For most people, the main way to make money from crypto is trading it or holding it until it appreciates. While these ways are lucrative, they’re just a scratch of what’s possible with crypto and the blockchain. In this article, you’ll learn how to become crypto-rich with decentralized finance (DeFi).

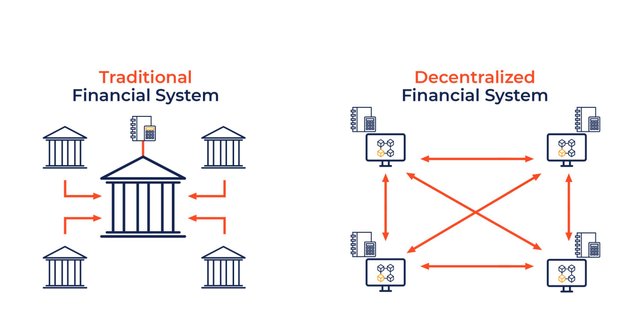

In simple terms, DeFi aims at installing a new financial system that is open and accessible to everyone without the aid of traditional banking systems. DeFi is the opposite of centralized banking, where central banks and financial institution makes the rules. There are no governing bodies, only blockchain protocols and smart contracts interacting here.

Here’s the interesting part, you can make passive income with DeFi and earn money even while asleep. Keep reading to discover the four ways to become crypto-rich with DeFi.

a) Defi Lending

Just as we have traditional financial institutions, there are also DeFi lending platforms to lend and borrow crypto. They are platforms where users can lend their cryptocurrencies to earn an annualized return. Instead of just holding your coins and tokens in your crypto wallet, DeFi lending platforms let you receive an annual percentage yield (APY) on your coins by lending them.

Compound and Aave are the leading DeFi lending protocols available in DeFi. Here’s how it works, you sign up on the lending protocol and deposit tokens you want to lend, and someone that wants to borrow will first supply other tokens as a form of collateral before taking up the loan. The APY or interest you’ll receive is not fixed. It varies depending on the stablecoin you’re transacting with and other market factors. To know the current transaction rates before lending your coins, check defirate for real-time interest updates.

b) Yield Farming

Yield Farming is another lucrative way of becoming rich with DeFi. As the name goes, yield farming lets people earn additional income for staking their cryptocurrencies. In simple terms, It’s the process of rewarding users a fixed or variable percentage of interest for locking up their crypto assets into a DeFi protocol.

For instance, when someone takes a loan via a financial institution, the amount lent out is paid back with interest. It’s the same concept with yield farming. Only that, your cryptocurrency is put to work and returned with interest to you. The key benefit of yield farming is juicy profits. You could cash out big time by doing it the right way.

c) Providing Liquidity to exchanges

Liquidity providers are decentralized exchange users who fund a liquidity pool with their tokens. Decentralized exchanges like UniSwap and SushiSwap create liquidity pools to enable users to earn rewards by trading liquid pairs. It is worth noting that liquidity providers are also known as trade facilitators and are compensated for every trade they enable.

For instance, a liquidity provider provides $7,000 worth of Ether and a $7,000 worth of stablecoin -DAI to a liquidity pool to facilitate trades between the two. For this reason, every time a trade on the ETH/DAI pair is executed, the liquidity provider would receive compensation for funding the underlined liquidity pool.

d) Crypto Staking

Since DeFi is not controlled by the traditional banking system, there has to be a way of validating and verifying transactions to avoid manipulations of any sort. That’s where the proof-of-stake model comes in. This model allows crypto users to stake their coins and create unique validators. Let me break it down, staking on DeFi means the process of pledging your coins to be used for verifying transactions. In return, the protocol gives you interest in using your coins.

You can only stake using cryptocurrencies that use the proof-of-stake model like Ethereum, Solana, Polkadot, Avalanche, & Terra, amongst others. To reduce your chances of loss, endeavor to only stake tokens you’re familiar with. Plus, always use tokens with high yield and market cap when staking. All things have been equal: Staking crypto could give you a guaranteed source of passive income when done properly.

Risks Associated with DeFi

It’s worth noting that DeFi is not all sunshine and roses; there are some prevalent risks too. The thing is, there are high risks involved, and you have to Do Your Own Research (DYOR). And seek guidance before investing your fortune into it.

Flash loan attacks and impermanent loss are two of the main risks associated with it. DeFi is not a get-rich-quick-scheme; it’s an alternative to traditional finance. Expecting huge returns overnight will only lead you to jump on fraudulent protocols with shiny rewards.

In Conclusion

Decentralized finance is the future of financial systems, and that future is now. Although not entirely perfect but worth paying attention to. If you’re looking for an extra source of income, then DeFi is a good place to start. It comes with high risk, however, with proper knowledge, and guidance, you could make millions investing in DeFi.