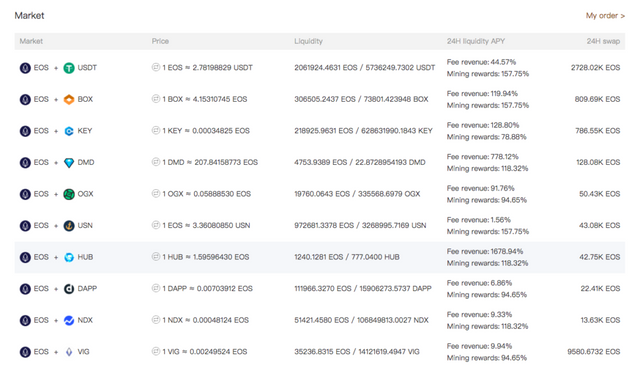

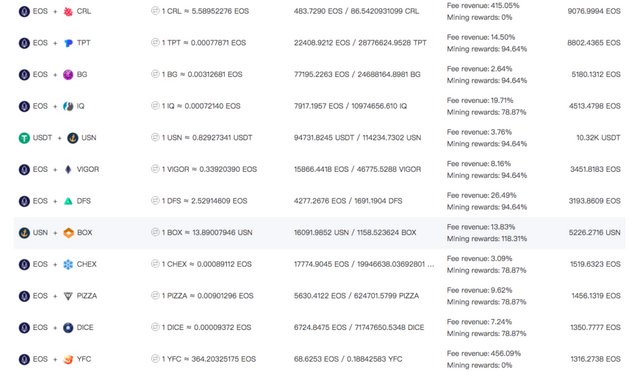

Liquidity

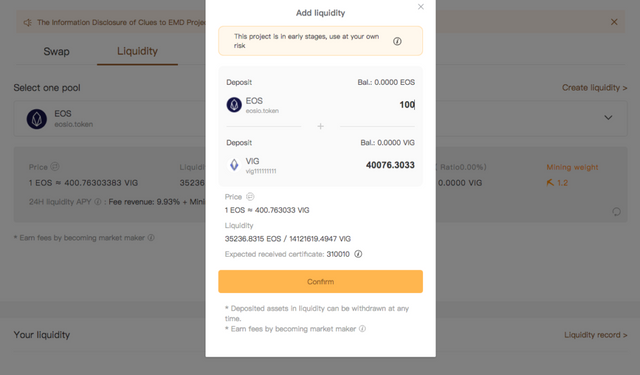

Since launch a number of liquidity pools have already been set up which allow for users to add liquidity into. Simply run a search of the pairings you wish to provide liquidity to and plug in the amounts that you wish to support. Filling in one side of the equation for the pools that are pre-existing will auto fill the other side.

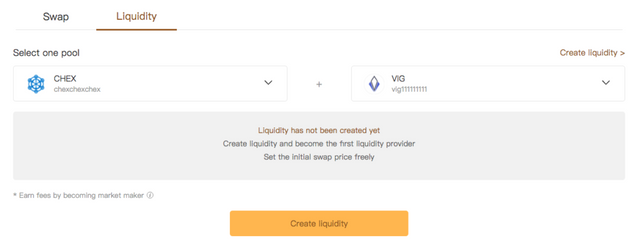

However, just because the pool doesn’t presently exist does not mean that it cannot be added to, just that it first needs to be set up. By setting a new pool up the new swap pricing will first need to be defined.

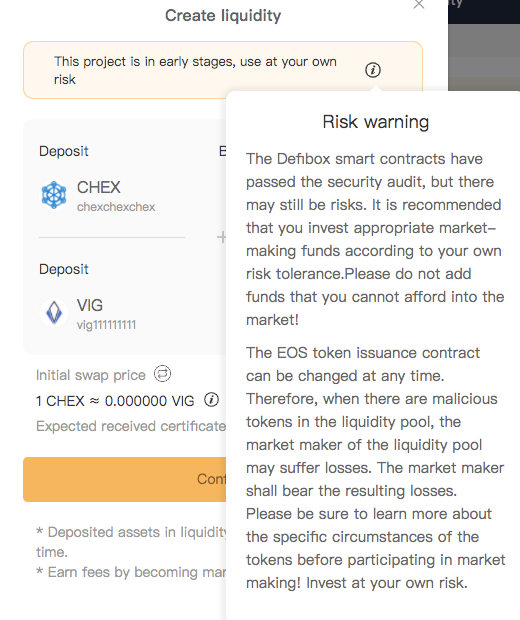

Simply define your parameters and it is off to the races. Likely a good idea to pay attention to the warning message as well, and remember that no matter what one does in this space there are some risks as well as benefits.

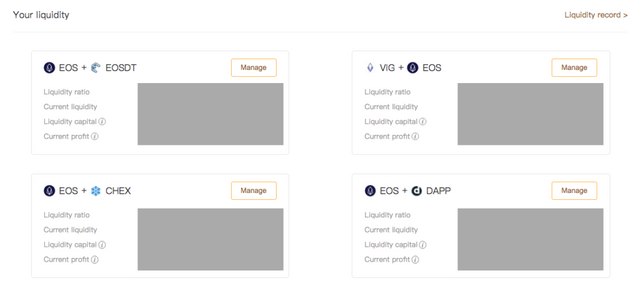

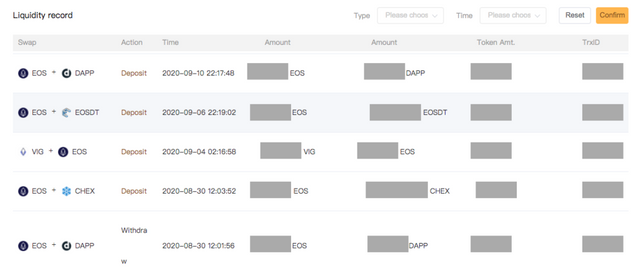

At the bottom of the liquidity page you can also easily view your accumulated positions in the liquidity market and even the liquidity history defined by certain parameters should that be desired by clicking upon the Liquidity record tab.

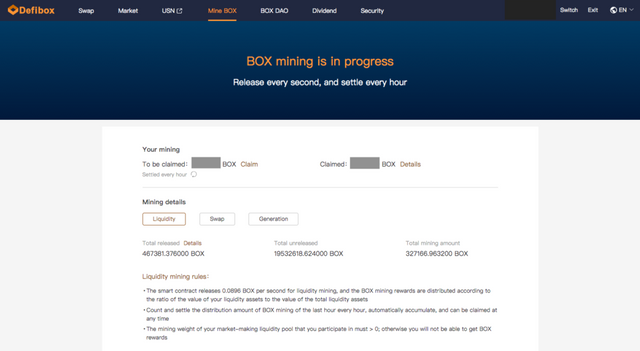

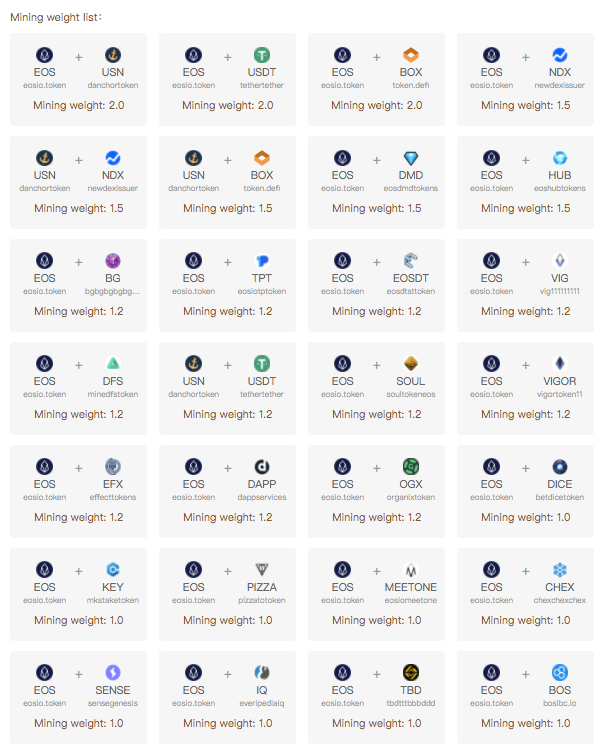

It should also be noted that when adding liquidity, there are certain pairings which will allow for a mining weight released every second and settled every hour for BOX tokens. To collect any BOX tokens you may be receiving from approved liquidity mining weights as well as from USN generation simply click on the claim shown on the Mine BOX tab.

It should also be noted that these mining weights are not necessarily pre-determined by any one entity and can be changed if proposed and approved by the BOX DAO governance model of Defibox.

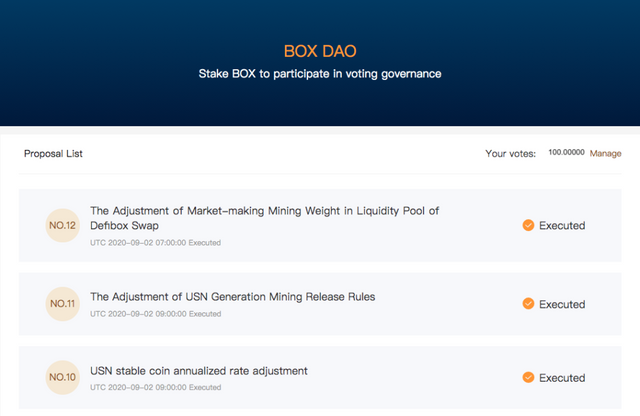

BOX DAO

Defibox is a DAO, or decentralized autonomous organization. The BOX DAO allows BOX holders voting rights decision making capabilities towards defining important parameters of each DeFi protocol such as which tokens are listed, which tokens pay dividends, Swap protocol transaction fees, BOX mining weight for each token liquidity pairing generates, and USN stable coin treasury interest and liquidation penalties. The Defibox Foundation reasons that due to the fact that BOX holders hold these rights regarding decision making parameters that BOX holders in turn will benefit directly from the government aspects of the protocols which they help to implement and maintain.

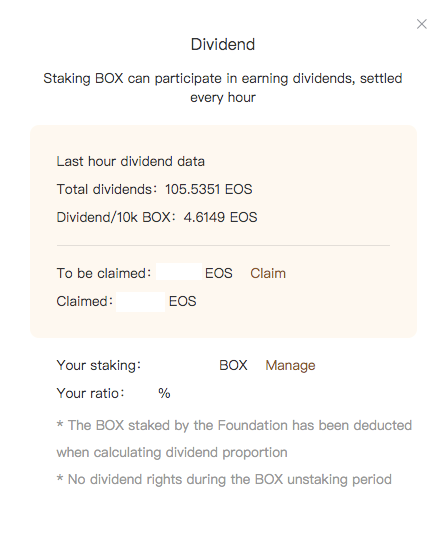

EOS Dividends

Another benefit to staking BOX tokens is the ability to earn dividends paid out in EOS for activities on the platform. Just as in the case of BOX mining, EOS dividends can be claimed every hour and will go directly into your account upon settlement. To claim dividends simply navigate to the Dividends menu on the top of the Defibox homepage, click the Claim button, and sign the popup transaction with the supported EOS wallet of your choice.

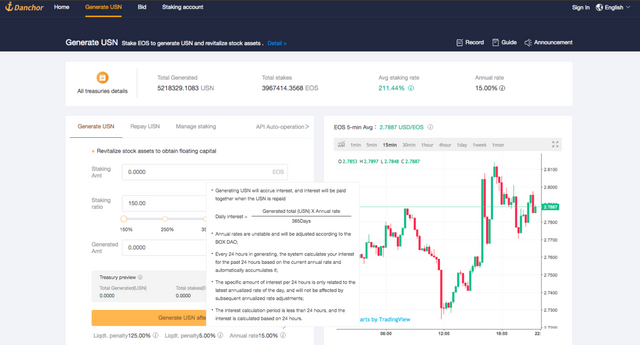

USN Stable Coin

Of course no Defi project would really be worth their salt if they did not in fact have some form of currency which functioned in a somewhat stable manner in regards to base fiat currencies. In the case of Defibox then, the USN stable coin does just this. USN is generated by staking EOS to the system and is pegged to the U.S. dollar at a one to one peg. A risk control mechanism of over-staking and liquidation ensures that market fluctuation can be sufficiently managed and that USN can keep its peg throughout turbulent times.

Navigating to the USN menu in the header of the Defibox page will bring you to the Danchor site which will then give multiple options in regards to Generation and repayment of USN. Much like the Defibox interface, the Danchor/USN page is very clean and self explanatory, however do be sure to read all of the info boxes in regards to liquidation penalties and annual interest rates, as should the “staking ratio of the treasury is less than or equal to the liquidation ratio, the treasury will be forced to liquidate” [source and further information can be found at https://support.newdex.net/hc/en-us/articles/360038387831-What-is-liquidation-]

There is also a bid option whereby “the staking items of liquidated account will be auctioned at a discount price, so as to take back the USN generated by the account in time and maintain the stability of the system” [source: https://support.newdex.net/hc/en-us/articles/360038021052-What-is-bid-when-liquidation-].

Security of the System

Being operational on the EOS blockchain offers a number of advantages in comparison to other DeFi projects out there in the space making loopholes sometimes found in contracts mute due to the sheer speed and faster block times of EOS, however doesn’t inherently solve all the problems with DeFi. Defibox has taken security one step beyond in doing the best it can to ensure the platform and by default user funds are safe in a number of ways from ‘security audits, a multi-signature contract, bug-bounty programs, and an open source code in an effort to uphold the principles of fairness and transparency, and put the security of users’ assets first’ (source: https://defibox.io/announce).

Multiple Security Audits of the Defibox smart contract have been completed by PeckShield and SlowMist, two very well known blockchain security companies. These audits ensure the public and user base that the Defibox smart contract code is free of any major vulnerabilities or security risks according to the best practices possible. The audit reports can be viewed here for any parties interested in taking a look.

A Multisig Contract across multiple EOS block producers, security companies, and trusted well known wallets is utilized by Defibox to ensure that the modification and deployment of any changes in the contract can only be changed in a completely transparent and decentralized manner. For more on the specifics please refer here.

Being one of the core tenants of blockchain is open source code, and eventual opening up of the Defibox contract code by the Defibox Foundation will allow for a more transparent partnership of openness aiding both the team and other developers in the industry looking to adopt and create similar protocols and bring about more trust in the spirit of true decentralization allowing everyone who wishes to see what changes have been made and implemented to do so.

Finally a Bug Bounty Program has been opened up to the community in the event that there still may be some vulnerabilities or potential risks post audit in the Defibox application. Those with such abilities are encouraged to inform Defibox of any issues they may have found before making them public and will be eligible for a bounty reward for their services. For more information please see the finer details check https://support.newdex.net/hc/en-us/articles/360046715092.

What the Future May Hold

Looking at the broad picture, Defibox has come out of the gates already swinging and has become in a very short time one of the go to DeFi applications on the EOS main net. An immense amount of liquidity has been locked up and the ease in connecting to a decentralized swap network within the EOS ecosystem has really spurned on the voice of reason when it comes to DeFi utilizing EOSIO technology. From a competitive point of view, utilizing a decentralized matrix of connection to both the swap/liquidity and USN stable coin interfaces in tandem with zero fee transactions it stands to reason that in the future Defibox will continue to gain traction not only within EOS but beyond. Although EOS may not be the hub of DeFi that Ethereum and other blockchains presently offer, the sheer incentive of low transaction fees is enough to draw many users in. Add to that the liquidity that projects and individuals are able to capitalize upon in both BOX mining and EOS dividends and the profit motive on all levels is clear. Although at present only the swap/liquidity and USN stable coin functions are operational on Defibox, in the future the project also has plans to implement decentralized lending and synthetic assets into their playbook and in tandem with the decentralized governance and decision model of BOX DAO should be more than enough to solidify their place in the broader EOS and crypto communities for at least the near, and potentially the far off future of how DeFi can and should be done.

Further Resources

For an excellent walkthrough on the key aspects of the platform such as token swaps, adding liquidity, mining BOX tokens, staking BOX tokens, and BOX DAO governance voting, check out the following Defibox walk through by HodlEOS.

For an overview of all the benefits of Defibox and how all the pieces fit together to provide transparency towards an accountable DeFi Application Platform on EOS, this video overview by ColinTalksCrypto does an excellent job of tying all the positives together in an overview of token swaps, lending, the USN stablecoin, staking, earning passive income, he DAO that is Defibox and more.

Official Channels and Links

Defibox Homepage: https://defibox.io/

Danchor / USN Homepage: https://danchor.io/

Twitter: https://twitter.com/Defiboxofficial

Telegram: https://t.me/Defibox

Whitepaper V1.2 (https://support.newdex.net/hc/en-us/articles/360046066792-Defibox)

*This article was compiled and written by Jimmy D for the Defibox article contest. The official link for the contest can be found at https://newdex.vip/events/articleContest

**This is a copy of the original previously published at https://medium.com/@jrdiegel/introducing-defibox-an-all-in-one-defi-application-built-on-eos-2728a4349205 by the same author