Content

Let's talk about the lock-up trend of ETH from three aspects: ETH 2.0 pledge, DeFi lock-up, and gray-scale purchasing power.

ETH 2.0 lockup rate of return is very attractive

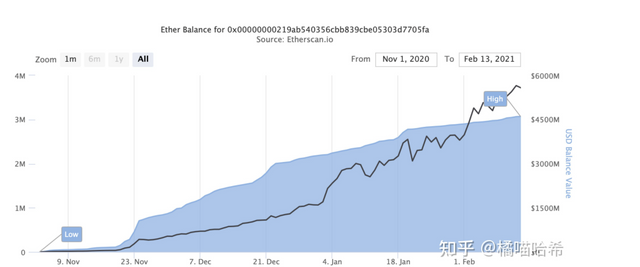

With the current pledge amount=3.07 million pieces, the annualized rate of return of ETH2 pledge is 8.56%. In the future, as the prospects for the merger of ETH1 and ETH2 become clear, the deterministic income prospects are expected to attract more pledged funds. If the pledge amount reaches 10 million, the annualized rate of return will be close to 5%.

As the currency price climbs and gradually stabilizes within a certain range, the 5% regular financial management income will become very attractive, so the ETH2 lock-up rate is likely to reach 10% in the end.

ETH2 pledge volume trend

Ethereum application lock-up is expected to hit a new high

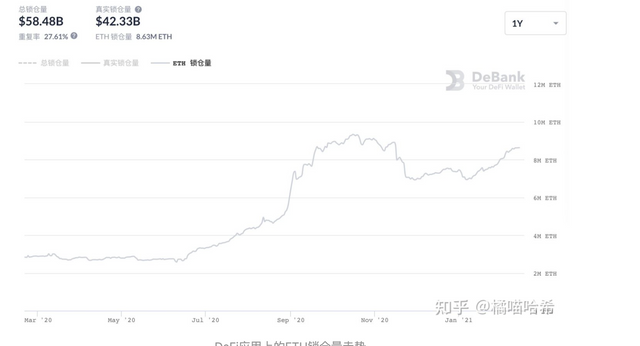

Since January of this year, the amount of ETH locked in DeFi projects has continued to rise, but it still has not reached the 8.3% higher than the pledge rate in September-October 2020. With the gradual growth of the DeFi lending market, ETH mortgage lending scenarios will become more abundant, and the ETH lock-up rate is expected to reach a new high, which will easily exceed 10%.

Trend of ETH lock-up volume on DeFi application

No redemption mechanism, part of ETH may be locked by Gray for a long time

Grayscale's CEO mentioned last month that in addition to BTC, many potential buyers are asking them about ETH and BCH, and the Ethereum Trust (ETHE), which has stopped purchasing since December last year, has also recently reopened. Some investors interpreted this move as the removal of certain potential policy risks of ETH (such as being identified as securities). Therefore, fund investors and retail investors have entered the ETH buy-buy-buy model. Due to regulatory reasons, Grayscale currently only accepts digital currency subscriptions, but does not accept redemption.

The current gray-scale BTC holdings are approximately 653,800, valued at 32 billion U.S. dollars (calculated at 49,000 US dollars/piece), accounting for 3.5% of the total market value, while ETH holdings are 3,128,600 BTC holdings, valued at 5.7 billion U.S. dollars (calculated at 1,830 US dollars/piece) ), accounting for 2.7% of the total market value.

If the institutional funds plan to continue to allocate digital currencies, then the continuous emergence of new purchasing power (and BTC holders who are awakened to the value of Ethereum) will enter the reopened Ethereum Trust in large numbers, so the total market value of ETH in gray positions is likely to account for It is not difficult to upgrade to more than Bitcoin, because at the current price, 1% of the total BTC needs 9 billion U.S. dollars, and 1% of ETH only needs 2 billion U.S. dollars. Since the lock-up period of ETHE in US stocks has reached 12 months, and the fund has not announced a no redemption plan, this will cause a large amount of ETH to be locked indefinitely.

Therefore, I personally have a thought: If trust funds such as Grayscale are used to gradually reduce the circulation of BTC and ETH in the secondary market of the currency circle and lock enough, will BTC and ETH become similar to "paper gold" "Paper BTC" and "Paper ETH", will their pricing power also be transferred to the stock market, such as ETHE?

Other thoughts: Under what circumstances will the amount of ETH lockup be reduced?

The answer is: DeFi triggered liquidation may lead to a short-term collapse of ETH.

With the bulls fully gaining the upper hand, the leverage ratio of the entire digital currency market may have been unimaginably high. There may be three main types of leverage in the market now:

(1) Exchange contract;

(2) Centralized/decentralized lending: Many arbitrageurs use lending agreements to pledge ETH, lend stablecoins such as USDT/USDC, and purchase coins again or conduct mining. This practice undoubtedly increases the market’s overall growth. Leverage rate, there is a risk of accidental liquidation. Take last year’s 3.12 sharp drop as an example. As the global market’s investment targets are all sold off, BTC’s fall is not surprising, but the pin to 3,800 US dollars the next day is mainly due to the huge amount of leveraged funds reaching the liquidation line and being liquidated. The currency price fell further, which undoubtedly cast a shadow over the possible normal correction of the currency price.

(3) Unlock the liquidity of ETH2 tokens: as shown below, the node converts the pledged ETH into ETH voucher one-to-one, and the voucher is used for mining, artificially granting liquidity and expanding leverage.