Eterbase is a regulation-compliant European cryptocurrency exchange offering fast, secure trading across a clean UI. Find out how it works today in our review. Eterbase, found online at Eterbase.com, is the world’s first regulation-compliant Europe-based cryptocurrency exchange.The company announced their exchange online on April 25, 2018. As of May 2, the company is offering early adopter membership access in exchange for entering an email address. You can get a sneak peek at the exchange on their official blog post here. Eterbase is in development by a Liechtenstein-based team of developers.

What Is Eterbase?

Obviously, there are plenty of cryptocurrency exchanges already available today. What makes Eterbase different? How does the exchange plan to compete? Here are some of the core features of the exchange:

Heavy-Duty Trade: Eterbase will use “proprietary infrastructures and matching engines” to offer “Secure, complex, high-volume trading” at a level “comparable only to Wall Street”, according to the official website.

Regulation-Compliant: Eterbase is built on a comprehensive regulatory core. That core abides by regulations like KYC, AML, CTF, and GDPR, which makes it fully-compliant with European Union regulations.

Clean and Professional: Eterbase aims to offer powerful trading capabilities for professional traders and beginners alike, including “human-centric design, 24/7 support, and an intuitive interface.”

Individual Client IBAN: Eterbase is applying to become an Electronic Money Institution, or EMI, under European regulatory standards. If successful, this will allow Eterbase to issue fully operational International Bank Account Numbers, or IBAN. That means they’ll be able to clear Euro payments directly while serving customers across the entire European Economic Area (EEA), which covers 31 European countries. This would give Eterbase similar coverage and service as a European-based bank.

SEPA & Debit Cards: Another advantage of getting an EMI license is the ability to integrate Eterbase with the Single Euro Payments Area (SEPA) system. SEPA is accessible to 500 million people and 20 million businesses across Europe. If Eterbase’s EMI application is successful, then the platform will be able to accept direct cash deposits and withdrawals on a payment account – just like a bank. Eterbase will also be able to issue debit cards and execute card payments – against, just like a normal bank.

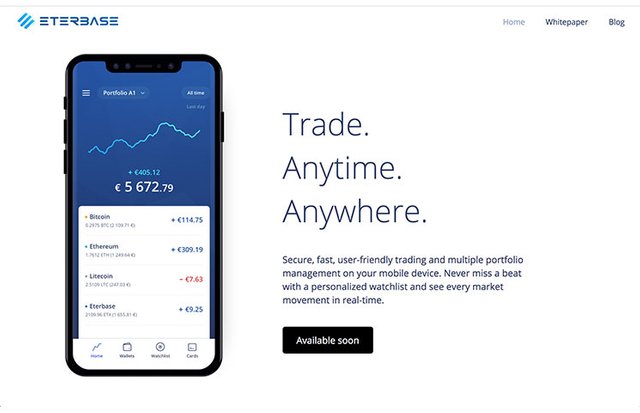

Mobile App: Eterbase plans to launch a mobile app in the future. That mobile app will offer secure, fast, user-friendly trading and multiple portfolio management on your mobile device.

Sub-Accounts: Eterbase will have a sub-account system where you can manage different portfolios and trading strategies across multiple accounts from within your single account. You can view your entire portfolio’s value at a glance while still implementing unique individual trading strategies.

Social Trading: Eterbase’s social trading feature lets you follow and interact with top traders. Top traders receive commission for everyone copying their trades.You can view a sample of the Eterbase dashboard online today at Eterbase.com’s sneak peek blog post. The dashboard appears similar to GDAX and other major cryptocurrency exchanges, displaying complex information in a simplified way while giving traders access to all of the data they need from a single screen.

Crowdsale:

Token details-

Ticker: XBASE

Type: Utility-token

Additional Token Emission: No

Accepted Currencies: BTC ETH EUR

What Problems Does Eterbase Seek To Solve?

Why do we need an exchange like Eterbase? The company believes the market is failing to address several key problems in the industry, including all of the following:

Growing Market Requirements: The crypto market is exploding with growth, but existing cryptocurrency exchanges struggle to handle the volume.

Limited Technology: Eterbase’s whitepaper mentions technological problems like rate-limited trading APIs, non-real-time transaction confirmations, and delayed order book updates. These issues make it “exceptionally challenging, if not impossible, to monetize trading strategies that require the simultaneous execution of many trades.”

Client Support: Eterbase claims most exchanges treat customer service as “an afterthought.” Eterbase will emphasize a “human-centric” customer service model that better responds to customer requests and complaints.

Lack of Fiat Acceptance: One annoying thing about cryptocurrency exchanges is that it can be hard to deposit money into the platform. Not all exchanges accept fiat currencies. Some exchanges only accept a particular type of fiat currency – like the USD or GBP. Eterbase wants to register as an EU-regulated bank, which would allow it to accept SEPA payments and other traditional payments from Europe-based bank accounts.

Exchange Security: Major exchanges are constantly bombarded with hacking attacks. Even the largest exchanges experience downtime. These are serious issues for an industry seeking mass adoption.

Trading Fees: The average top exchanges charge trading fees of 0.1% to 0.2%, increasing friction in the marketplace. Eterbase will actually offer negative trading fees to some users (you’ll earn money as a market maker on certain membership tiers, for example).

Listing Requirements: Today’s leading exchanges can command $1 million as a listing fee. That’s why many new token developers are forced to use secondary markets where they face low liquidity and large spreads.

How Do Eterbase Tokens Work?

Eterbase tokens, or ETX tokens, are ERC20-compliant tokens built on the Ethereum blockchain. Tokens can be redeemed for discounts, products, and services available through Eterbase.There’s a total supply of 1 billion ETX tokens.The primary purpose of ETX tokens is to access the Eterbase tiered membership scheme, which we’ll talk about below.

Eterbase Fees

Eterbase’s fees will be based on a tiered membership scheme. The more tokens you’ve deposited into the Eterbase platform, the higher your membership tier will be. Members on a higher tier will pay lower commissions than members on a lower tier.Here’s how fees break down:

- Basic (0 ETX Required): 0.10% (maker fee), 0.10% (taker fee)

- Plus (10,000 ETX Required): 0% (maker fee), 0.075% (taker fee)

- Professional (50,000 ETX Required): -0.01% (maker fee), 0.05% (taker fee)

- Premium (100,000 ETX Required): -0.02% (maker fee), 0.03% (taker fee)

Other bonuses are available as you move to a new membership tier. Members with 0 ETX tokens, for example, can issue a maximum of 100 requests per minute, while the other three tiers allow 500 to 5,000 requests per minute. Premium members can register up to 100 accounts. They also have a 75% discount on withdrawal fees, among other benefits.

About Eterbase

Eterbase is in development by a team based in Vaduz, Liechtenstein. That team is registered under the name Eterbase AG, which is registered under corporate number FL-0002.570.473.As the Eterbase whitepaper explains, Liechtenstein is “one of the most important financial centers in Europe” and has a favorable regulatory environment that has made it a hub of fintech innovation.

Eterbase Conclusion

Eterbase aims to distinguish itself from the competition by launching a fully-regulated Europe-based cryptocurrency exchange. That exchange will offer enterprise-grade trading capabilities along with a tiered membership system that significantly rewards ETX token holders. Eterbase is also applying to become an Electronic Money Institution (EMI) under EU law, which means the exchange could accept SEPA transfers and interact directly with European banking systems.To learn more about the new exchange, visit online today at Eterbase.com.

Website: https://eterbase.com/

ANN: https://bitcointalk.org/index.php?topic=3664292.0

BTT Report: https://bitcointalk.org/index.php?topic=4704620.0

Telegram: https://t.me/ETERBASE

Author:

Bitcointalk Username: adifx

Bitcointalk Profile URL: https://bitcointalk.org/index.php?action=profile;u=1502350

Telegram: Telegram url: https://t.me/soaib_hossain_sohag

ETH WALLET: 0x71123E62201060fC3155AF4E4c752AC3659DDECA

Email: [email protected]