Direct from the desk of Dane Williams,

This is not your average forex broker blog.

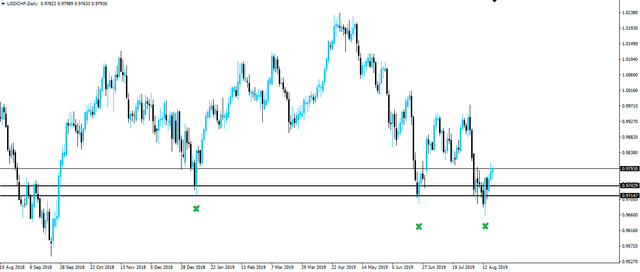

USD/CHF Technical Analysis

Morning team,

USD/CHF is just one of those pairs... My irrational nemesis.

Funnily enough, after being psychologically scarred from taking losses in the past, I actually see the Swissy as my personal trading kryptonite. While it's supposedly an inverse correlation of EUR/USD, I just find the price action on USD/CHF to be completely whack!

Can I explain it any better than that? Nope.

Am I being completely irrational? Probably... Definitely.

But every trader develops irrational hurdles within their own trading, this is just mine. It is what it is and it's certainly something that I find weighs on my mind when I have a position in any of the Swissy pairs.

As a result, I have to make sure that my trading plan is spot on before I enter any Swissy trades. I know I'm going to be psyched out by the price action and by implementing a rock solid plan before I enter, I don't let myself.

So after featuring the Swissy in the weekend's weekly market preview, lets take a deeper dive into the narrative of the pair.

You can see from the daily chart that price has held higher time frame support quite nicely. Price has respected this zone with a couple of sharp bounces off it.

While price has chopped through it on this latest test, all of those candles have long wicks, showing that each time the bears have tried to take control, the bulls have immediately stepped back in to buy the pair back up hard. A bullish sign.

From an intraday point of view however, USD/CHF looks to have already had it's tradable bounce. Today's Inner Circle daily email focuses on trading the EUR/USD daily support zone that we discussed yesterday.

Still a much better prospect in my opinion.

Best of probabilities to you,

Dane.

Today's Economic Releases

AUD Monetary Policy Meeting Minutes

@forexbrokr | Steemit Blog

Market Analyst and Forex Broker.

Join my Inner Circle ⭕️ - www.forexbrokr.com