Today I want to touch two topics. The first one is the inflation and its place in Ethereum. The second one is Eligma, I am doing review of this project. Let’s start with the first one.

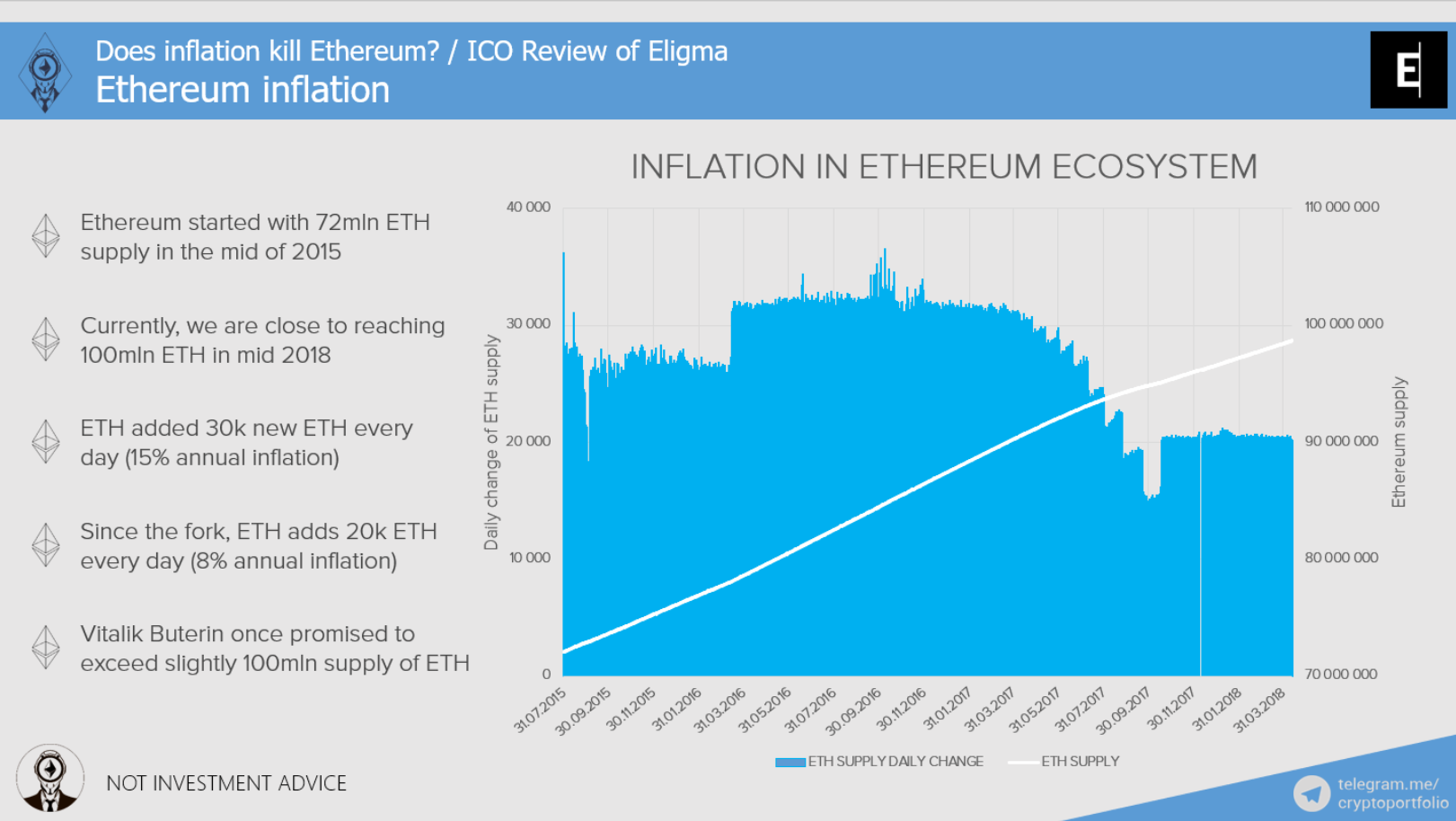

On the right part of the slide, you can see graph with two important numbers for Ethereum ecosystem. The white line is supply of Ethers, the blue clustered column is daily change of Ether supply. What we can generally say about these numbers:

• Ethereum started with 72mln ETH supply in the mid of 2015. The founders conducted ICO and they collected ~$20mln. Part of ethers were distributed to investors and the other part to Ethereum team

• Currently, we are close to reaching 100mln ETH in mid-2018. That’s already 28mln ethers more than in the beginning. Quite an increase in supply, so I understand the interest of investors in decreasing inflation rate by going proof of stake or lessening the block rewards for miners

• ETH added 30k new ETH every day (15% annual inflation if we take 72mln ethers supply as a reference)

• Since the fork, ETH adds 20k ETH every day (8% annual inflation based on current overall supply of ethers). Ethereum foundation plans to further decrease it with the new fork. Recently, on the 1st of April, Vitalik Buterin joked about making Ethereum a fixed supply blockchain with 100mln ethers. A lot of people took it seriously, and so the discussion was started. Let’s see the advantages and disadvantages of making Ethereum a finite supply blockchain on the next slide

• BTW, Vitalik Buterin once promised to exceed slightly 100mln supply of ETH. He said on numerous occasions that POS transition would make Ethereum supply float around 100mln mark. And that this mark will not be greatly exceeded

Personally, after researching the topic of inflation in the blockchain space, I started to be in favor of moderate inflation (~5% every year is OK for me). Seeing the EOS whitepaper and its target inflation of 5% also contributed to formation of my opinion .

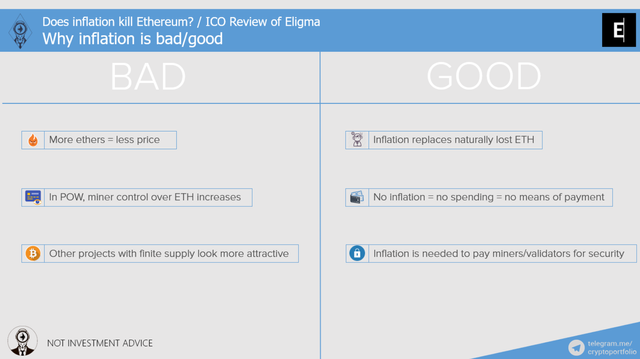

This slide shows pros and cons of inflation in Ethereum ecosystem.

Cons:

• More ethers = less price, as simple as that. Substantial growth of ethers’ supply will surely bring the price down which is bad for investors

• In POW, miner control over ETH increases. What does that mean? If we stay with proof of work consensus mechanism for too long without decreasing block rewards(~inflation), miners will exercise more power over Ethereum blockchain. It’s bad

• Other projects with finite supply look more attractive. For example, Bitcoin seems to be perfect project for people who value lack of inflation

Pros:

• Inflation replaces naturally lost ETH. It is a pretty sad topic for many. Everybody once saw reddit posts with people asking for help in reviving their wallets, which are forever lost. I was one of the people who lost considerable amount of DAO tokens. To say I was pretty sad is to say nothing. I am still disappointed in myself for accidentally deleting the wallet (it is lost forever, I tried every possible solution). This kind of situation brings deflation to the blockchain which means the supply of cryptocurrency decreases. The naturally lost ETH must be replaced with new ETH (IMHO)

• No inflation = no spending = no means of payment. What does that mean? If we have no inflation, the users are less eager to spend, and more motivated to save, expecting price to increase. This environment creates vicious circle, which is not helping the cryptocurrency to become means of payment. The means of payment functionality is extremely important if we are to go mainstream with our blockchains

• Inflation is needed to pay miners/validators for security. Currently, we pay miners to mine blocks and create the system where it is not possible to make double-spending. In the proof of stake consensus mechanism, we will still have to pay validators (instead of miners) to secure the blockchain from double-spending attacks

I think that inflation is needed. My perfect number would be 3-5% annually just to secure network, replace the naturally lost ETH, and make cryptocurrency usable. What do you think? Should we aim at becoming blockchain with almost zero inflation like Bitcoin or the blockchain with moderate 5% inflation? What will be better for investors long-term?

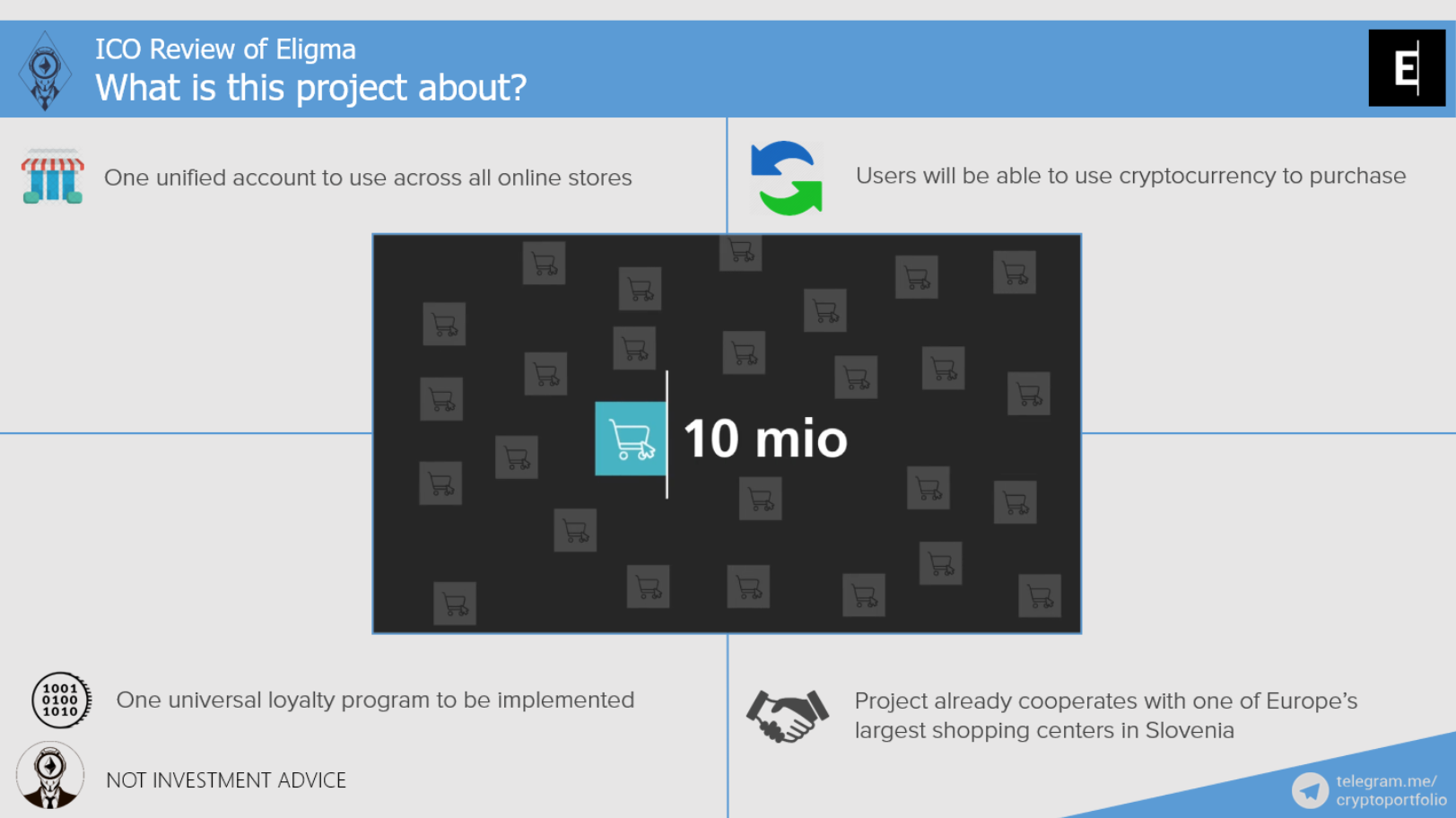

Now let’s talk about the project that will try to become an entry point into ecommerce for all customers.

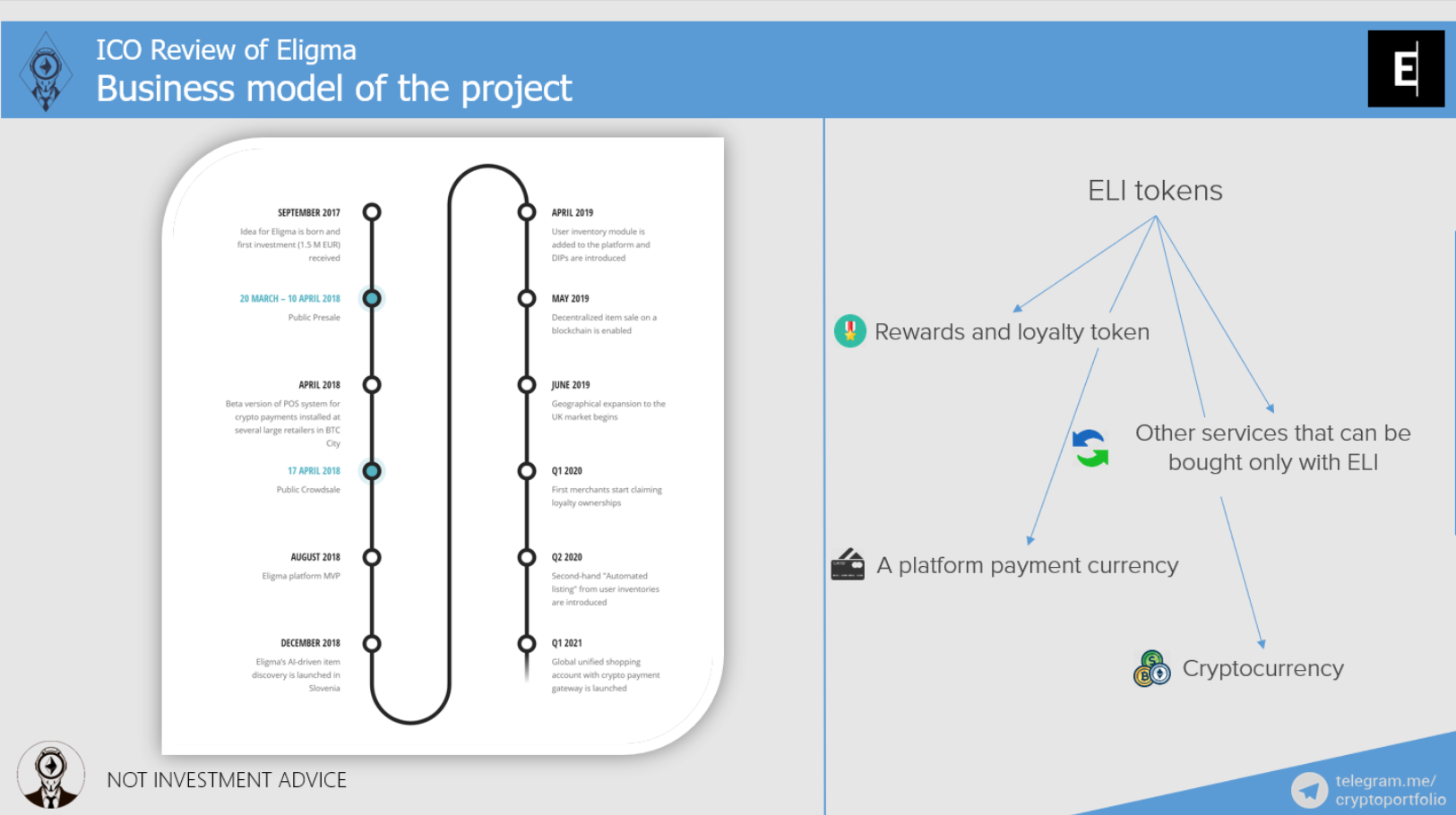

What this project is about:

• One unified account to use across all online stores. From Eligma, customers can shop in all the online stores anywhere in the world. This way, consumers are able to save time on shopping and get the cheapest option from one of the available stores

• Users will be able to use cryptocurrency to purchase products. Even if a store doesn’t accept cryptocurrencies, Eligma will give an opportunity for customer to buy with crypto

• There is a lot of loyalty programs in the shopping world and a lot of the loyalty points are simply lost. To avoid that, Eligma will present universal loyalty program for all businesses that can be really of interest for customers

• Project already cooperates with one of Europe’s largest shopping centers in Slovenia, BTC. This April, they start testing EliPay system in one of the shopping centers. Also, they cooperate with NETIS, blockchain lab and consultancy, ABC, Slovenian startup accelerator, SPARTAN SOLUTIONS, blockchain development company, VIBERATE, crowdsourced live music ecosystem and blockchain-based marketplace, ICECAT, syndicator of e-commerce product content

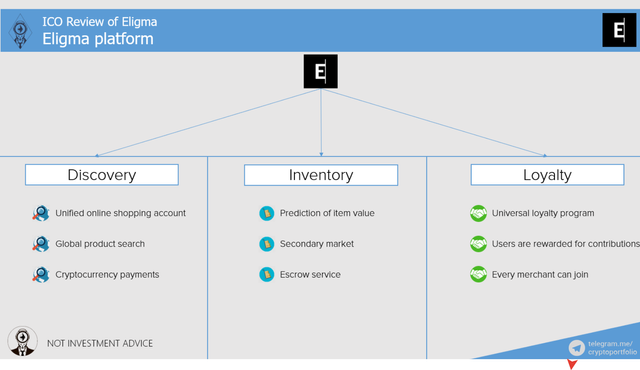

On this slide, I would like to take a closer look at the Eligma platform.

Eligma is based on three main pillars:

- Discovery

a. Eligma will display global discovery results based on the search input and knowledge about the user

b. Unified online shopping account will enable users to simply and securely connect all the online stores and manage all their purchases from one place

c. Cryptocurrency payments will be possible thanks to Eligma’s internal cryptocurrency payment gateway

- Inventory

a. AI-predicted item value gives an opportunity for users to see the current and future value on purchased goods (or imported into system)

b. When a user decides to sell an item, he will be able to create universal listing with a single click

c. To make sells and purchases as safe as possible, Eligma will provide escrow services

- Loyalty

a. Universal loyalty program will be done with ELI tokens

b. Users will be rewarded with tokens by doing such things as registering, providing information, adding items, referring new users, and so on

c. ELI tokens can be spent on purchases on Eligma, using escrow services, advertising, and buying other services on the platform

Good breakdown of the inflation problem on Ethereum. I don't really see the point of Eligma though, doesn't Bitpay provide the same service (interface for merchants) without any tokens involved.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

wow very excellent post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @cryptoportfolio! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last announcement from @steemitboard!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @cryptoportfolio! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit