Today I would like to touch one of the topics I always raise when talking about investing in cryptocurrencies with my close friends, buddies and family. If you studied economics you must be familiar with boom and bust cycles. Yes, that is first thing I talk about with people who want to invest. It is crucial to understand that it is impossible to experience never ending growth in any economic sphere. At some point, growth ends and what’s next? Economic downturn. And when we touch the topic of cryptocurrencies, there is extreme volatility. It is not American stock market where 1% price change is considered to be significant movement, cryptocurrency sphere is absolutely new financial market where 10–40% change is considered to be “normal thing”.

I understand human nature, I understand why people want to invest when market has already experienced 10000% growth. They simply want a little piece of the possible super profit. But. We all know how it ends. When the huge inflow of newcomers ends, the market crashes. A lot of people get disappointed in cryptocurrencies and pack their bags to leave cryptomarkets as they did before during the past market bubbles. And that is exactly the time when you should invest. Waiting is hard, but it always pays off. Like it paid off for many initial Ethereum investors who are already dollar millionaires.

So, I will try to make you understand why I withdrew a large portion of my portfolio from the market. Why I do not like to invest into shitcoins or just overvalued coins. Why I believe there is going to be from 50% to 95% correction across a lot of coins that are traded on digital exchanges. What decisions you will make is up to you. But remember just one thing, it is better to be the minority than majority when we talk about financial and cryptocurrency markets.

Shall we begin?

Here I showed my thoughts on valuation in general.

What is overvaluation and why you should understand this term.

Overvaluation in cryptocurrency market is the situation when current price greatly exceeds true market value of cryptocurrency. How do we find true value of cryptocurrency? That’s $ 1 000 000 question for some of my readers and viewers! = )

First of all, it is almost impossible to find true value of particular cryptocurrency, but it is still possible to compare crypto with existing financial instruments. How do we understand which financial instruments to use while comparing cryptocurrencies? Here is the answer.

Bitcoin, ethers and other cryptos (such as LTC, DOGE, etc) are considered as currencies now, while other cryptocurrencies (especially the ones which went through ICOs recently) are centered around making profits for its holders ( I shouldn’t name them because I feel like Securities and Exchange commission is watching and reading my blog). So, bitcoins, litecoins, and ethers (even though the creators of Ethereum refuse to acknowledge ether as a currency) can be compared to national currencies. It is hard to digest now but give it another 3 years and you will understand why. Basically, those coins have a huge road ahead in terms of growth but I still expect them to go through ups and downs. And downs are much more near than ups in my humble opinion.

From the other side, we have ICO projects which are much more interested in making money for its holders. They use very strange ways to benefit coin holders, but it is all done to avoid SEC actions. For example, Ethereum casinos send all profits to wallets, which can be accessed by coinholders to withdraw profits. By not directly sending money to wallets, they try to overcome the oversight… Weill, all I can say that it will not work but OK. Let’s go with that. So, we should compare those coins’ capitalizations to existing working companies’ capitalizations.

This is where it gets really interesting, because many cryptocurrencies have insane valuations in comparison to real world profit making companies. We’ll get to that.

Overvaluation is a part of boom cycle, but it always ends. As I mentioned above, it is never ending cycle of ups and downs, this is why I chose UROBOROS image to illustrate this mechanism vividly. Does this image make you feel uneasy? It surely makes me.

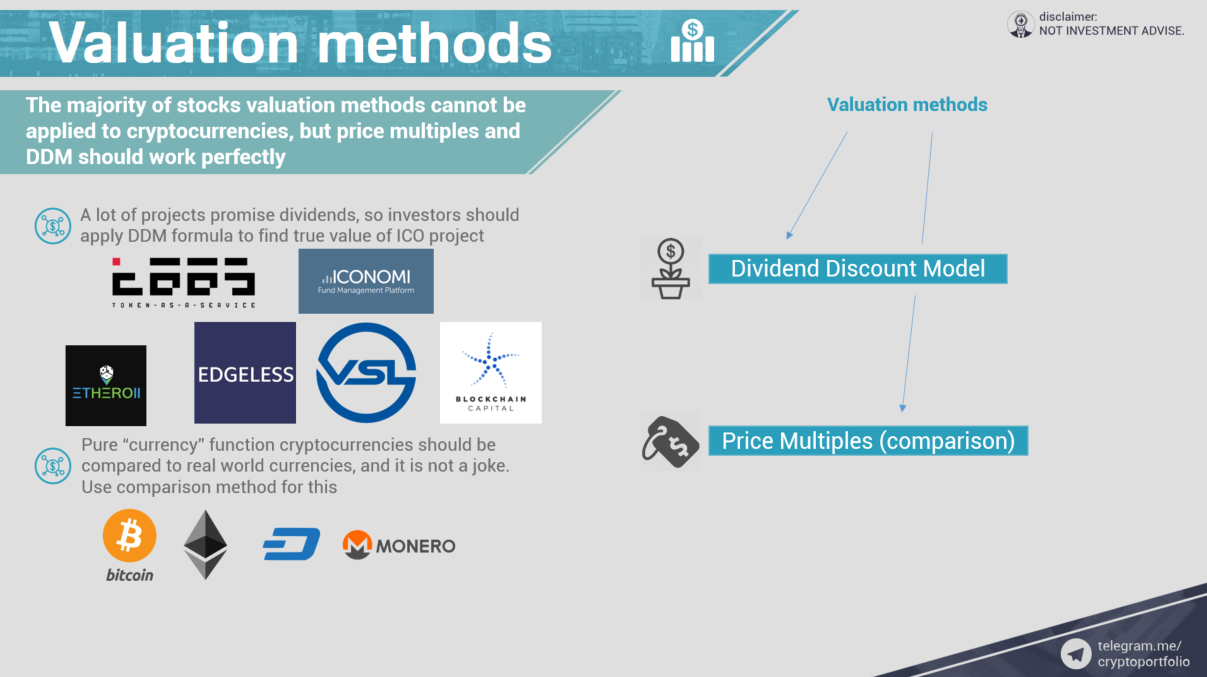

What valuation methods can we use to try to find true value of existing or appearing cryptocurrencies? In reality, the methods I am about to show you are mostly useless right now. And many cryptocurrencies, especially with pure “money” function, have much more variables that should be taken into account. But let’s assume that projects already pay dividends and pure “currency” function cryptos are really successful.

The first method is dividend discount model. By using the payout numbers, we find approximate market valuation with the DDM formula. Right now almost no project returns money, but in future you will be able to evaluate projects when they start to pay dividends. What examples can I give you where you can try to evaluate cryptocurrency?

TAAS, the Ukrainian cryptofund, ICONOMI, Ethereum Casinos ( Etheroll, Edgeless, Vslice), Blockchain capital. If I missed something, please, give me other names in the comment section.

Another method is price multiples. In other words, comparison method. We simply try to find true value of certain cryptocurrency by comparing it to something. In the case of pure currency cryptos, we should compare them to real world currencies. No joke, set up a timer in your gmail account to send you a letter in 2020, you can thank me later. Hodl bitcoins and ethers, man. What examples can I give you here?

Of course, bitcoins, dash, monero. What about ethers? As I mentioned a million times before, ether is a currency and will be used as a currency. And I know that Vitalik and other members of Ethereum Foundation strongly disagree. Low inflation after POS, wide adoption, and actual usage equals to strong currency.

If you are a subscriber to my telegram channel. You already know what’s on this slide. If not, subscribe, right now!

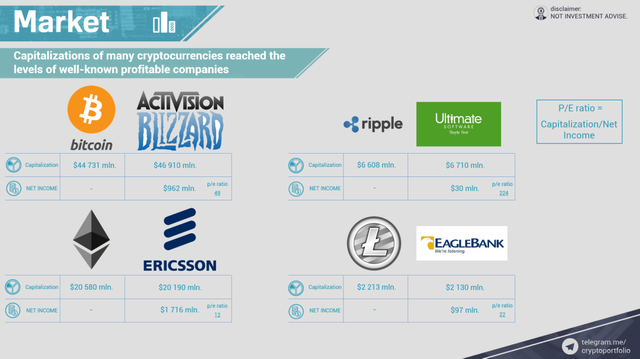

Let’s compare the biggest cryptocurrencies with the real-world companies. We will take a look at annual earnings of companies that have close capitalizations to cryptos. And we will start with…

Bitcoin vs Activision Blizzard Inc.

Net Income of Activision for 2016 was almost $1bln. P to E ratio is 49. By the way, the bigger P to E ratio ( It is capitalization divided by Net Income) the bigger hopes of investors about their investment. If you want a benchmark, average P/E ratio of American Stock Market is about 27. So Activision is a highly valuated investment.

Ethereum vs Ericsson. Ericsson had almost $2bln. in earnings in 2016. P/E ratio is 12. Yep, let’s buy some undervalued Ericsson shares =)

Ripple vs Ultimate software. $30 mln in net income. P/E is 224, wow.

Litecoin vs EagleBank. $97 mln in net income. P/E is 22. And I know that right now capitalizations of cryptocurrencies may be different, they change each hour quite dramatically for God’s sake.

Yep, it wasn’t the end. Let’s continue =)

NEM vs NetGear. Net income is $75 mln. P/E is 21.

DASH vs Broadsoft. Net income is $1mln, P/E is 1688. Quite high hopes about this investment.

ETH Classic vs Altra. Net income is $25mln. P/E is 52.

IOTA (is it blockchain =)?) vs Anika. Net income is $32 mln. P/E is slightly less than the average, 23.

Well.

Monero vs Parksterling Bank. Net income for 2016 is $19mln. P/E ratio is 33.

Stratis vs Student transportation Inc. Net Income is $6mln. P/E ratio is 93.

EOS vs Financial institutions INC. Net income is $31mln. P/E ratio is 14.

Verita…SHITCOIN vs Mitek. Net income is $2mln. P/E ratio is 159.

What are the conclusions?

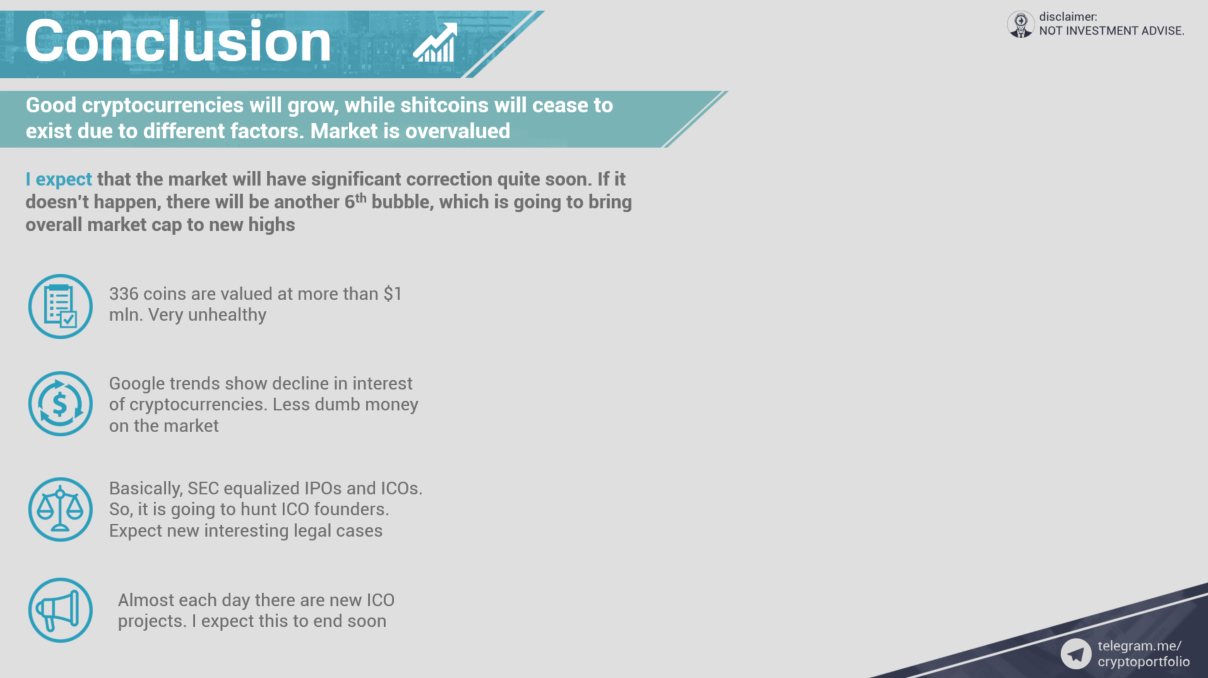

Good cryptocurrencies will grow, while shitcoins will cease to exist due to different factors. Market is overvalued as of now.

I expect that the market will have significant correction quite soon. If it doesn’t happen, there will be another 6th bubble, which is going to bring overall market cap to new highs. Maybe financial apocalypse will happen tomorrow, and BTC will cost $1mln each, but let’s just assume normal scenario.

So. There are 336 shitcoins that are valued at $1 mln. minimum. Is it normal? Answer this question yourself. If you cannot answer this question, buy some putincoins (yes, there is a currency called putincoin, no joke),

Google trends show decline in interest of cryptocurrencies. Less dumb money on the market. Ending stream of newcomers who can put some new money into the market.

Basically, SEC equalized IPOs and ICOs. So, it is going to hunt ICO founders. Expect new interesting legal cases. Be careful, because investors also could be held accountable.

Almost each day there are new ICO projects. I expect this to end soon. If it doesn’t end, then I do not understand something very important.

Authors get paid when people like you upvote their post.

If you enjoyed what you read here, create your account today and start earning FREE STEEM!

If you enjoyed what you read here, create your account today and start earning FREE STEEM!

SEC only applies to USA so not sure that will have any effect on ICO's they will all be conducted in ICO friendly countries. America is in a difficult situation as crypto is going to be the future, if they try to protect the existing banking infrastructure too much they will drive Fin Tech to other countries and America could be left behind.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think there is no need for the text if there is a video. Maybe a short summary.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't like watching videos and really appreciate it when the author provides a transcript! Thank you cryptoportfolio!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I100% agree with you . The crypto market is on risk due to some foolish and selfish actions.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Really liked your thought process! A market crash is inevitable and the higher it goes the bigger the crash...

The time for investing in shitcoins is definitely over! Now only real projects with actual value will give you a return on investment.

Unfortunately, the shitcoins outweigh the good ones by a lot. Every investor should do due diligence before jumping on a new hype.

One project I've done some research about is ONG.social. It's a social media platform fighting censorship with a similar compensation model as steemit. The main benefit is that you can post on ONG and it acts as a hub and posts on your other social media sites as well. The ICO is coming up in a few days.

But please don't take my word for it. It's just a project I like. If you want to check it out just google their whitepaper it explains the whole project way better than I ever could lol.

Just keep in mind to do your own research and don't follow anybodys advice blindly...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm also interested in onG but besides that I'm also curious what is your definition of shitcoin?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I will look into this onG .social ICO. I have been hearing some hype about it recently

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I do not trust ICOs they are shit and scam. There may be some which are good but majority is a shit. Taking money before starting a project and there is no regulation so it is bound to crash sooner or later. By the way great comparison of the companies with cryptocurrency as there is no regulation of cryptocurrencies there won't be any model to evaluate the worth of cryptocurrency in near future. Cryptocurrency has no intrinsic value the only value it has is the market adoption and usage of technology.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks. I thought it would be interesting to see cryptocurrency in comparison with real world money making companies. I know we cannot compare it, but , imho, some cryptocurrencies (especially, centered on dividends and profits) can and should be compared with listed companies on stock exchanges. This way we can see how under/overvalued crypto is.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Could you try to write your text in proper alineas please ?

Im sure if you write in alineas it will be pleasant reading :) !

Thnx

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks. Next time it will be better

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Pleasure mate, !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think Ethereum is going to create a lot of of problems with the ICO's, but overall the market cap will continue to increase and all coins will enjoy profits as we are the early adopters.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You're right. We just needed to get in early enough that the coming crash doesn't take too much off our assets. Don't hold too long though, buy something nice like a holiday or a house.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great insight but I think Cryptocurrency is still better choice than Fiat currency and new cryptos give new investors greater opportunity to taste and make plans for greater investments... once more people understand how it works it will only keep growing there are still millions of people who still have no idea about Crypto currency or never tried it due to lack awareness or due to propaganda against the system...... Crypto system is much better system than Fiat currency system based on debt, giving almost everyone opportunity to make profit off of it while Debt based banking is turning majority into loss than growth and manipulation only makes it worse....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

or more like billions of people =)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing! Learning is earning ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks For Share.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You only need to look at the platforms behind most of these coins to know that their selling dreams that they can't even explain in simple terms. That's how you know whether they're valuable or not.

IOTA is a blockchain in the way that a zebra is horse....but it's still going to kick ass. Valuation aside, it has real-world applications i.e giving robots access to bank accounts.

Thanks for the P/E analysis. Learning something new everday.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great Post. You bring up a lot of interesting points, and it'll defenitely be very interesting to see how the popular cryptos evolve as more mass adoption accurs and larger and larger influxes of people are joining the crypto train.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Always appreciate the contrarian viewpoints, everyone needs a splash of cold water now and again right?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Na man NA

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good post!

One thing that came to my mind is that most people investing in cryptocurrencies are tech-people like engineers and IT-people (like myself). People in that sector have had quite many good years and are pretty wealthy. If that changes, due to a financial crisis or something like that, and unemployment increases in that sector it may have a big impact on the entire crypto-currency economy. I mean they will stop investing and maybe also sell off to finance their living.

Any opinions on that?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good pos brother, please help me vote my post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Crypto markets might be overvalued but, comparing traditional companies to cryptocurreny and decentralized applications is not apples to apples. Visa and Master Card together have a market cap of about $370 billion but, you cannot simply compare this to bitcoin's market cap. Bitcoin is more than a payment processor and represents a store of value in addition to the actual utility of cheap, fast, and secure payments.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Seems to me that most "shitcoins" are akin to "penny stocks" or what used to be called "pink sheet stock" that only could be traded on the extended NASDAQ OTC exchanges. Wildly unpredictable, backed only by "Ed Bob's Great Idea" being made in his garage, thinly traded, subject to wild fluctuations based on rumors and price pumping... and GOD FORBID you'd actually want to trade more than $100's worth on any given day.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is very well analysed. I share a similar sentiment. Pulled off 1/3 of my investment near the top last month. No need to be greedy anws.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You missed wings under projects that are paying funds or rewards. https://www.wings.ai

I've earned almost 7k USD on the first two forecasting events for Bancor and Adex.

Looking forward to rewards from forecasting also on WingsDao for coindash, DaoAct, Indorse and Stox!

Excited for upcoming beta release and enjoying awesome rewards in pre-beta now!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

All fine but u were not able to estimate PE for cryptos so entire analysis is of no value for making any decision.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are right, many cryptocurrencies are overvalued, but still we have many projects with great potential for growths. For example Steem, Sia, Verge, and few others :) Upvoted and followed :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Market capitalizations of certain coins have little meaning in illiquid markets. e.g. a coin is formed with 1 billion coins pre-mined. One coin is sold for 10 USD. Now it has a capitalization of $10 billion. We are seeing the illiquidity in bitcoin cash - if there is no market demand then the valuations need to be viewed in this context.

Also comparing Litecoin to the market cap of a company while interesting , it is more of a currency like Bitcoin that should be compared to overall money supplies, e.g. M1 etc.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

interesting post. Thank you for writing this

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting blog. I was about to post a similair thread. Investing in cryptos is still a risky thing. I was researching a way to do better investment analysis on the current cryptos. I was wondering if anyone of you uses: https://www.coincheckup.com It's a great site that gives in depth research on every tradable cryto in the market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/steem/@swiftcoin/gold-coins-with-your-bitcoin-and-steem

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit