ETHLend is a decentralized loaning application (DAPP) running on the Ethereum Network that offers secure, distributed loaning Smart Contracts. ETHLend endeavors to democratize the procedure substantial loaning process by expelling force and control held by conventional banks and vast monetary establishments. Not at all like other blockchain advance applications, ETHLend enables a borrower and a moneylender to choose fundamental advance points of interest without the need of a go between. Basically, this implies a moneylender and purchaser anyplace on the planet can make a credit contract on their terms.

Issues Solved by Decentralized Lending

Decentralization can settle a significant number of the inborn issues related with our current brought together obtaining framework. Here are the three most compelling motivations the decentralization of advances bodes well.

Trust: Decentralization totally evacuates the need to put stock in your advance supplier and your counterparty. Credit guarantee is bolted and controlled by Smart Contracts that are communicated on the general population blockchain.

Straightforwardness: The Ethereum organize gives a straightforward record which is open for assessment. Each exchange is recorded and can be confirmed. Ethereum's straightforward bookkeeping evacuates the visually impaired put stock in required by exchanges between two keeping money foundations.

Access: By using the Ethereum organize, ETHLend moneylenders and borrowers can orchestrate advance exchanges from anyplace on the planet. Advance exchanges occur from Ethereum deliver to Ethereum address permitting unlimited, overall access. Unconstrained, the two borrowers and banks can get to a considerably more extensive pool of credit liquidity.

How does ETHLend loaning work?

ETHLend expects borrowers to post ERC-20 good tokens or Ethereum Name Service (ENS) areas as security against Ethereum Loans in the event that the borrower defaults. At present, no one but borrowers can make credit asks for on ETHLend. To put a credit ask for, a borrower must set information, for example, the advance's length, intrigue premium, and measure of tokens required for security. On the off chance that a moneylender consents to these terms, an advance understanding will be made. Just two situations can come about because of the production of any advance:

The borrower reimburses the advance. The loan specialist at that point gets his or her unique foremost in addition to intrigue. Or then again

The borrower neglects to reimburse his or her advance. The loan specialist would then get the borrower's posted insurance

The LEND Token Sale and Current Price

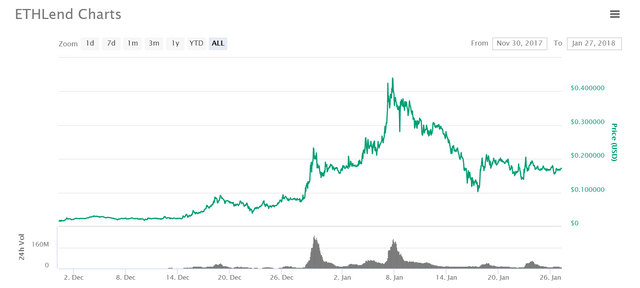

ETHLend's token offer of LEND finished November 30th, 2017. As indicated by ICODrops, ETHLend raised $17,860,000 of its $17,900,000 objective. The greatest supply of LEND tokens to be made is 1,299,999,942 while the current coursing supply of LEND tokens is 1,032,154,231. Loan's cost essentially dropped for a ten-day time span beginning on January seventh. Amid this ten-day time span, Lend's cost dropped the distance from 40 pennies to 10 pennies.

Loan's enormous value drop might be credited to the false bits of gossip that the South Korean government intended to boycott bitcoin and digital currency trades. This news appeared to make the whole market slide. Since bottoming, the cost of LEND has balanced out and moved sideways in the 15 to 20 pennies go. The digital money showcase is by all accounts following its verifiable pattern of drooping in January. It wouldn't astonishment to see the market to move sideways one more week or two preceding coming back to a moderate moving positively trending market.

Loan Token Functions

ETHLend's LEND token is an ERC-20 good token that was sold in the presale offering and ICO. The LEND token has a few vital capacities on the DAPP.

Markdown Fees

Clients of LEND tokens will get 25% value diminishment on stage expenses contrasted with paying with Ethereum. In spite of the fact that LEND tokens can be purchased and sold on trades, the essential use for LEND is to make a markdown while paying for ETHLend DAPP sending charges.

Airdrops

Dynamic moneylenders and borrowers will be paid with quarterly airdrops. ETHLend intends to utilize 20% of its decentralized application charges to buy LEND from the market and "airdrop" the LEND to all loan specialists and borrowers on ETHLend. Airdrops will be utilized to build client appropriation and furthermore to add more volume to credit books.

Selective Functions

Specific administrations on ETHLend will be just available to be obtained by LEND. Cases of these highlights incorporate included advance postings and email advertising efforts.

Referral Bonuses

ETHLend intends to buy extra LEND to remunerate loan specialists and borrowers who include new members to the decentralized loaning stage.

Production of a Decentralized Credit Rating of Borrowers

ETHLend likewise plans to offer unsecured credits to its client base in the long run. Unsecured Loans, credits in which the borrower does not post security on account of default, are significantly more dangerous for the bank. To enable banks to address the trouble of assessing the basic danger of unsecured advances, ETHLend intends to make a decentralized FICO assessment for every one of its clients. Succinctly, Ethlend borrowers will be able to construct their notoriety after some time as they effectively pay back credits.

Each ETHLend borrower will have a decentralized FICO score made from a few information sources. The essential wellspring of information for these FICO scores will be Credit Tokens (CRE) which will be issued from ETHLend itself. Notoriety based loaning will enable Ethlend to present the idea of unsecured obtaining for clients and give more data to secured banks. Moreover, ETHLend intends to empower clients to communicate their decentralized FICO assessment to different blockchains. Borrowers at that point will have the capacity to utilize their all around earned FICO assessment on applications on various blockchains too.

Credit Tokens (CRE)

Credit Tokens are an ECR-20 good token that will be solely utilized as a part of ETHLend to speak to a borrower's notoriety. These tokens can't be exchanged or even exchanged to another address. The more Credit Tokens related with a client's record, the more dependable the client's record is.

ETHLend will deal with borrower's notorieties by issuing Credit Tokens to clients who effectively pay back advances. For each 1 ETH a client effectively pays back, the client will get 0.1 CRE. Similarly, ETHLend intends to "consume" Credit Tokens with extreme heat from accounts that that neglect to pay back advances. A client with a high measure of CRE will have the capacity to acquire advances that another client with a low measure of CRE proved unable. Clients with higher measures of CRE will be remunerated with better financing costs and in addition be required to post bring down levels of guarantee for comparative credits contrasted with clients with less CRE.

Conclusion

ETHLend gives a decentralized stage where secured, distributed Ethereum advances can occur between any two individuals on the planet. Expelling governmental issues and outskirts from the condition, ETHLend plans to upset the loaning business. ETHLend eventually tries to make a really worldwide commercial center that will profit all members looking to both give and get credits.

Really nice post keep watching you 😁

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice post i vote for you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

this currency has a good future

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sure is

make sure to follow me to get some more updates

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice one bro......Do for me what i have done for you. https://steemit.com/ned/@evanschigo/sex-dolls-interview-with-seyi-hunter-970b95d2bdf21

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

ready man https://steemit.com/drawing/@rodoli2010/some-drawings-part-2-algunos-dibujos-part-2

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

excellent information men... thank you...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Make sure to follow me for more

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit