That seems to be the perennial question on everyone's minds these days. I remember a time, when I used to wonder why the issue of the Fed raising or lowering interest rates was such a big deal...

It didn't seem to make no god damned difference to my life.

For just a brief moment, some aging old gaff took center stage in the world's media to drop the bomb on whether interest rates were going to go up or down. "How could a fraction of a percentage point increase; 25 basis points or 0.25%; the rate hike in March 2017, possibly make any difference in my life?" I thought to myself...

All that means to me is that my savings account consisting of a grand total of 100 dollars will earn me an additional 25 cents in annual interest! Big deal, who cares right?

Wrong!.... many of us do not realize that we live in a world of revolving credit. Everyone is lending money from everyone else....that is the whole foundation of our sick financial system at the moment. It allows us to spend more than we have or produce which in turn leads to inflated incomes, because one person's spending = another person's income.

Big corporations lend from banks all the time to maintain smooth operating cash flow, and countries; especially developing nations, lend from developed countries either directly or via global financial institutions such as the World Bank, International Monetary Fund (IMF) or the European Central Bank (ECB).

And all these loans run in the billions and trillions. At the moment, the US alone has a national debt of 50 trillion dollars! So, interest rates hike or cuts of even a hundredth of a percentage point can create huge ripples in the economy capable of tearing apart the very fabric of society, not just of the US but of the world!

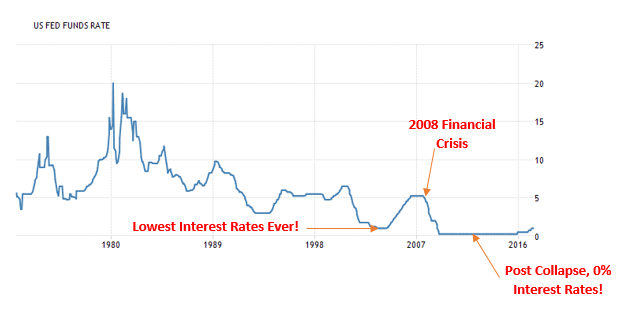

In the years leading up to 2008 Financial Crisis, the Fed Fund Rates were at an all time low of around 2 percent; as you will see from the graph below. When interest rates are that low it signals a time of expansion. Borrowing increases frenetically as debt is super cheap, people spend more which in turn leads to higher income and so the economy is “stimulated” without actually increasing output in terms of GDP growth.

As the nation was riding this euphoric wave of excess and spending beyond its means; a bubble was developing. The Fed recognizing this unsettling development tried to pull the brakes by increasing the interest rates gradually in the period leading up to the financial crisis.

However, it was too little, too late, due to financial deregulations and easy availability of cheap credit, debts had already been allowed to pile up to dangerously high levels. A point at which the system could no longer sustain it, and so the bubble popped, which led to a major recession, the effects of which we still feel even to this day.

When a recession of that magnitude hits, the central bank in an effort to stimulate the economy simply cuts interest rates even further to almost 0% and printed trillions of dollars to bail out the huge corporations which contributed to the financial crash. But humans being reactionary creatures, naturally tend to be distrustful of governments and banks in the aftermath of such a major crisis and so tend to borrow and spend less. The bank themselves after having been chided for their reckless lending practices tightened their arses to restrict lending.

However, as I mentioned before, one man's spending = another man's income, so in effect what this does is, it lands a double whammy and the economy retrogrades.....almost to a halt.

So the government steps in again, with stimulus packages, increasing the budget deficit to all time highs, as what happened during the Obama administration. It is surprising how quickly people forget the lessons of the past and become so forgiving of government’s shortcomings when there are free handouts.

The economy is apparently stimulated, stock markets are bullish as is the case now and people slowly fall back into their old spending habits again….

And then now old Yellen from the Fed steps in again and says to everybody, hey you know what the economy is doing fantastic, we have lots of faith it will do well in the coming months so we decided to raise interest rates again!

WTF???

If you have been following me so far, you would know by now that interest rate hikes, = less borrowing = less spending. With higher interest rates, the value of the US dollar increases and this in turn leads to larger trade deficits, as other countries will not be able to import as much American products and services due to the more expensive US dollar, which in turn hurts the economy even further. So just as the country is about to apparently recover, the Fed pulls the brakes again?

That ladies and gentlemen is a very bad sign! It means that the government is playing a very dangerous balancing act; it does not want us to get too carried away with borrowing and spending, because they know we are on the brink of a major credit bubble collapse, way bigger than any collapse in history!

The problem we now face is that the world economy; not just the US’s, is dangerously over leveraged, meaning we as a planet have taken on way too much debt then we can possibly repay.

We are tip toeing on the brink of a major and catastrophic deleveraging period. A period of major upheaval, death and destruction...as was the case in the Second World War which was born off the back of the German Hyperinflation

So the way I see it is, we need to think outside of the box, and come up with a radically different approach for our future economic system, one which does not reward living beyond our means and borrowing ourselves into our graves, but one which rewards real productivity and hard work.

Our very future depends on it!

And the STEEMIT economic model is one such genius application which demonstrates how inflation can be used to actually reward true work and contribution to the community.

very nice post, well written and you make a good point

lets hope the crypto currency economy can save the fiat one

upvote from me

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks alot man!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @ganeshaji! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit