Bubble Trouble Ahead

Why Another Financial Crisis Is Inevitable?

We are currently living in several bubbles in our markets.

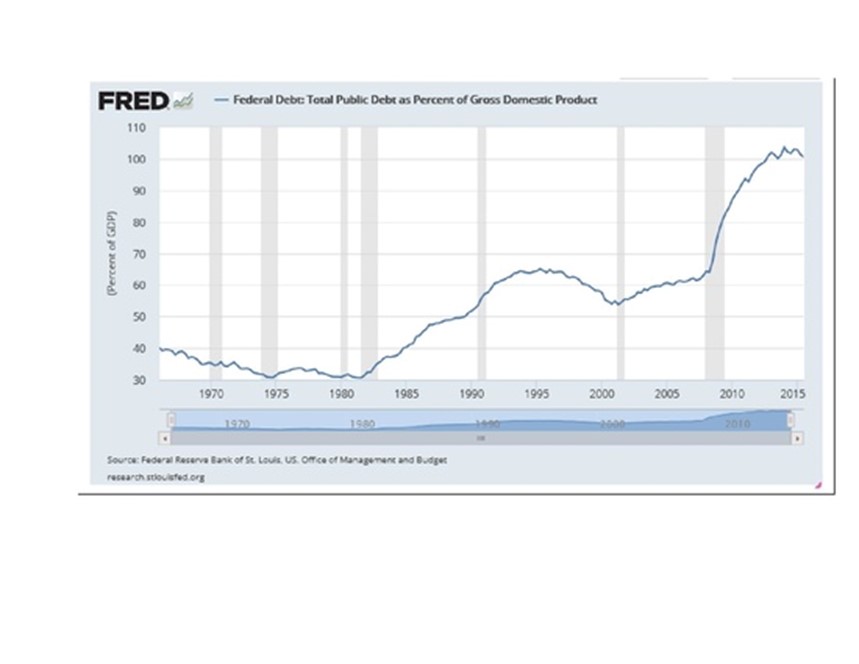

Central bankers wanted a Quantitative Easing “wealth effect” where stock price increases would pump-up consumer spending and thus business production. Their hope was that stock prices and business production would rise together, a balance that would avoid stock market bubbles. Instead, central bankers got what they feared, bubbles as stock prices rose faster than the economy could expand.

Faced by bubbles, the new priority for central bankers should be to prepare for a bubble bursting’s. All of these Central Banks QE action operations did NOT create any real growth in our global economies. Therefore, these QE “artificially” inflated stock markets globally, as a byproduct. The Keynesian Monetary Model philosophy is solely based on creating more ‘debt’.

We are currently witnessing the early chapters of this economic crisis that has started in other parts of the world.

The Europe Union Bank Recovery and Resolution Directive sets a new common framework across all 28 countries of the European Union on how troubled banks will deal with interventions to prevent failures. It is a framework for managing the orderly resolution of banks that operate across national borders. The agreement went into force on January 1st,2015.

The BRRD is an important milestone for Europe due to the fact that within its’ context of this new and wider regulatory reforms are now implemented in the banking and investment industry., It highlights controversial and concerning aspects to ensure that bank creditors will contribute significant funds in the event of a bank failure; this has the potential to fundamentally alter the risks and costs of capital that investors may provide to banks around the globe, today!

In addition, the crash which usually follows an economic bubble destroys a large amount of wealth and causes continuing economic malaise; this view is associated with the debt-deflation theory and elaborated within Post-Keynesian economics.

A protracted period of low risk will simply prolong the downturn in asset price deflation as was the case of the Great Depression in the 1930s for much of the world and the 1990s for Japan. Not only can the aftermath of a crash devastate the economy of a nation, but its effects can also reverberate beyond its borders.

The FED has the illusion of a recovery, but it’s not the real thing.

We have close to 100 million adult Americans without jobs

We currently have 46 million citizens on food stamps today compared to 18 million back in 2000.

Too big to “fail" banks that each have more than 40 trillion dollars in exposure to derivatives...

JPMorgan Chase

(Total Assets: $2,476,986,000,000 (about 2.5 trillion dollars)

Total Exposure to Derivatives: $67,951,190,000,000 (more than 67 trillion dollars)

Citibank

(Total Assets: $1,894,736,000,000 (almost 1.9 trillion dollars)

Total Exposure to Derivatives: $59,944,502,000,000 (nearly 60 trillion dollars)

Goldman Sachs

(Total Assets: $915,705,000,000 (less than a trillion dollars)

Total Exposure to Derivatives: $54,564,516,000,000 (more than 54 trillion dollars)

Bank of America

(Total Assets: $2,152,533,000,000 (a bit more than 2.1 trillion dollars)

Total Exposure to Derivatives: $54,457,605,000,000 (more than 54 trillion dollars)

Morgan Stanley

(Total Assets: $831,381,000,000 (less than a trillion dollars)

Total Exposure to Derivatives: $44,946,153,000,000 (more than 44 trillion dollars)

Deutsche Bank

Total Exposure to Derivate: $75 Trillion (Is 20 Times Greater Than German GDP)The U.S. national debt is sitting at a grand total over $20 trillion.

awesome

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit