What is up guys and girls?

Slow day today (with regards to trading). Been doing my third year Bachelor project on an aileron model where we are required to find the deflection throughout the entire structure. Something different than trading, you know?

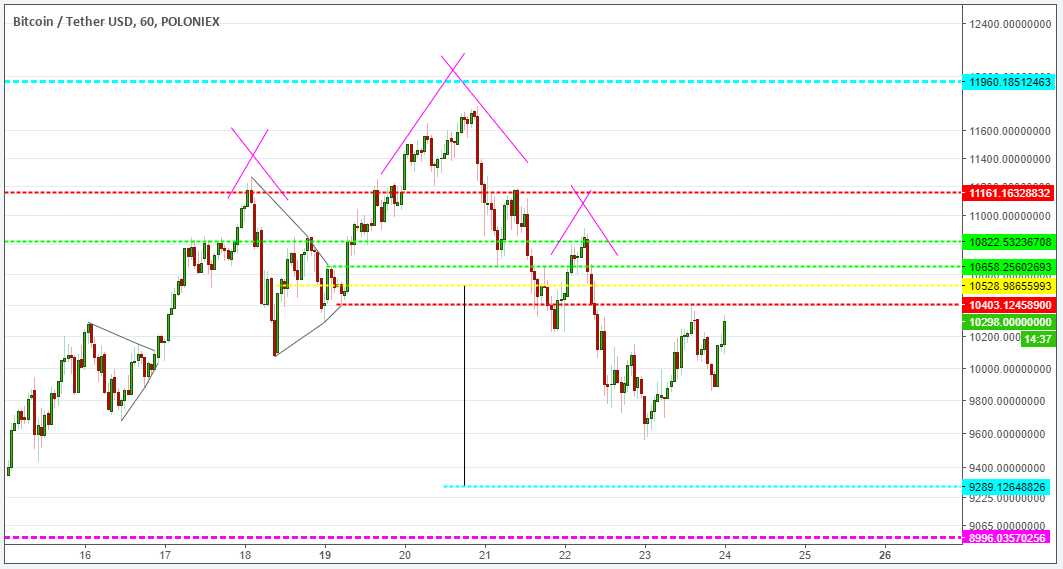

Have been checking the charts here and there but personally I am just observing what Bitcoin will do (as it will impact the rest of the market). The current bias is still that 9200$ level:

Yes, it's throwing back however that is merely my view, the market does not really care. So until proven otherwise, that will be my stance. By the way, as I did not enter on the primary head & shoulders break, I have set up the following trade (the order is currently pending on an exchange).

Mind that rather than setting my short limit order around the neckline at 10500$ (yellow dotted line), my primary goal in any trade is to reduce the risk I am taking thus, respecting a decent Risk:Reward Ratio (which you should aim to be greater or equal to two).

With this in mind, rather than setting my order around the neckline, my order is put around the 10650$ mark (red dotted line) and stop loss above the 11000$ level (due to the round nature of the number). The target is still 9200$ which puts it as a trade with a Risk:Reward of 3.15.

Just for comparison, note how our Risk:Reward would decrease if the entry level was to be set at the 10500$ level:

A bit less patience and BAM , instead of having one in two profitable trades to break even, you require three. Something to keep in mind when you take your next trade :)

Disclaimer: Cryptocurrency trading is highly speculative in nature which can mean currency prices may become extremely volatile. Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. It is possible that you will sustain a loss of some or all of your initial investment so never risk capital that you cannot afford to lose. You acknowledge and agree that no promise or guarantee of success or profitability has been made between you and BeIndependent [bit by bit].

►Free e-book on How to Start Your Cryptocurrency Journey: http://beindependentbb.com

►Join us on Telegram: https://t.me/beindependentbb

► Find us on Instagram: https://www.instagram.com/beindependentbb/

►Find us on Twitter: https://twitter.com/beindependentbb

I am n expert in shorting BTC, but, I don't see or agree of the risk-reward ratio of 3:15 - care to elaborate?

I see that you are either right or wrong and the chances in each is undetermined. So, you can be whipsawed if BTC first jump to $10,650 filling your order to short it and then immediately go past $11,000 your stop order and in just a few minutes, you will be out $350 / BTC.

That could be a high risk and low reward scenario if BTC never come close to dropping to $9,200 where you will cover your short even if BTC never go up to $11,000.

Also, how do you calculate and get 3:15? I calculated it to be 4:14 based on your numbers / BTC prices.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey! My current entry stands at 10650$ with a target at 9200$ and stop at 11090$ which if we calculate the difference between reward and risk, we are risking around 450$ if we loose while aiming for a 1450 gain. Thus the Risk:Reward of the trade we are considering is 1450/450=3.22

Because the head& shoulders already broke out, the trade that is being considered has actually a low probability of being triggered. My scenario is that the Bitcoin price would return slightly above the neckline of the head & shoulders.

Looking at it this morning, the price returned to the neckline but severely dumped straight down. This makes me lean for a potential inverted HVF structure in formation.

In case you don't know what a HVF is, you can check out the post where I go over the basis of HVF Theory and what characteristics of price behavior I am looking for on a chart:

https://steemit.com/trading/@beindependentbb/19-what-is-the-hunt-volatility-funnel-hvf

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

After a massive dump, a R/R of 2 in a short position is a shitty trade off.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree, that's why the short entry was moved higher

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Looks like there is no trade - time wasted ...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

One can always take something from a trade that he/she didn't take. Opportunities (and money) come and go. Having some fiat on the sidelines in days like these are always good to be making more Bitcoin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The swing, even if you catch the top and bottom, for this trade is just too small w.r.t. cryptocurrencies - IMHO.

They look like a lot if they were stocks, but they are not.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit